Recruiters are suffering, but 2021 looks bright

Hiring freezes and mass layoffs have been hard on the firms, but a turnaround could be close.

25th November 2020 11:51

by Rodney Hobson from interactive investor

Hiring freezes and mass layoffs have been hard on the firms, but Joe Biden and Covid-19 vaccines could signal a turnaround.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Hope that next year will see the world returning to normal has propelled shares in many sectors higher – in the case of American stocks, to higher levels than before Covid-19 struck. One important group of stocks that are often seen as a bellwether for the wider market are still generally languishing: the recruitment companies.

When countries including the US and the UK were suffering record drops in gross domestic product in the second quarter, it was quite reasonable to expect recruitment stocks to bear the brunt. Rising levels of layoffs were hardly conducive to paying for the privilege of searching for new staff.

However, the almost equally impressive bounceback in the third quarter left shares in recruitment companies behind. The imposition of further lockdowns in Europe, plus the uncertain political situation in the United States, means the sector is still largely out in the cold.

Yet it is fair to think that next year could be spectacularly different. The Asia-Pacific region, with China in particular, has largely returned to normal. It will take longer in the Western world, but as weaker companies go to the wall stronger companies will expand to fill the vacuum. Any upheaval in the jobs market means work for the recruiters.

New president, good news

The United States, under new President Joe Biden, is likely to try to patch up trade relations with Europe and China that have been damaged under Donald Trump. More upheaval means more work for the recruiters.

It is easy to forget how the sector was thriving after 10 years of solid recovery from the 2007-8 financial crash. Downturns tend to be short and sharp, and with three Covid-19 vaccines ready to roll there is good reason to believe that the next upward trend will start in earnest next year.

As the US is still the largest economy in the world it makes sense to look there for investment prospects in the sector.

Two possibles

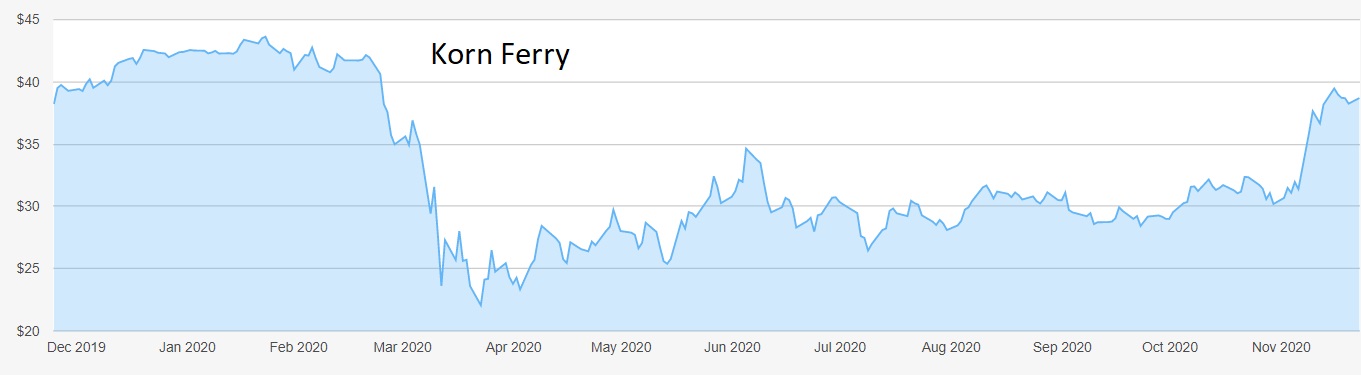

Korn Ferry (NYSE:KFY) is possibly the best known American recruitment firm. It also offers advisory services covering business organisation, development and motivation. It employs 7,500 staff serving clients in 100 offices in 50 countries.

In the three months to 31 October, the company’s second quarter, fee revenue of $435.4 million (£327 million) was down 12% on the same quarter last year, with earnings per share dropping from 78 cents to 51 cents. At least the worst is over, as fee revenue represented a 27% increase from the company’s pretty dire first quarter.

Korn Ferry is still not offering any financial guidance for its third quarter to the end of January in view of the considerable uncertainty caused by the new lockdowns.

Source: interactive investor. Past performance is not a guide to future performance.

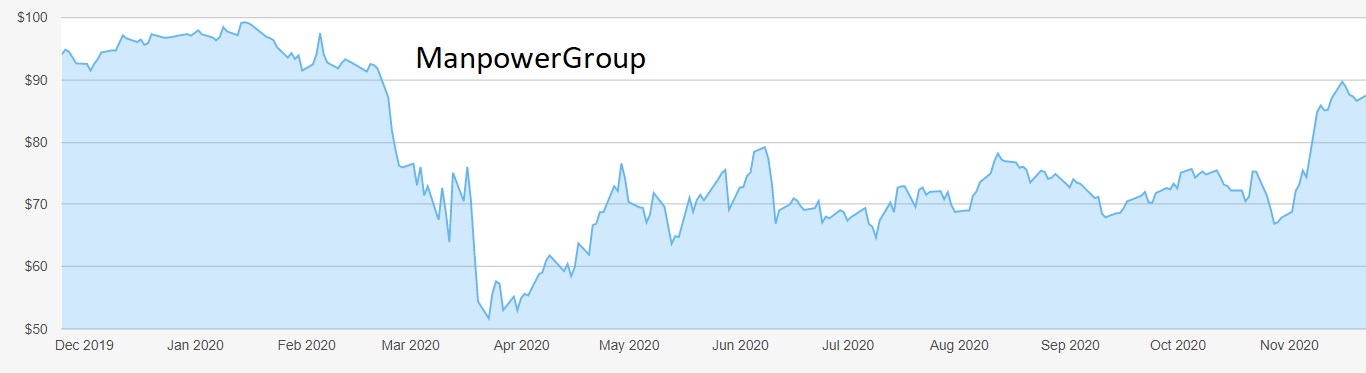

Manpower Group (NYSE:MAN), the third largest staffing company in the world, reported net earnings of only 18 cents a share in the three months to 30 September. This compares to $2.42 in its previous third quarter, on revenue down 13%.

- FTSE 100 predicted to boom on back of Brexit trade talks

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

However, it was able to point to strengthening demand for services as the global recovery from the depths of the second quarter of 2020 took hold. Earnings per share are expected to be back above $1 in the fourth quarter.

Source: interactive investor. Past performance is not a guide to future performance.

It is sufficiently confident to increase its half-yearly dividend to $1.17, a 7.3% increase from the previous $1.09.

Korn Ferry shares are well down from the $67 peak just over two years ago and have not quite recovered to the $42 level enjoyed before the coronavirus crisis. Manpower stood at $136 at the start of 2018 and at $99 in January this year. At $92 now it is further adrift than Korn Ferry.

Hobson’s Choice: I prefer Manpower out of the two. It is recovering faster and looks more confident about near-term prospects. Buy up to $96. Don’t pay more than $42 for Korn Ferry until the future looks clearer.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.