Richard Beddard: how do you score this car dealership?

Motorpoint seems able to weather a drop in car demand, but investors just cannot know for sure - yet.

21st August 2020 15:50

by Richard Beddard from interactive investor

Motorpoint seems able to weather a drop in car demand and fend off rivals, but investors just cannot know for sure - yet.

Motorpoint (LSE:MOTR) is a covetable company in an inglorious industry, as far as long-term investors go. It sells cars. Maybe the way it sells them makes it investable.

Inglorious industry

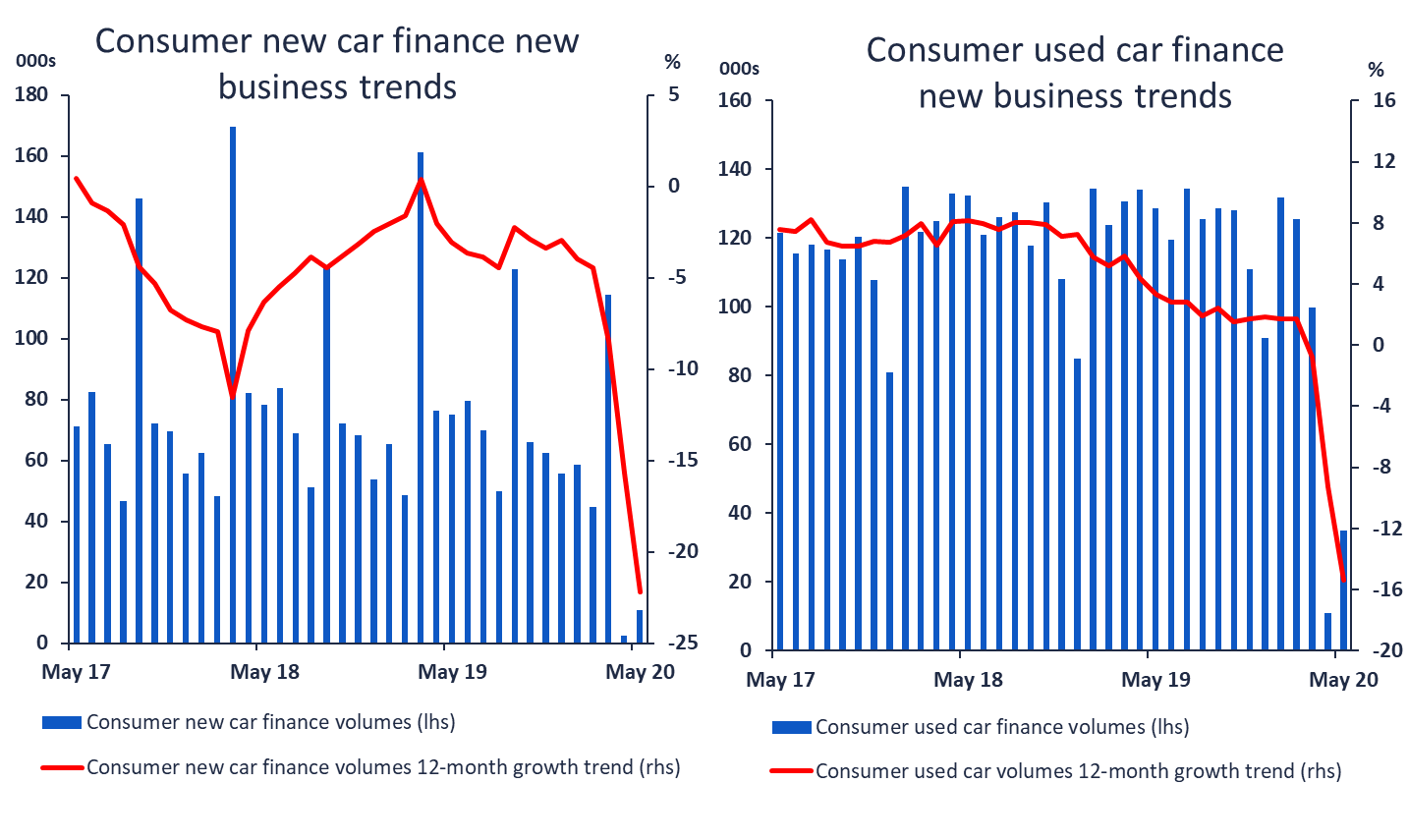

Cars are among the biggest purchases we make, and big purchases are often the first we defer during a recession. Most cars are bought on credit, which makes them more affordable, but our borrowing power also takes a hit during tough economic times.

Car dealerships that in normal circumstances earn good profits take on a different complexion in recessions.

Lockdown was a special case. People could not buy cars, even if they wanted to. The effect may turn out to be more short-lived than a typical recession, but it was certainly more dramatic.

Toilet paper sales probably followed an inverse trend. Source: Finance and Leasing Association

As well as the ebbs and flows of the economy, the motor industry is also changing as manufacturers push out electric models and experiment with autonomous vehicles. Nobody knows for sure where this is leading. But one scenario, perhaps in the distant future, is fewer of us will own cars.

Technology has already given people in cities more choices, through Uber and car sharing. Increasingly, we demand that stuff comes to us.

A better way to buy a car?

Why bother with Motorpoint at all then, if the industry is unreliable and changing? Not all car dealerships are the same. Motorpoint, founded in 1998, is the biggest of the relatively new car supermarkets. In January, it opened its 13th site in Swansea.

The schtick is choice, value and no hassle.

Motorpoint sells nearly-new cars much more cheaply than new ones, and as it is not tied to a particular manufacturer like most new car dealerships. It can sell any make of car it can get its hands on.

The price in the car window is Motorpoint’s best price, and although a one-year-old car looks and feels much like a new one, the savings are considerable. There’s no haggling, which is off putting to many of us.

The business model appeals to me so much, I bought our last car from Motorpoint.

Although it was not a smooth transaction - some documentation and the plug-in satnav had not arrived at the supermarket with the car - we still drove away in it. We got the missing bits in the post, and would buy from Motorpoint again.

Lest this seem like an advertorial, my anecdote is representative. More than 30% of customers in 2020 and 2019 had bought from Motorpoint before.

Putting the customer into culture

Like all good sales operations, the company puts staff at the centre of its strategy, because staff make customers happy. The chief executive greets new starters in their first two weeks to talk them through the company ethos. The company gives out annual and long-service awards and promotes from within.

All staff receive at least the Real Living Wage, which is higher than the government mandated minimum wage, a discount on car purchases and can participate in share schemes.

- An investor’s guide to buying motor stocks in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Judging by the accolades, the staff and customer-centric strategy works. Motorpoint has been one of the Sunday Times Top 100 Best Companies To Work For over six consecutive years and its rating on Glassdoor, a recruitment site, is 4.6 out of 5, well above most car dealerships.

The company is one of few that have a Platinum Trusted Service rating from Feefo, a customer review platform. Its Net Promoter Score (NPS) is a towering 81 and it has been rising. The NPS asks customers how likely they are to recommend a firm’s product or service.

We might be sceptical of some of these measures, but all of them?

Often it is founders that imprint a strong culture on companies, but David Shelton, the company’s co-founder and a non-executive director, resigned last year and has disappeared from the list of significant shareholders. His fellow co-founder resigned and sold up in 2013.

Who will carry the torch for customers now? Hopefully everybody, if the culture is truly engrained, but Motorpoint has an experienced chief executive in Mark Carter, who was appointed in 2013 after two years as chief financial officer. He owns nearly 10% of the shares. Mark Morris, chairman since 2013, has a similar-sized stake.

Recession risk

We cannot easily look back and see how Motorpoint fares in recessions as it was a much smaller company during the last big one in 2008. The company was also unlisted and did not report as much financial information.

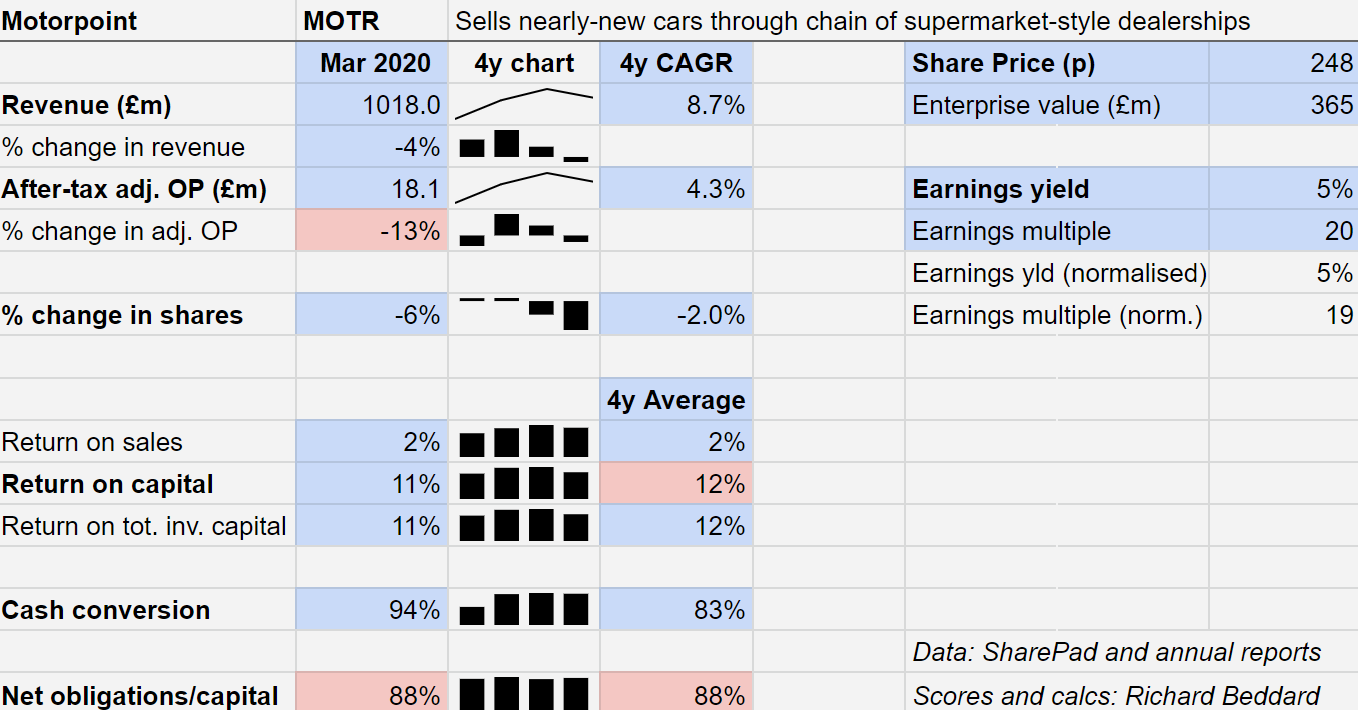

One of Motorpoint’s selling points is keen prices and finance rates. It relies on shifting a lot of cars and earning a modest profit from each one. Its profit margin, the amount of profit it earns as a percentage of revenue, is just 2%.

If it cannot sell in high volumes because people are not buying, it has little scope to lower prices and tempt customers back and still make a profit.

Investing in low profit margin businesses for the long-term only makes sense if we have good reason to believe that companies will still be able to sell profitably in volume when the economy is weak.

Motorpoint believes that, as the cheapest supplier of nearly new cars, it may attract custom in a downturn. Increases in market share might reduce the impact of lower demand for cars generally.

Whether 2021 is the test remains to be seen. The company does not know what the impact of Covid-19 will be on the rest of the year, although the second hand car market has reportedly bounced back.

Financials

The impact on the year to March 2020 was significant but not severe. The company expected an improvement on the previous year after the first eleven months, but was stymied in the twelfth, when it closed.

Revenue declined 4% compared to the previous year and adjusted profit fell 13%, denting the growth trend since Motorpoint floated in 2016.

Return on capital of 11% in the table above looks modest, and the level of financial obligations appears high at 88% of the capital required to operate Motorpoint.

Many car dealerships, including Motorpoint, finance stock with very short term borrowing secured against the cars they purchase and account for it as trade payables (money owed to suppliers).

I am nervous about this practice, because it seems imprudent, so for now I have added stocking finance to borrowings in calculating Motorpoint’s profitability and debt levels.

Conventionally calculated, Motorpoint’s return on capital of 20% and financial obligations worth 60% of operating capital compares well to many peers.

Motorpoint has reopened initially through online sales and a nationwide home delivery service launched just before lockdown (with a 7 day returns policy), then reserve and collect, and finally by reopening sites.

Motorpoint launched free home delivery just before lockdown. Source: Motorpoint.

By July, trading volumes were higher than the equivalent period in 2019 at normal profit margins and the balance sheet had improved since the year end.

I am a fan of Motorpoint’s staff-first culture and the way it innovates to keep prices low. Due to its scale it has been able to develop online sales and nationwide delivery, which may become competitive advantages smaller supermarkets cannot recreate.

In reducing costs and freeing up more space for sales, the company’s adoption of a hub and spoke model for vehicle preparation (repair, servicing and cleaning) may also differentiate it.

But Motorpoint’s relatively short track record as a listed firm and my uncertainty about its financing mean I am not yet ready to give it a score.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.