Richard Beddard: QinetiQ looks perfect – but where’s the growth?

The defence contractor has good turnaround potential, if investors are patient enough to wait.

14th August 2020 15:05

by Richard Beddard from interactive investor

The defence contractor has good turnaround potential, but will investors be patient enough to wait, asks our companies analyst.

The company’s mission is to help its mostly military clients create, test, and use equipment.

Create it, test it, use it

Around 6,000 employees, most of them engineers and scientists, develop technology, sometimes in partnership with customers who provide funding. They make sure equipment will work when it is needed, and they train clients to use it, sometimes under simulated battle conditions.

QinetiQ's (LSE:QQ.) new US acquisition MTEQ is developing the next-generation bomb disposal suit for the US army. In the UK the company is measuring the acoustic and electromagnetic signatures of all Royal Navy vessels over their lifetimes. It operates the world’s oldest test pilot school.

Under a €75 million (£67.5 million) contract with the European Space Agency (ESA), QinetiQ is developing the Altius satellite, which will study the distribution of ozone in the earth’s stratosphere and help chart climate change.

The pool of expertise, the testing ranges and other specialist facilities QinetiQ operates, and the company’s long association with the UK Ministry of Defence (MOD) are its competitive advantages.

An unmanned drone works in tandem with a manned helicopter to identify targets above Salisbury Plain in June. QinetiQ is evaluating the technologies for the UK Army. Source: qinetiq.com

Most of QinetiQ’s income comes from tests and evaluation, because the company started life as part of the government’s Defence Evaluation and Research Agency. It was privatised in 2001 but the relationship lives on in the Long Term Partnering Agreement (LTPA) to test and evaluate technology for the MOD, at least until 2028.

Services, research, evaluation, testing and training account for about £800 million, or 75% of total revenue. The rest is products incorporating technologies like robotics and sensing solutions as well as small satellites.

Strategy for growth

QinetiQ’s strategy since 2016 has been to maintain its lead in UK testing and evaluation (it has a 30% share of UK research, development, testing and evaluation spending), while developing products and services it can market at home and abroad.

International revenue has grown from 21% of total revenue to 31% since the company targeted 50% international revenue in 2016.

An ongoing transformation programme seeks to galvanise employees to collaborate and work more purposefully.

But where’s the growth?

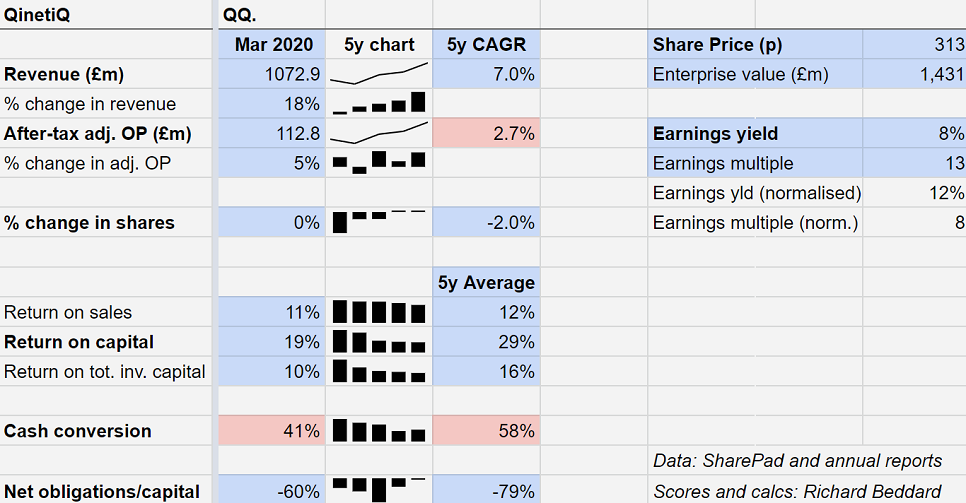

QinetiQ has strong finances. It earns good returns on capital, and is not funded by debt.

The problem is growth. Although the company says it has grown organic revenue for the last four years and profit for the last two years, growth is modest even when the contribution of acquisitions is included.

The company has grown revenue at a Compound Annual Growth Rate (CAGR) of 7%, and profit at less than 3% CAGR over the last four years.

Cash conversion is also modest, although this is due to high levels of capital expenditure, which might deliver growth in future.

Geopolitical risk

The world seems to be entering more hostile times, which may mean more spending on military technology. But Western governments have for a long time been reluctant military spenders.

QinetiQ says it entered the new financial year in April with a burgeoning order book, 19% bigger than the previous year, excluding the positive impact of two acquisitions.

In the short-term though, some work is being deferred due to the pandemic, and QinetiQ is waiting to see the likely impact before deciding to pay a final dividend.

In the longer term it faces challenges too.

UK defence spending, responsible for 69% of revenue, is pegged to a minimum of 2% of Gross Domestic Product (GDP).

However, GDP is shrinking alarmingly as a result of the pandemic, so the government may reduce the defence budget.

- ii view: BAE takes profits hit ahead of dividend decision

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

After the merger of MTEQ and QinetiQ’s existing US businesses the company believes it is poised for the next phase of US growth. But overseas expansion can be hazardous too.

As recently as 2013 the company earned half its revenue from the US government, enough to meet its current target for international revenue. Revenue was already falling though, as the military withdrew troops from Afghanistan.

QinetiQ found it could not compete against bigger domestic rivals less burdened by regulations and smaller domestic rivals favoured by US government policy.

In 2014 it disposed of its US Services business, having written-off hundreds of millions of dollars of investment in acquisitions to build it up.

Cultural change

Times are different, and QinetiQ may be wiser now. Perhaps its new international expansion will be more successful.

One reason for hope is the company’s policy towards employees, the source of the innovation that will drive growth and profitability.

QinetiQ says it aims to provide meaningful work because of the industry it is in and intellectual stimulation by dint of the scientific problems it must solve.

It also wants to have a good environment in terms of flexible working, training, and a share scheme that will pay every employee shares worth £740 this year.

It is more forthcoming than most companies about employee and customer engagement, which are key performance indicators.

The need for cultural change was recognised as long as a decade ago when, after an acquisitive period post-flotation, QinetiQ introduced a ‘self-help’ policy in 2012 that may, along with the rationalisation of the business, have begun laying a foundation for growth.

The company could be a good long-term investment, but it’s a complex business. Turning QinetiQ around must be testing shareholders’ patience and there are more nimble companies helping customers create, test, and use defence technology, Cohort (LSE:CHRT) for example.

Cohort is smaller. It earned revenue of £131 million in the year to July 2020 compared to over £1 billion at QinetiQ. But its relatively small size may have allowed it to adjust more quickly to changing military requirements.

Once predominantly a supplier of training, it has, through acquisition become a supplier of products. Today it earns more revenue abroad than it earns at home.

It has grown adjusted profit at 14% CAGR over the last five years. It seems to have achieved what QinetiQ is still seeking to achieve, albeit on a much smaller scale.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.