Richard Beddard: rich rewards for shareholders in this FTSE 100 company

5th May 2023 14:09

by Richard Beddard from interactive investor

This huge business just needs to do more of what it has done well in the past to keep growing, argues our columnist, who explains why he’s just upgraded this share.

Dividends do not, to my mind, make or break a good investment. If a business can put the money to good use, investing to earn high returns, I would rather it did that than make me find a high returning business to invest the dividends in.

That said, this year Bunzl (LSE:BNZL) is trumpeting its 30th consecutive year of dividend growth. Despite having made countless good investments over the years it has also achieved nearly 10% compound annual dividend growth.

It is no accident that Bunzl can reward shareholders so richly.

Essentials in demand

Bunzl supplies low-cost essentials consumed by businesses and organisations such as hospitals. These are everyday items they cannot do without, packaging, cleaning products, safety glasses and syringes. It supplies restaurant chain Wagamama with home delivery packaging and collects it for recycling. Last year it became the sole supplier of thousands of essentials to Sprouts, a chain of 370 farmers markets in the US.

Bunzl does not make these items, it sources, warehouses and supplies them just in time, working with customers to find, or customise, the right products for them.

- Shares for the future: how I would set up a new portfolio step by step

- Share Sleuth: taking some profits in Games Workshop

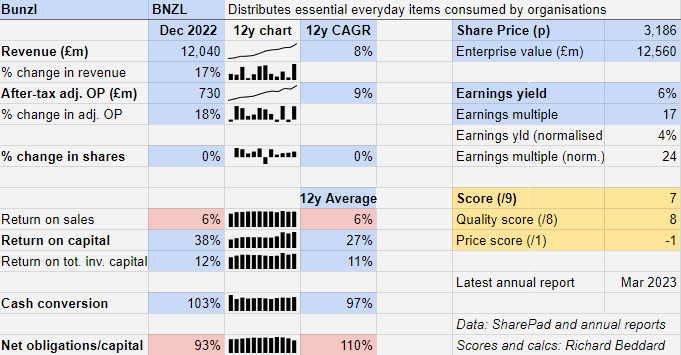

Helped by currency movements and acquisitions, Bunzl grew strongly in the year to December 2022. Return on capital was higher than the company’s very healthy average, for the third consecutive year. As usual cash returns were roughly the same as profit.

Bunzl sold its UK Healthcare division, its first disposal since 2018, a decision it says reflects its commitment to “optimal capital allocation”. It acquired 12 businesses (it has since added more).

Correction: This article was originally published with an incorrect data table, scoring Bunzl 6 instead of 7.

The only red flags in the numbers relate to Bunzl’s modest 6% profit margin and relatively high level of financial obligations, which are roughly equivalent to the value of the capital required to operate the business.

Financial obligations, which include lease and pension liabilities, only become a problem if a company cannot afford the interest or repayments when they fall due, but Bunzl has thrived for decades while supporting this level of debt.

Low profit margin (return on sales) becomes a problem when revenues fall because there is not much of a buffer between revenue and costs, meaning profit can easily turn into a loss.

But Bunzl grew revenue and maintained its 6% profit margin through the credit crunch and the Covid-19 pandemic. Indeed, return on capital improved from its already high levels above 20% to more than 30% between 2020 and 2022, due in part to the sale of very high volumes of health and hygiene products.

- Lloyds Bank and NatWest among FTSE 100 mega-dividend payouts in May

- Insider: betting on a FTSE 250 bargain and FTSE 100 growth play

In the current year, the company expects revenue to increase slightly and operating margins to be slightly higher than historical levels, as Bunzl’s attention shifts from passing on rising costs to managing deflationary prices, which it must also pass on through indexed or cost-plus contracts.

The tools it has at its disposal to maintain profitability are the same whatever the economic weather: sourcing products cheaply and developing more profitable brands and services.

It must also be mindful of higher interest rates. The company uses debt prudently to finance acquisitions, but should it use its prodigious cashflow to repay debt instead of refinancing it, Bunzl will have less cash to spend on acquisitive growth for a while.

Supersized

Bunzl is a giant, with more than 22,000 employees working from over 150 locations, most of them in North America and Europe. Eleven per cent of revenue is earned in the UK.

As the biggest supplier of its big customers, it is integral to their operations, and as the biggest customer of its suppliers, it takes priority and can negotiate cheap prices. The breadth of its range means it can often fill a truck bound for a single company, reducing transport costs and emissions.

It has achieved this scale by acquiring local and regional distributors and integrating them into its supply network and webshops. Online tools to help customers choose the right product, reduce costs, and meet other objectives like plastic reduction in packaging.

The bigger Bunzl gets, the more efficient it becomes. It consolidates warehouses, spreads investment in IT across more subsidiaries, and its range increases.

The benefits drive organic growth and also accrue to customers. Last year, logistics company CEVA chose Bunzl as sole supplier of more than 1,000 essentials to its 100 strong warehouse network in Belgium.

Previously, each CEVA warehouse sourced essentials like packaging independently and the consolidation, Bunzl says, has reduced CEVA's costs, improved “in time and in full” delivery from less than 90% to more than 99%, and created an opportunity to sell packaging to CEVAs customers through a joint venture.

Customers save not just because the products are cheap, but because they do not have to hold large stocks themselves.

In its latest annual report, Bunzl uses MultiLine, a Danish foodservice distributor, as a case study of a successful acquisition. MultiLine joined Bunzl in 2003, enabling the combined operations to become the "number one" food service distributor in the country. Since then, it has grown adjusted operating profit at a Compound Annual Growth Rate (CAGR) of 11%.

Critical to the sustainability of the acquisition policy is financial discipline. The company has not grown by becoming more indebted or by raising money from investors.

The retention of the previous owners of acquired businesses is also important, so local expertise and entrepreneurialism is retained in Bunzl.

Its managers know local rivals well, which is useful when they become acquisition targets.

Last June, Bunzl acquired hygi.de, a fast-growing German online distributor of hygiene and cleaning products after a courtship lasting 10 years.

The acquisition is significant, Bunzl says, because hygi.de is a platform for expansion in one of its under-penetrated markets. In February it followed up with the acquisition of another German distributor.

Bunzl has followed this buy and build strategy since 2004, but it is unlikely to abate. The countries in which Bunzl has the highest market share are relatively modest in size. Top of the list is the Netherlands, followed by Denmark and the UK.

Bunzl may also be turning a shakeup in its biggest product category to its advantage. Although the company earned 36% of revenue from packaging in 2022, a sector under pressure to move away from single-use plastics, more than half of that revenue came from often more profitable alternative materials.

The company has developed its own recyclable, reusable and compostable brands and uses the data it collects from orders to show customers they meet environmental goals like net zero-commitments and regulations on plastic packaging by switching.

Scoring Bunzl

Bunzl is my kind of investment. Even though it is huge the company just needs to do more of what it has done well in the past to keep growing.

Though it has a global footprint, Bunzl is a collective of local and regional businesses, supplied locally. The company says 75% of its purchases are domestic, and it tells me only 10 to 15% are sourced in China, which is of course one of its markets. This gives me confidence at a time of evident geopolitical risk.

Efficiency and scale mean more than just lower costs and more products. This year's annual report includes case studies of sales people, graduate recruits, and customer service people that have developed their careers at Bunzl to lead operations in individual sectors and territories. These are opportunities that would not be available to employees of smaller businesses.

Frank Van Zanten, the company’s chief executive since 2016, developed his career at Bunzl too. He joined the company in 1994 when it acquired the Dutch business he ran.

Does the business make good money? [2]

+ High and consistent return on capital

+ Consistently high cash conversion

+ Modest but consistent profit margins

What could stop it growing profitably? [2]

? High financial obligations

+ Scale advantage over competitors

+ Low dependency on individual/Chinese suppliers

How does its strategy address the risks? [2]

+ Financial discipline

+ Acquisitions

+ 75% of purchases are domestic

Will we all benefit? [2]

+ Decentralised, high employee engagement

+ Very experienced board

+ Turning sustainability into competitive advantage

Is the share price low relative to profit? [-1]

- No. A share price of £31.66 values the enterprise at about £12.5 billion, about 24 times normalised profit.

A score of 7 out of 9 indicates Bunzl is a good long-term investment.

It is ranked 10 out of 40 stocks in my Decision Engine. It was previously ranked 28 with a score of 6.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Bunzl.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.