Richard Beddard starts 2019 with a 'buy' recommendation

4th January 2019 15:21

by Richard Beddard from interactive investor

This manufacturer of gas masks and milking equipment is following a simple strategy that builds from a position of strength. The shares aren't too pricey either.

Happy New Year! I have a lot to say about Avon, so without preamble let me remind you I am scoring Avon to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

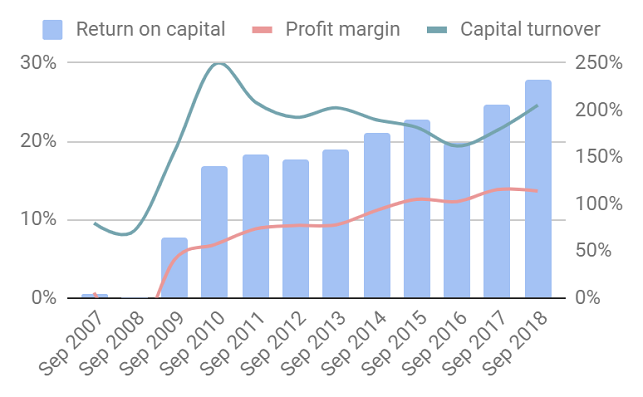

Avon Rubber is two businesses. It manufactures gas masks and breathing apparatus (Protection) as well as milking equipment for dairy farms (milkrite|InterPuls). Since the company reconfigured itself in the early 2000's its performance has been transformed. Shorn of unprofitable businesses, and as it has scaled up, return on capital improved to reach 28% in the year to September 2018:

Source: interactive investor Past performance is not a guide to future performance

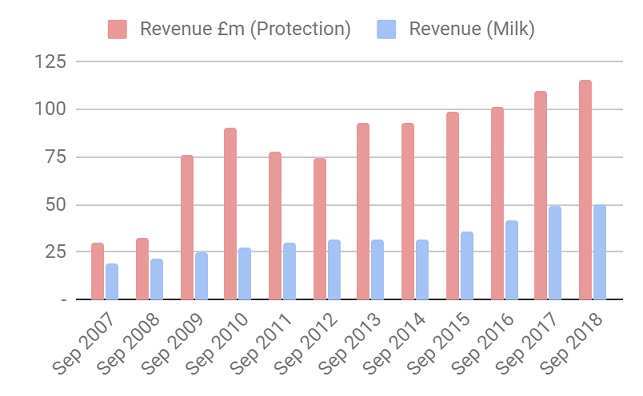

The decade from 2008 coincides with a ten-year contract with the US Department of Defence to supply the M50 General Service Respirator, a gas mask that protects troops against chemical and biological hazards. The contract has had a huge impact on the Protection division's revenue:

Source: interactive investor Past performance is not a guide to future performance

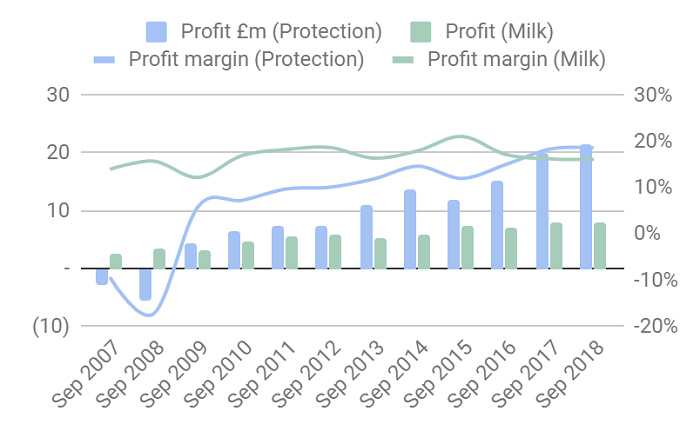

Over the decade profit margins in the division also improved to match the smaller milk division:

Source: interactive investor Past performance is not a guide to future performance

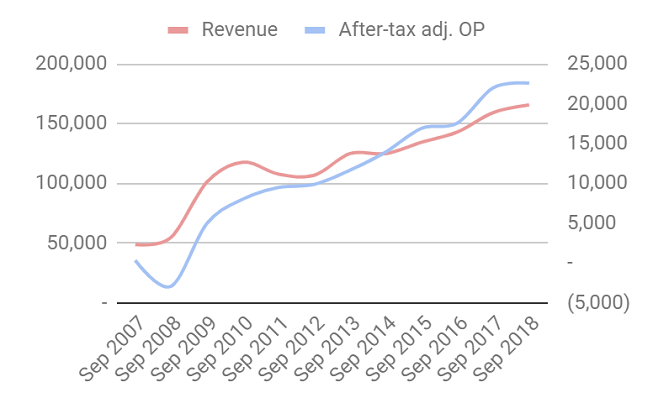

The Milk division acquired InterPuls to become milkrite|InterPuls in 2015, which also boosted revenue and profit. InterPuls added a range of pulsators and other milking equipment to milkrite’s market leading clusters and linings, the apparatus that attaches to the cow.

The happy result has been rapid and profitable growth:

Source: interactive investor Past performance is not a guide to future performance

Adjusted profit in the year to September 2018 grew 9% and 12% at constant currency rates, although in sterling terms growth was more subdued.

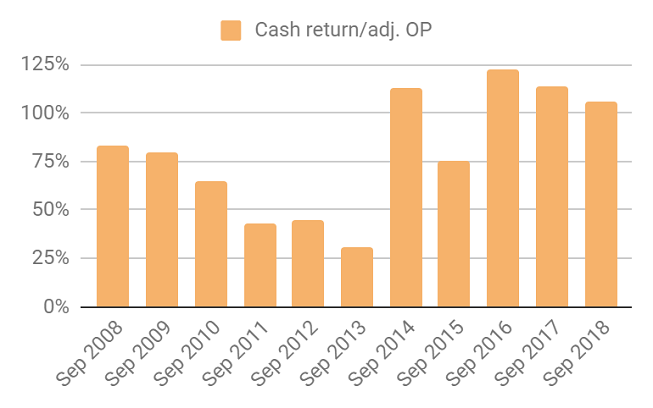

Until recently cash flows were impeded by investment in manufacturing capacity but over the last five years cash returns have averaged around 100% of adjusted operating profit:

Source: interactive investor Past performance is not a guide to future performance

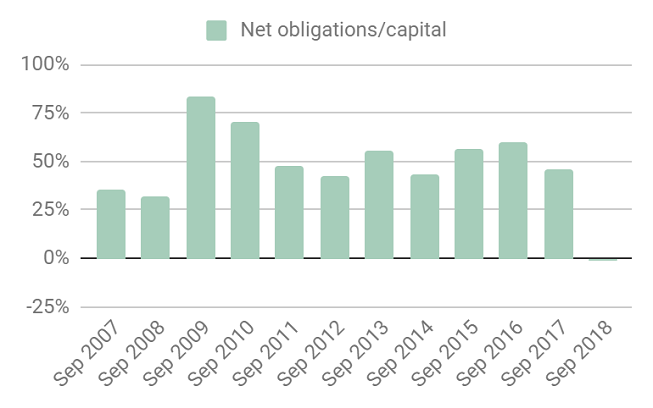

And all that cash flowing into the business means Avon's cash balance just about eclipsed all financial obligations in 2018, including operating leases and its defined benefit pension deficit:

Source: interactive investor Past performance is not a guide to future performance

"Confidence in future performance", underwritten by a closing order book 26% higher, allowed Avon Rubber to pay out 30% more cash in dividends in 2018 than it did in 2017.

This is why Avon is so confident...

Adaptable: How will it make more money?

Score: 2

In 2018, I described Avon's new strategy as more business like: making manufacturing more efficient, widening distribution, developing new products incorporating more technology in the Protection division, and more services at milkrite|InterPuls, which is shifting to leasing equipment, and acquiring businesses that can help it deepen and widen these niches.

In 2019, Avon implemented the strategy.

In terms of manufacturing, it consolidated production lines and installed a new one near a customer in Kazakhstan.

The product development element of the strategy received a boost as Avon lifted research and development spending to 5.9% of revenue from 5.2% in 2018. It introduced AvonAir, a modular powered air breathing apparatus range that is small, comfortable, configurable and can be integrated with hydration and other systems. Due to its modular construction it can be adapted as threats change and configured to the particular requirements of customers, lowering the cost of ownership and maintenance. It has been approved by NIOSH, the US health and safety authority, leading to “significant sales momentum in the US”.

Though the smallest division of milkrite|InterPuls, Farm Services is growing fastest, revenue grew 20% in 2018. The service model gives Avon a direct relationship with its customers, and the opportunity to sell more complex technical solutions.

The company made one small acquisition and one small disposal in 2019. It added Merricks to milkrite|InterPuls, the distributor of a patented nipple for calf nurser bottles manufactured by Avon. It sold Avon Engineering Fabrication, an ill-fitting part of Avon Protection that supplied coatings for hovercraft skirts and bulk liquid storage tanks.

Resilient: What could go wrong?

Score: 1

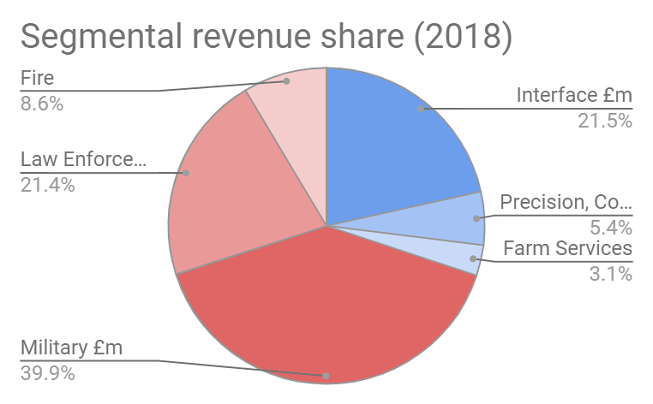

In 2018, income from the US Department of Defence increased slightly to nearly 80% of revenue from military sources, which is 40% of total revenue, a significant dependency on one customer. Although its sole-source contract for the joint services general purpose mask (the M50) has expired, Avon is still the only supplier. It sold more M50s in 2018, the year the 10 year agreement expired, than in 2017, delivering 179,000 M50 mask systems, but it also anticipates orders will decline to a minimum of 50,000 per annum from 2020 plus revenue from spares, filters, and sales outside the US.

Source: interactive investor

[In the chart above revenue from Avon Protection is coloured pink and revenue from milkrite|InterPuls is blue. Interface refers to the consumables that attach to the cow (clusters and liners), Precision, Control and Intelligence is machines like pulsators, Farm Services is the rental of clusters, liners, pulsators and neck and leg tags.]

Avon believes new orders for more sophisticated products from a wider range of customers will more than make up the shortfall. New systems, the M69 aircrew mask and the M53A1 mask and powered air system, will "underpin" Avon's relationship with the DOD once it has agreed multi-year contracts in 2019. It anticipates worldwide demand for the MCM100 underwater rebreather, and has received its first significant order from the Norwegian Armed Forces. A five-year contract to supply the UK General Service Respirator means it is supplying the UK Ministry of Defence again.

In 2019, Law Enforcement was the fastest growing Protection division. It generated 21% of total revenue in 2019. The smaller Fire division contracted as customers delayed purchases pending new National Fire Protection Association standards. Avon launches a compliant range in Spring. It also profits by selling consumables like filters, spares, and sometimes services to established customers of long-lived products (the M50 lasts up to ten years).

Since Avon is a market leader in two niches it is operating from a position of strength, with regulatory approvals and know-how that would be expensive for competitors to attain and patents they would have to circumvent. By focusing on deepening and broadening these niches, I think the strategy addresses the risk of customer concentration.

While milkrite|Interpuls depends on the prosperity of farmers, whose incomes are buffeted by feed and dairy prices, it is highly profitable through the cycle.

Since Avon earns 70% of revenue in the US and has a base in the EU (Italy), it is less dependent than many UK companies on a benign Brexit outcome.

Equitable: Will we all benefit?

Score: 2

Avon's annual report provides a thorough account of the business and the company's product ranges, without which many shareholders would be lost because it operates in obscure and increasingly technical niches. The financial performance benchmarks by which the company judges itself augur well for profitable and cash generative growth. By holding the Annual General Meeting at its Melksham headquarters at 10.30am, Avon gives shareholders the opportunity to visit the business and time to get there.

The company's values are encapsulated in an acronym: CREED, which, sadly is not inspired by the tremendous extension of the Rocky film franchise, but nevertheless stands for something worthwhile: Understanding customer needs and expectations, motivating employees through recognition and reward schemes, employee empowerment through training, a friendly and engaged working environment, and diversity. Avon aspires to be a "great place to work", providing changing room facilities, gym discounts, healthy food, and share incentives to employees.

As I wrote last week, treating employees, customers and shareholders fairly is just good business, and companies that do it well are likely to win in the long-term.

Staff reviews on recruitment sites are broadly positive and further evidence of a strong corporate culture comes from the board. Chief executive Paul McDonald and finance director Nick Keveth were appointed in 2017, but McDonald has worked at Avon for over 15 years, previously as the boss of milkrite|InterPuls. The broader management team claims a combined 142 years experience.

None of the directors are significant shareholders yet though, and their pay is escalating. The chief executive and the finance director are receiving a handsome pay rise, a maximum bonus opportunity of 100% and an LTIP of 125% in 2019. It is not an atypical policy, but it means the chief executive will earn between £450k and over £1.3m in cash and shares, depending on how the firm performs.

The remuneration policy is being put to a binding vote at the AGM on 31 January. If I am a shareholder by then (and I may be, see below) I would probably vote against it. Though most companies peg executive salaries to well paid peers’ reinforcing the pay rise spiral, I think those with the strongest corporate cultures could and ought to show more restraint.

Cheap: Is the firm's valuation modest?

Score: 0

Based on 2018's profit the shares look reasonably good value. They trade on a price earnings ratio of about 17, adjusted for debt and other financial obligations. 2018 was a good year though. Lower feed prices boosted demand from dairy farmers, and M50 sales were high.

Avon will probably grow more modestly in future than it has in the past because it must replace lost M50 sales, but the company is confident that will happen and a score of seven out of 10 means I am starting 2019 with a 'buy' recommendation. Yay!

All my recommendations are not just for Christmas though, they are for the long-term.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.