Richard Beddard: a tech firm helping solve world’s biggest problems

14th October 2022 15:35

by Richard Beddard from interactive investor

Even after a sharp decline in 2022, this billion-pound hi-tech company has doubled in value over the past five years. Our columnist thinks it’s one to own for the long term.

Yesterday (Thursday 13 October), Oxford Instruments (LSE:OXIG) pre-announced mixed results for the first half of its current financial year (March to October 2022). Revenue growth, which was strong in the full year to March 2022, has been tempered by challenges securing components and rising costs as yet not offset by price rises.

While revenue has been higher than the same period in 2021, it is due to currency movements rather than strong trading.

The company believes it will make more money during the remainder of the year as it increases production to deliver its record order book and higher prices come into effect.

- Find out about: Trading Account | Share prices today | Top UK shares

It seems likely for the second year running, Oxford Instruments will grow revenue as well as profit, perhaps further vindicating the Horizon strategy launched by the company’s newly promoted chief executive, Ian Barkshire, in 2017.

Organic growth

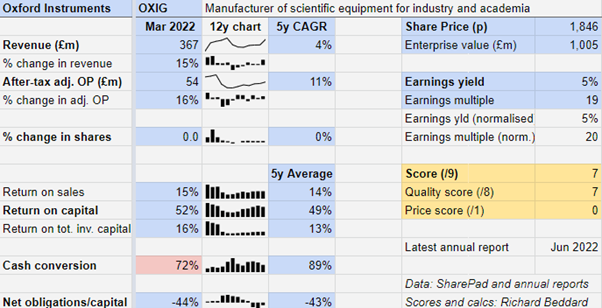

The numbers for the year ending March 2022 were pleasing on the eye.

The company acquired a business in August 2021, but its contribution was relatively small and organic revenue increased 14.5% and organic adjusted operating profit rose 15%.

Under Barkshire, Oxford Instruments has restored profitability and its strong finances after a period of acquisitive growth that diminished both.

The only red flag in my summary is a near miss, cash conversion. If operating cash flow minus capital expenditure (crudely how much the company makes in cash terms after investment in its existing businesses) is less than 75% of operating profit, I deem the difference significant enough to question whether the profit figure is realistic.

The drains on Oxford Instruments’ cash in 2022 were probably benign. It splurged on working capital to secure components at a time of shortage and support growth, it increased capital expenditure to fund a new semiconductor facility near Bristol, and it paid additional cash into its pension scheme.

The pension scheme is in surplus, and Oxford Instruments believes it should become self-sufficient in 2026.

Despite the cash outflows and the money spent on the acquisition in August, its finances remain firmly in the black.

Hi-tech tools

Oxford Instruments’ subsidiaries make hi-tech equipment that enables manufacturing, analysis and fundamental research down to the atomic level.

The instruments help scientists to see, measure and characterise materials like super-alloys, viruses, pharmaceuticals, and foods.

They include cameras, microscopes, and x-ray equipment and components and sub-systems used in equipment made by other manufacturers, like the manufacturers of 3D micro-CT scanners increasingly used for breast cancer screening.

It also makes cryogenic refrigerators that can reduce temperatures close to absolute zero. Such temperatures are required to remove heat ‘noise’ and make sense of the very small.

Applications developed by Oxford Instruments’ customers in industry and academia improve the performance of materials, making them lighter, stronger, cheaper and purer.

The company’s atomic force microscopes and Nuclear Magnetic Resonance spectroscopes help manufacturers understand the properties of batteries and how they change over time.

- Do you agree with these FTSE 250 cyber salaries?

- Stockwatch: a bombed-out mid-cap share for your watchlist

The company’s fastest growing market in 2022 was quantum technology. It supplies cryogenic environments and cameras to the developers of quantum computers like Google, Amazon, and IBM, a market, the company says, that is shifting from early-stage research to applied research and development of a technology that could prove disruptive.

Its biggest market was semiconductors, which it supplies with etching and deposition equipment.

In short, Oxford Instruments makes some of the picks and shovels required to invent and manufacture technology that may solve the problems we face today: disease, the energy supply, and climate change to name but three.

Lessons of the past

Under Barkshire, acquisitions have played a distant second fiddle to focusing on the many businesses the company already owns. The acquisition of WITec, a manufacturer of Raman microscopes, is the only acquisition it has made.

Raman microscopes are used in chemical analysis. It is a new product for Oxford Instrument, but closely allied to its existing materials characterisation businesses. The price, £36 million, was well under a year’s profit for the mothership.

The modest cost, and the similarity of the business make it, to my mind, a low-risk transaction and confirm that the company has learned lessons from its acquisitive past.

Slightly more concerning perhaps, is the amount of revenue the company earns from the Far East, and particularly China, because geopolitical tensions have spilled over into tariff wars in the past, and tensions are not abating.

Export prowess is positive, it shows the company’s products are relevant around the world, but it may also cause problems in future. Oxford Instruments earns 28% of revenue from China.

My biggest concern, though, is complexity. The company’s subsidiaries are organised into nine divisions (collected into three for reporting purposes) and serve a multitude of high-tech markets that are beyond my comprehension.

I wonder though, if the risk that it might all become too complicated to manage is mitigated by the straightforwardness of the company’s strategy, and its commitment to keep that strategy simple.

Innovation 101

“Market intimacy” is a phrase repeated monotonously throughout Oxford Instruments’ annual reports. It means knowing the customer well.

Everything flows from this. What the customer wants guides innovation, and efficiency gains fund it. More targeted and profitable investment justifies an increase in spending on research and development, which has risen from 7% of revenue in 2017 to 9% of higher revenue in 2021 and 2022.

The company operates three divisions, one focused more on applied science and commercial customers, one focused more on fundamental science and academic customers, and a services division that supports the other two with after-sales services.

Most of the efficiency gains have been made in the services business, which as a result also earns the highest profit margins.

It has achieved this by developing better services and delivering them through locally trained teams and by digitising its products and providing remote support.

Meanwhile, it has also grown more profitable, by turning down business to develop specialised one-off systems that do not tie into its own product development roadmap.

Across the board Oxford Instruments has rationalised suppliers and, it says, the closer links it has with the remaining ones has helped it deal with shortages as the global economy emerges from the pandemic.

Revenue growth from the two product divisions has partly come from launching products with a broader appeal.

In semiconductors, Oxford Instruments has developed its etch and exposition processing systems for semiconductor research and development into a volume manufacturing technology.

It anticipates its new BC43 benchtop microscopy system should address a much broader market than the company’s earlier products because it is easier to use, cheaper, and still delivers research level performance.

Talent war

Oxford Instruments wants its employees to feel proud to work for the company, and since it is at the forefront of technologies helping scientists understand disease to make better medicines, materials to improve them, and processes like nuclear fusion, it is off to a flying start.

During what the company describes as an “ongoing talent war”, it does not take their pride for granted. It monitors how many new starters say it is friendly and welcoming (98%), how many employees say they are proud to work for the company (85%), and how many feel trusted to do a good job (92%).

It also monitors how many vote with their feet, 11% of the workforce left the business in 2022. The same proportion were promoted or took on new responsibilities, partly thanks to a new programme to help employees develop their careers.

One person whose career has flourished is the chief executive, who joined in 1997, and has been technical director and chief operating officer.

It is somewhat disappointing that at the year end Ian Barkshire only owned 1,995 shares, down from 12,642 in 2021. His holding is worth about £35,000, which seems very modest compared to his pay, which has exceeded £2 million in both of the last two years.

While he owns unexercised share options, I do not believe these holdings give him much of a financial incentive in the long-term prosperity of the business. His strategy and growing track record, however, suggest otherwise.

Scoring Oxford Instruments

Does the business make good money? [2]

- High return on capital

- Decent profit margin

- Good cash conversion

What could stop it growing profitably? [1]

- Strong finances

- Complexity

- Geopolitical risk

How does its strategy address the risks? [2]

- Efficiency funds investment

- Close relationships with customers guides investment

- High levels of R&D capitalises on the above

Will we all benefit? [2]

- Experienced management

- Wants staff to be proud

- KPIs foster strategy and culture

Is the share price low relative to profit? [0]

- The price is reasonable. A share price of £18.46 values the enterprise at £1 billion, about 20 times normalised profit.

A score of 7 out of 9 indicates Oxford Instruments is a good long-term investment.

It is ranked 17 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.