Richard Beddard: these shares are good value after triple hit to results

14th April 2023 15:00

by Richard Beddard from interactive investor

Three factors combined to weaken this small-cap company last year, but our columnist believes the shares are a good, if speculative, long-term investment.

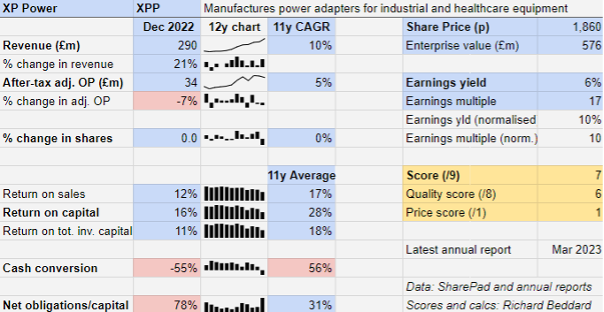

Long-time fan of XP Power Ltd (LSE:XPP) here. I am not used to seeing results like this from the manufacturer of power converters:

Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Falls in adjusted profit are rare, negative cash conversion is unprecedented, and so too is worrying levels of debt.

There were three big factors that combined to diminish XP Power’s financial strength in 2022: the loss of a court case, two acquisitions, and chaotic component supply and shipping.

A US court found XP Power had stolen trade secrets in March 2022. In total, the company incurred £52 million in legal costs during the year on top of £10 million in 2021, most of it in the form of a £47 million provision for $40 million in fines and ongoing legal costs.

Although the company has not paid the fines yet, it has purchased an appeal bond from an insurance company. This is collateral guaranteeing XP Power will be able to pay up if it appeals and loses.

- 10 shares for investors wanting defensive options

- Stockwatch: more investors might appreciate this Marmite share

The bond used up a £37 million slug of cash, which along with money spent on acquisitions, land for a new factory, and stockpiling because of component shortages, explains XP Power’s negative cash conversion and high level of debt.

The company believes it has provided for the worst case legal scenario and that the fine could be revised downwards without an appeal, but it also acknowledges “a broad range of potential outcomes.”

Heavy adjustments to profit ignore the legal provisions and a write-off relating to product development using the disputed intellectual property, because they obscure the underlying performance of the business.

Even so, profitability deteriorated in 2022. Despite a 21% increase in revenue, helped by the acquisitions and exchange rate movements, adjusted profit fell 7% due to high freight and component costs, and a five week Covid-19 lockdown at XP Power’s Chinese factory.

These problems have receded, although that means the company is experiencing a sharp slowdown in new orders as it fulfils the pandemic backlog.

Mercifully, it also expects to use higher revenue and improved cash flow to repay some of the debt, and order intake to pick up again in the second half of the year.

Long-term consequences

Although it is tempting to write the court case off, there may be longer-term consequences.

The disputed intellectual property is not incorporated in the current product range, XP Power cannot use it in new products, which has impacted RF (Radio Frequency) product development.

XP Power entered the RF market when it acquired Comdel in 2017, and although RF contributes a relatively small proportion of revenue, it is an important component of the company’s strategy to supply more sophisticated products to its customers.

If XP Power chooses to appeal, the court case could drag on, consuming financial and management resources that would otherwise be invested.

With its hands full for all sorts of reasons in 2022, XP Power introduced 15 new product families, half the number it targets per year, although the company says that the potential revenue from each new family varies widely, and it has high expectations of the low voltage high power converters it has introduced over the last three years.

Set against these legal misadventures and turbulent trading conditions, is an impressive business that has generated an average return on capital of 28% over the last 10 years and double-digit compound annual revenue growth.

Still moving up the value chain

Power converters regulate the electricity supplied to machines. They power everyday equipment like laptops and washing machines, but XP Power specialises in converters for more sophisticated industrial, semiconductor manufacturing machinery and medical equipment.

Of these segments, healthcare contributes the least revenue (20% of the total in 2022), and was the only one to contract, due, the company says, to component shortages. Generally, though, healthcare is a more reliable market than semiconductor and industrial markets that contribute nearly 40% of revenue each. They grow strongly but less predictably.

Efficiency and reliability are critical because failure could stop a production line or a medical procedure. As machines become more complex, XP Power is selling more converters, of more complex design, to its blue-chip customer base, nearly 60% of it in North America.

- Six value share tips for 2023 – and beyond

- What 120 years of stock market data tells us about where to invest today

Once designed-in, power converters are unlikely to be substituted for a different brand because of the design and testing work that would be required.

Low-voltage converters, which generate nearly 80% of XP Power’s revenue, are not very complex, though, and the company faces competition from other low-cost manufacturers in the Far East.

This explains why XP Power has developed more sophisticated low voltage converters and acquired businesses that make high-voltage and RF products. These require a greater level of collaboration to design in to products, which XP Power is well placed to deliver because it has more sales engineers in the field and more product families than its rivals.

It also explains XP Power’s investment in Green Power, converters that use new materials and semiconductor components to reduce energy consumption and emissions, and increase reliability.

Selling more to existing customers increases XP Power's dependence on them. Its biggest customer contributed 17% of revenue in 2022, but big customers make many different machines, and the company says it is unlikely a customer would change supplier all at once and across the board.

Two German acquisitions in January continued XP Power’s journey up the value chain. Both make high voltage products used in equipment like particle accelerators and laboratory power supplies.

They also diversify the company’s manufacturing base, which includes specialised facilities in Germany and the USA as well as larger factories in China and Vietnam. This is important because geopolitical friction may result in higher tariffs and prohibitions on products with components sourced in China.

Next-up is a factory in Malaysia, to be constructed in 2023 and 2024. The company believes the newer of its two Vietnamese factories is the most environmentally friendly in the industry, and the Malaysian one will incorporate similar innovations and be twice the size.

Increasingly, XP Power is using third-party suppliers to manufacture low-voltage power converters.

Voting with their feet?

XP Power’s history up until the court case had mostly been a joyful one for shareholders. The company successfully used market knowledge it gained from being a distributor to design product families that are easy to modify and fit into customers' machines. It set about manufacturing them efficiently too.

This transformation coincided with stronger profitability and growth lasting more than a decade, and ever-present was James Peters, XP Power’s chairman. He retires this month. Oskar Zahn, the company’s chief financial officer, is also leaving after only two years.

Continuity comes in the form of chief executive Gavin Griggs, although he is a fairly new recruit. He joined XP Power in 2017 as chief financial officer, and was promoted in January 2021.

Business is easier when commenting from the sidelines in hindsight, but I wonder about the board’s decision to go ahead with two acquisitions while waiting for a legal judgement which had the potential to weaken its finances, and while it was dealing with monumental issues in its supply chain.

XP Power publishes detailed employee turnover statistics, which is an indication it values employees. Its modest UK workforce appears steadfast, but the company is experiencing high levels of turnover at its Asian manufacturing sites, which have been under pressure due to the pandemic and rapid expansion. In North America too, many staff left the business voluntarily in 2022, due the company says to the “great resignation” following the pandemic.

Scoring XP Power

I have admired XP Power’s evolution over the years, but it is financially, organisationally, and legally challenged at the moment and the combination is unsettling.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

? Good cash conversion is spoiled by legal costs

What could stop it growing profitably? [1]

? High level of borrowing

? Commoditisation of low-end products

? Potential for more legal shenanigans

How does its strategy address the risks? [2]

+ Selling more to largest customers

+ Moving up the value chain

+ Diversifying manufacturing base

Will we all benefit? [1]

? New management

? Employee engagement

+ Green Power

Is the share price low relative to profit? [1]

+ Yes. A share price of £18.60 values the enterprise at £576 million, about 10 times normalised profit.

A score of 7 out of 9 suggests XP Power is a good long-term investment, but it also feels like a speculative one.

It is ranked 18 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in XP Power.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.