Rolls-Royce ‘reassuring and bullish’ update pleases City

There’s lots to like in the latest comment from the popular aero engineer, and analysts have been quick to have their say. City writer Graeme Evans reports.

1st May 2025 15:21

by Graeme Evans from interactive investor

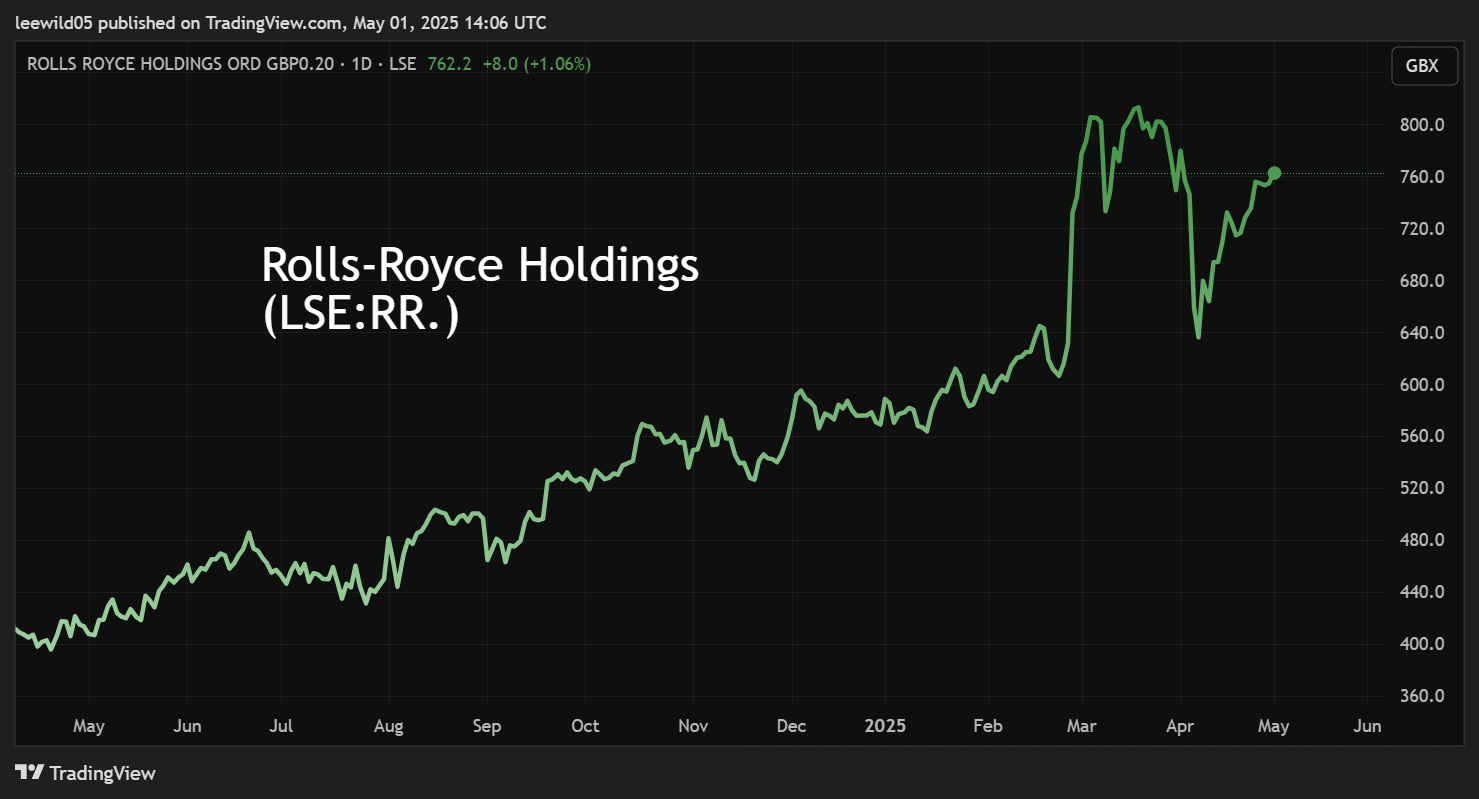

Rolls-Royce Holdings (LSE:RR.) shares were today above their “Liberation Day” price after a confidence-boosting update included the direct impact of tariffs in unchanged guidance.

Initial dealings were priced 4% higher at 783p before the FTSE 100 stock settled at 763p in mid-afternoon trade, up from the 635.8p seen at the height of market turmoil of 7 April.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Morgan Stanley, which has a price target of 900p, called the AGM update “reassuring and bullish” and said the shares deserve to outperform as a result.

Counterparts at UBS are at 1,000p, having moved its recommendation from 640p in the days following February’s forecast-beating annual results.

Source: TradingView. Past performance is not a guide to future performance.

The Swiss bank noted large engine flying hours in today’s release were better than it expected at 110% of 2019 levels and that defence order intake remains strong.

It said: “The language in the statement is generally bullish, highlighting a strong start to the year across all divisions.”

Both banks highlighted the significance of the commentary on tariffs, which showed that their impact should be fully offset by mitigating actions.

Morgan Stanley said Rolls joined GE Aerospace (NYSE:GE) in confirming guidance inclusive of tariffs, representing a more bullish stance than some peers.

It added: “We think this demonstrates the resiliency and diversity of the group, developed as part of management's multi-year transformation plan.”

- Lloyds Bank and Aviva part of £9bn FTSE 100 dividend windfall

- Stock market winners and losers during Trump’s first 100 days

Today’s update means February’s upgraded guidance for £2.7 billion-£2.9 billion of underlying operating profit and free cash flow is still in place.

Chief executive Tufan Erginbilgic told shareholders at the company’s AGM in Derby that the tariffs have created a degree of uncertainty for the industry but that a “more resilient and agile” Rolls was better equipped to respond to external challenges.

He added: “Our transformation of Rolls-Royce is progressing strongly and we continue to expand the earnings and cash potential of the business.”

His focus on commercial optimisation and cost efficiencies and the return of engine flying hours to above pre-Covid levels have led to a faster-than-expected turnaround.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- What City thinks of BP shares after profit slip-up

A much stronger balance sheet means the engine maker is set to pay a dividend of 6p a share, the first distribution since January 2020, on 16 June. It is also buying back £1 billion of its shares, a surprise move which sparked a 15% surge for shares on the day of annual results.

The initial slide for shares in the wake of Donald Trump’s Liberation Day tariffs announcement meant investors who braved the turbulence were able to build their Rolls’ exposure at prices last seen on the morning of the annual results. They peaked in March at 818p.

Their confidence was rewarded by today’s update after Rolls reported that demand for its products and services had been strong across the group.

As well as growth in engine flying hours in the three months to 31 March, strong aftermarket revenues growth was driven by higher shop visit volumes.

- Lloyds Bank Q1 profit falls amid tariff caution

- The 20 most-popular dividend shares among UK fund managers

In power systems, strong revenue growth has benefited from continued demand for back-up power generators for data centres.

The defence business also recently delivered the first engine to Boeing for the MQ-25 programme, which is the US Navy’s first aircraft carrier-based unmanned air vehicle to be used for refuelling, intelligence and surveillance.

With 50% of divisional revenues to the US and much of this local-for-local, Morgan Stanley noted that the defence business is fairly well insulated from tariffs risks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.