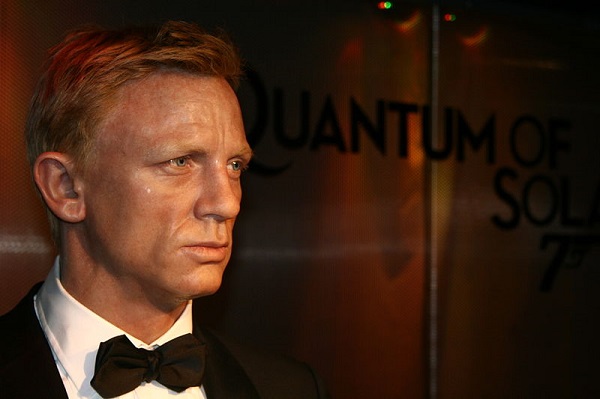

Royal Mint launches James Bond gold collection

The Royal Mint launched its James Bond coin and gold bar collection dedicated to No Time To Die.

3rd March 2020 10:48

by Myron Jobson from interactive investor

The Royal Mint launched its James Bond commemorative coin and gold bar collection yesterday ahead of the release of the 25th James Bond film, No Time To Die.

The Royal Mint launched its James Bond commemorative coin and gold bar collection yesterday ahead of the release of the 25th James Bond film, No Time To Die.

For the author, Ian Fleming, the trappings of wealth so vividly brought to life in the Bond novels were not inspired by gold – either gold fingers or gold bars – but by wealth created by investment trusts.

Ian Fleming’s grandfather, Robert, co-founded Scottish American Investment Company (LSE:SAIN), one of the oldest investment trusts in the sector, launched in March 1873, and still serving shareholders today. He later formed the merchant bank of Robert Fleming and Company. Whilst Ian Fleming was born in Mayfair, London, his grandfather, Robert, hailed from Dundee – so James Bond’s Scottish roots are perhaps no coincidence.

Commenting on the launch, Myron Jobson, Personal Finance Campaigner, interactive investor, says: “Diamonds may be forever, but gold can be a nervous investors best friend, if a very fickle one best kept as part of a well-balanced portfolio.

“The James Bond coin and gold bar collection is more than just a pricey souvenir to commemorate the upcoming film. They each have an intrinsic value which could be worth more than its weight in gold if there are enough gold fingered 007 fanatics keen to get their hands on one.

“In the modern era, many investors dedicate a small portion of their portfolio to gold to hedge against uncertainty in the wider economy. But even gold can have a mind of its own – whether it’s emotional, cultural, or economic – gold is not immune to sensitivities.

“Owning physical gold can be expensive. You would need to factor in the cost of storage, insurance and transaction fees which adds up. So for investors looking seriously at gold as a hedge against the unexpected, we like iShares Physical Gold ETC (LSE:IGLN), which buys and stores gold bullion, is competitively priced with ongoing costs at 0.19%, and is on our Super 60 rated list.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.