Saltydog: when to step back into markets after the coronavirus crash?

The momentum investing strategy used by Saltydog's Douglas Chadwick means the Tugboat portfolio has avoi…

6th April 2020 10:52

The momentum investing strategy used by Saltydog's Douglas Chadwick means the Tugboat portfolio has avoided painful market corrections and left the investors feeling understandably smug.

In the last few weeks, stock markets around the world have been in free-fall, and where they go next nobody really knows. Of course, there are some who say they do, but now is the time to choose your “expert” media inputs very carefully.

The financial industry by and large promotes a “buy and hold” approach, whereby you choose your investments wisely and hold them through the good times and the bad. Proponents maintain that successful investing is about “time in the market, not timing the market”. They will say that if you miss the few days during the recovery, when the market really soars, then you and your portfolio could be badly jeopardised.

However, they always fail to mention the very pleasant feeling generated by being out of the market when it tumbles, and in the last 25 years there have been some significant tumbles. The largest was the dot.com crash, starting in 2000, then the financial crisis of 2008/09, and now the spread of coronavirus.

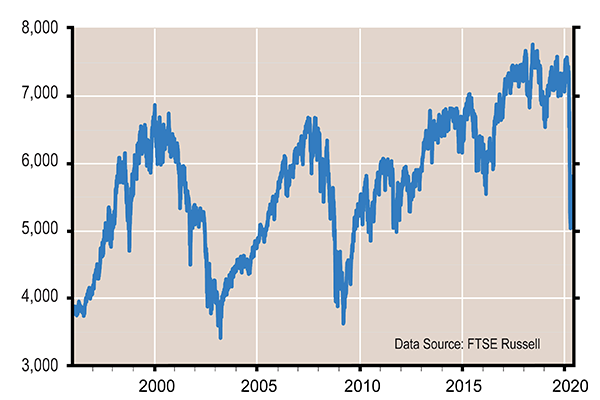

How the FTSE 100 has performed since 1996

At Saltydog Investor, we are trend or momentum investors. We buy into uptrends and sell out of downtrends. If it turns out that the correction is a small one, then unfortunately we can end up selling and then buying back at an increased price. Not a clever result, but definitely better than experiencing the wealth-destroying crashes that you can see in the FTSE 100 graph.

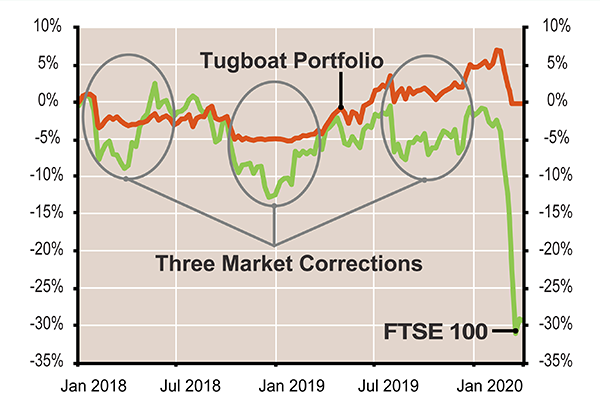

In recent times, we have used this approach religiously due to the precariousness of existing world economies, and this time it has paid off in spades. Looking at the Tugboat portfolio graph, you can understand why at Saltydog we feel reasonably smug. Since the beginning of 2018, we have successfully navigated three market corrections, and are now well positioned to make the most of the next upturn after this coronavirus crash.

How the Tugboat portfolio fared during previous market corrections

The next question is when to step back into the markets? Who can know this answer? Hopefully the markets will make a definite upward turn, and then it will be the time to make small purchases and watch carefully to see if that trend continues. Thankfully, we have a 30% comfort cushion. We will use the Japanese philosophy of taking small steps quickly, and no great leaps into the unknown!

For the moment, I am trying to imagine which sectors I will be invested into in 12 months’ time, assuming the world has moved on by then. I think it will be a mistake to ignore the “Greta” effect, and the desire of many people to improve the world's environment. Sustainability and good ethical governance are now mainstream issues, and there are funds that provide a good return for people wishing to invest in these areas. At Saltydog, our demonstration portfolios were invested in three such funds for most of last year.

- Royal London Sustainable World Trust, which went up 30% in 2019.

- Liontrust Sustainable Future Managed, which went up 25% in 2019.

- Janus Henderson Institutional Global Responsible Managed, which went up 25% in 2019.

I also see no reason why technology funds in all their shapes and forms will not continue to be at the forefront, with biotech and energy funds leading the charge. There is certainly one fascinating new kid on the block, and that is “Waterfuel”. This involves using electrolysis to split water into hydrogen and oxygen, cheaply, efficiently and safely. The hydrogen can then be stored and later fed into existing gas installations or used to power hydrogen-driven engines.

This is not a new idea, but using free green energy to produce the electricity for the electrolysis process is new. Imagine an obsolete North Sea Oil platform, connected to the UK by a gas pipeline, then build a new-style electrolysis stack on to this platform and supply it with electricity from a strapped-on tidal turbine. The resulting hydrogen flow is then pumped ashore. This is really green, and you are not going to run out of water or electricity to power the process. A number of businesses are working in this arena of hydrogen storage and creation, along with hydrogen fuel cell designs, including ITM Power plc, Ceres Power Holdings plc, AFC Energy plc, and Powercell Sweden AB. I am now looking for the fund manager who is investing into this type of business.

These are certainly interesting times. As Jesse Livermore might have observed: “When you are investing, you cannot allow any of your brain's emotional executive committee to knock on the door of the decision-making boardroom, let alone take a seat at the table. You have to stay in the present. Do not let what happened yesterday affect your investment decisions of today.”

Douglas Chadwick is a founder director of Saltydog Investor.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.