Senior Conservatives urge no Budget tax hikes

The chancellor should focus on getting business moving, according to top Tories.

25th February 2021 15:04

by Marc Shoffman from interactive investor

The chancellor should focus on getting business moving, according to top Tories.

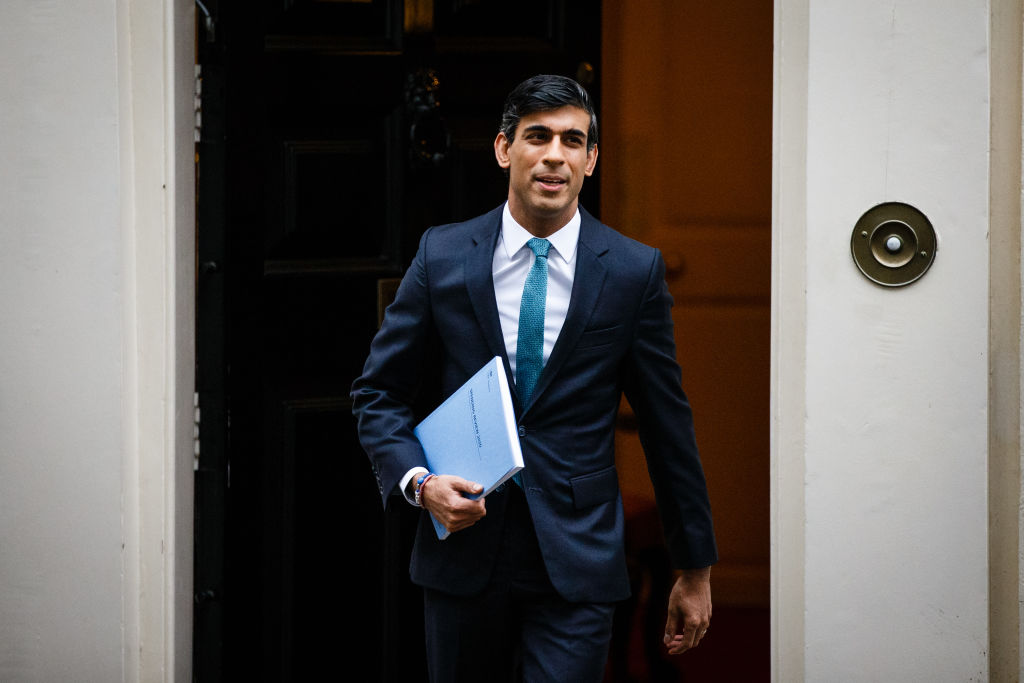

Senior Tories have urged chancellor Rishi Sunak to avoid any tax rises in his impending Budget.

Sunak is due to deliver his Budget on 3 March and will be under pressure to outline how he will repay state support given during the pandemic.

There have been plenty of suggestions, including raising capital gains tax or bring in a wealth levy of some sort.

This could hit savers cashing in non-ISA products or other assets.

There is also speculation the government will reduce tax support pension savers currently receive. This includes cutting the 40% pension tax relief available to higher-rate and additional rate taxpayers.

The Institute for Fiscal Studies has previously warned that tax rises will eventually be needed to boost government public spending, but said it is too soon to be introduced at the next Budget.

Senior Tory MPs and former cabinet ministers have echoed this.

Former Tory leader and work and pensions secretary Iain Duncan Smith says the focus should be on “getting business moving and taking advantage of our early vaccinations”.

Former Brexit secretary David Davis warns he would vote against any Budget tax rises, according to the Daily Express.

He says: “We already have the highest tax burden in 50 years. If we get tax increases, we won’t have any money left to pay the bills.”

- Budget 2021: how could pensions change?

- Hiking pensions tax will harm consumers, experts warn

- Are you saving enough for retirement? Our calculator can help you find out

Davis says there needs to be more encouragement for new businesses, which won’t be helped with higher taxes.

Shona Lowe, private client director at advisers 1825, says rumours of tax rises often come to nothing but it is important to be prepared.

Lowe adds: “The overall direction still seems to indicate that certain tax rates will increase or reliefs may be reduced. That makes it more important than ever to make use of current tax rates and rules.

“This could be maximising the use of your income tax personal allowance and your capital gains tax annual exempt amount plus ensuring you are making use of current inheritance tax exemptions such as the annual allowance, regular gifting from income and potentially exempt transfers.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.