Share price crash could offer good entry point at this tech star

8th September 2021 09:22

by Rodney Hobson from interactive investor

It’s one of the best-known pandemic stocks, but the price has slumped. Here’s what our overseas investing expert thinks could happen next.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Have we embarked on a new normal or will we go back to the old ways as the Covid-19 pandemic gradually fades away? That agonising question is seriously distorting investors’ reactions to quarterly results from companies such as Zoom Video Communications Inc (NASDAQ:ZM).

Zoom provides a videoconferencing service that has transformed the whole concept of working from home, as well as providing a means for families and friends to protect their sanity by keeping in touch during lockdowns. It has even put a new phrase into the popular vocabulary: “You need to unmute!”

The company provides a limited free service that it hopes will reel in customers who will progress to paying a modest monthly fee for unlimited on-air time, with some moving up the scale to more sophisticated – and more expensive – arrangements.

Zoom reported a record second quarter to the end of July, with revenue up 54% year-on-year to top $1 billion for the first time. The figure was boosted by a doubling of the number of corporate clients paying more than $100,000 a year for the ability to host videoconferences for large numbers of participants.

Net income of $316.9 million was up 71% on a year earlier and cash flow remained strong.

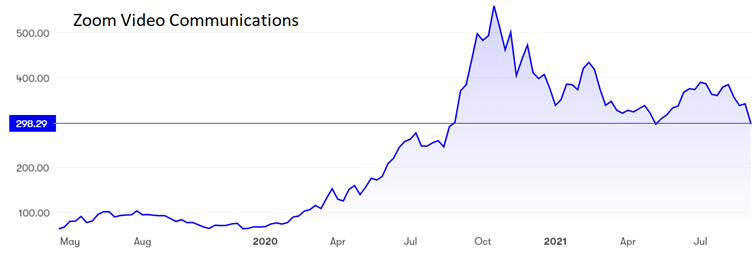

Yet the shares bombed 17% when markets opened in New York the day after the results came out and they are down from $559 last October to just below $300 now.

Source: interactive investor. Share price in US dollars. Past performance is not a guide to future performance

Zoom admitted that the spectacular growth of the past 12 months or so will not continue. It expects revenue in the third quarter to be round about the second quarter level, and for net income to be slightly lower. Even so, full-year revenue should hit $4 billion compared with $2.65 billion last time and net income is predicted to hit $1.5 billion.

Last month Zoom settled a class action in the United States alleging that personal data had been shared with Facebook (NASDAQ:FB), LinkedIn and Alphabet (NASDAQ:GOOGL)-owned Google. Zoom denied doing anything wrong, but it did agree to improve security and stump up $85 million to compensate claimants and pay the costs of the case.

Zoom does seem to have been caught out by the speed of its expansion. If usage remains more stable it should be able to avoid this kind of problem in future.

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

- Anthony Scaramucci: The ii Family Money Show

- Stockwatch: look no further than this amazing tech giant

Realistically, from now, on user numbers will not see anything like the meteoric growth of the pandemic months but neither are they likely to fall off sharply. Subscribers who pay via direct debit and who want to drop out will be slow to make the effort to cancel. That’s the big advantage from the company’s point of view of locking people into direct debits.

In any case, many client companies will have realised that it is much cheaper to bring team members together through Zoom rather than pay for them to travel long distances for a meeting.

Zoom holds a dominant position in a niche market, having replaced the now largely forgotten Skype as the market leader. In technology more than any other sector, spotting what the customer really wants and meeting that need at an affordable price is crucial. The range of Zoom’s pricing structure is well thought out. Margins are spectacular at as much as 70% and the business can be scaled up easily and efficiently.

Hobson’s choice: Zoom is worth considering now the shares are at a more sensible level. This was easily one of the best performing US stocks during the first nine months of 2020 and a correction was well overdue. That downturn may now have run its course. Buy up to $308, where there could be resistance.

One word of warning though: there is no dividend, so for the time being investors will be relying on share price recovery. There could, though, be a payout in the next financial year.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.