Share Sleuth: there’s no escaping the impact of coronavirus

Richard Beddard explains how the coronavirus crash has hit him harder than the credit crunch, or the do…

17th April 2020 12:34

by Richard Beddard from interactive investor

Richard Beddard explains how the coronavirus crash has hit him harder than the credit crunch, or the dotcom crash, but that he still sees reasons to be optimistic.

Earlier today, I found my wallet in a drawer. The contents: a fiver, an old receipt, an English Heritage membership, and a card with ink-stamps from Waterstones’ cafe nearly entitling me to a free cup of coffee, seemed like relics from a bygone era. It’s been weeks since I used any of these things.

I am writing this month’s column in early April, and there’s a danger that by the time you read it, my words will be quaint anachronisms too - such is the speed of events. Take last month’s Share Sleuth, drafted in a cafe. The pandemic had yet to be declared, face masks seemed ludicrous, and I was nervous about adding shares in Hollywood Bowl to the Share Sleuth portfolio.

It felt slightly crazy to buy shares in a business that requires people to gather, but I deemed a small investment worthwhile because unease about coronavirus had finally reduced the share price to an affordable level. By the time Money Observer hit newsstands, we had all but been confined to our homes. Restaurants, cinemas, and many shops were closing, and so too were bowling alleys.

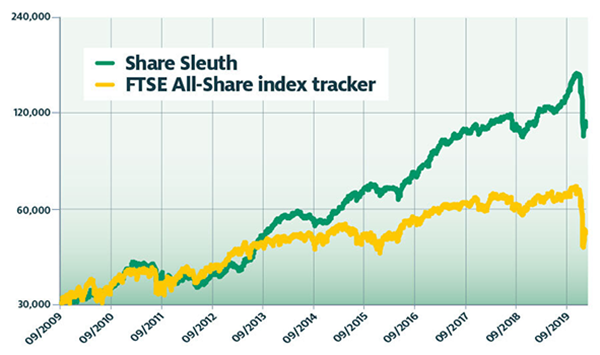

This crisis has hit me harder than the credit crunch, or the dotcom crash. I don’t track the value of my investments routinely, so much of the time these earlier crashes felt like they were happening to other people. But there’s no getting away from the impact of the virus. Stuck at home, it is easy to dwell on questions we cannot answer: how long this will last and what the impact will be.

Twilight zone

Running a public portfolio presents challenges. Plotting the chart on this page draws my attention to Share Sleuth’s performance; correspondence – always welcome – from readers has taken an anxious turn; and we are in a kind of twilight zone in which analysing and writing about companies sometimes feels absurd. During the financial crisis, bad businesses went bust, and good businesses slowed down. This time good businesses have ceased operating, and we do not know when they will start up again.

As I age, the value of my pension savings is taking on more significance. A friend and mentor old enough to remember investing during the Cuban missile crisis in 1962 is experiencing a reduction in the dividend income that helps support him. How much his portfolio might be worth in 10 or more years’ time – the timescale of those of us still growing our assets – is less important than what happens sooner. He is more vulnerable to the disease; but as always he is utterly indefatigable, which is why he is a source of inspiration to me.

The Share Sleuth portfolio has a very modest amount of cash, enough to fund a single trade, but I haven’t made one. My mind has been anxious as we adjust to the lockdown, and I have lacked the mental bandwidth to make decisions beyond those thrust on us by new circumstances.

As for reducing holdings, it goes against the grain. I didn’t predict a pandemic, but favoured resilient businesses with strong finances, run and operated by good people, companies that should ride out any scenario short of the end of capitalism as we know it. Maybe years of good returns softened me up, so I intend to introduce more rigour into my judgements of companies, but there won’t be knee-jerk expulsions from the portfolio.

To be a long-term investor is to be an optimist and, as the fog lifts, I see a large number of decent businesses trading at relatively low valuations. Although I have no valuable insights on the progression of the pandemic, or how traders will respond, I believe in people. I believe we will find better ways of coping with this virus and perhaps even stamp it out, and I believe that good businesses will adapt, get back to work and ultimately prosper.

No knee-jerk explusions

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 4,755 | ||||

| Shares | 109,488 | ||||

| Since 9 September 2009 | 30,000 | 114,244 | 281 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 586 | -41 |

| ANP | Anpario | 937 | 3,168 | 3,233 | 2 |

| AVON | Avon Rubber | 192 | 2,510 | 4,771 | 90 |

| BMY | Bloomsbury | 1,256 | 3,274 | 2,499 | -24 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 2,616 | -28 |

| CGS | Castings | 1,109 | 3,110 | 3,316 | 7 |

| CHH | Churchill China | 341 | 3,751 | 4,143 | 10 |

| CHRT | Cohort | 1,600 | 3,747 | 7,840 | 109 |

| DTG | Dart | 456 | 250 | 2,538 | 915 |

| DWHT | Dewhurst | 735 | 2,244 | 6,799 | 203 |

| GAW | Games Workshop | 113 | 324 | 5,132 | 1,484 |

| GDWN | Goodwin | 266 | 6,646 | 5,227 | -21 |

| HWDN | Howden Joinery | 748 | 3,228 | 4,009 | 24 |

| JDG | Judges Scientific | 159 | 3,825 | 6,781 | 77 |

| NXT | Next | 45 | 2,199 | 1,700 | -23 |

| PMP | Portmeirion | 349 | 3,212 | 1,099 | -66 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,403 | -12 |

| QTX | Quartix | 1,085 | 2,798 | 2,658 | -5 |

| RM. | RM | 1,275 | 3,038 | 1,721 | -43 |

| RSW | Renishaw | 92 | 1,739 | 2,681 | 54 |

| SOLI | Solid State | 1,546 | 4,523 | 5,921 | 31 |

| TET | Treatt | 1,222 | 1,734 | 5,132 | 196 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 5,360 | 143 |

| TRI | Trifast | 2,261 | 3,357 | 2,198 | -35 |

| TSTL | Tristel | 750 | 268 | 3,135 | 1,069 |

| VCT | Victrex | 323 | 6,254 | 6,072 | -3 |

| XPP | XP Power | 339 | 6,287 | 8,916 | 42 |

Notes: No transactions. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £114,244 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £51,197 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 6 April 2019.

Share Sleuth over 10 years

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.