This showbiz star is no Mickey Mouse stock

Watch for a boom at this company when post-lockdown animal spirits are unleashed. Results could surprise.

12th May 2021 09:27

by Rodney Hobson from interactive investor

Watch for a boom at this company when post-lockdown animal spirits are unleashed. Results could surprise.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Just as things are starting to look up for entertainment conglomerate Walt Disney (NYSE:DIS), investors have been getting cold feet ahead of quarterly results due on Thursday 11 May. It is always dangerous to buy immediately before figures are released but there is scope for Disney to surprise on the upside.

Disney, as they say in showbiz, needs no introduction. Based at its studios complex in Burbeck, California, it makes live and animated films, streams programmes direct to consumers, operates cable channels and runs theme parks. Its best-known characters include Mickey Mouse and Luke Skywalker.

It has been a tough past 15 months for Disney. Its theme parks around the world have been closed, its cruise lines suspended and its film making has been put on hold, not only because of the difficulty of maintaining social distancing on set but also because cinemas have not been open to show films anyway.

Nor is it out of the woods yet. The Disneyland and California Adventure theme parks were reopened on 30 April after being closed for more than a year, but Paris Disneyland, which was supposed to reopen on 2 April, remains closed in view of the third wave of Covid-19 cases sweeping Europe.

- Bill Ackman: I think this could be the Black Swan event of 2021

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Check out our award-winning stocks and shares ISA

On the positive side, the Disney+ streaming service has been a great success among those confined to their television sets for entertainment during the pandemic.

Its hit series The Mandalorian that opened on 30 October quickly made ratings agency Nielsen’s Top 10 list of streaming titles, the first such success for Disney+. This was followed by WandaVision, a new TV series based on Marvel characters. Another Marvel series, The Falcon and the Winter Soldier is currently top of the Nielsen ratings.

Disney+ subscribers have been growing strongly and steadily and probably now top 100 million. Add in other Disney streaming services such as Hotstar, Hulu and ESPN+ and total subscribers are approaching 150 million. Disney has a wealth of content to offer from inhouse production units such as 20th Century Studios, Searchlight, Fox Television and ABC Studios.

By 2024, as Disney+ expands into Eastern Europe and the Far East, its subscriber numbers are forecast to reach about 250 million, three or four times its original target. Global subscriptions for all streaming channels will reach 300-350 million, well ahead of the just under 200 million currently achieved by Netflix (NASDAQ:NFLX).

- ii view: Disney streaming growth overshadows park challenges

- Why Warren Buffett just rang the alarm bell on inflation

All this is the future: the last set of quarterly results issued in February reflected continuing struggles. Earnings per share at 32 cents showed a double-digit fall for the third consecutive quarter. Even so, analysts had been braced for a hefty loss and revenue at $16.25 billion was slightly higher than expected.

Revenue from theme parks was chopped in half but streaming services to locked down consumers came to the rescue, soaring 73%.

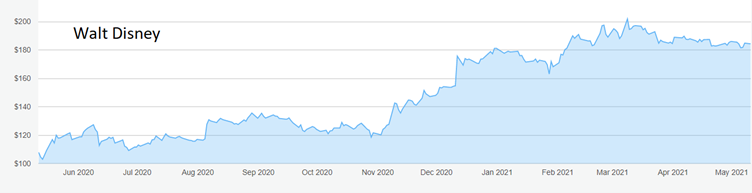

Source: interactive investor. Past performance is not a guide to future performance

Expectations for second-quarter results to the end of March are again somewhat downbeat, with earnings possibly halved and revenue again showing a double-digit decline. Investors will be particularly eager to see what plans if any are announced regarding restoring the suspended dividend.

As the world gets back to normality and vaccines are rolled out, Disney should return to growth. Much depends on how well new chief executive Bob Chapek performs. He knows the business well, having been chairman of Disney Parks, Experiences and Products, but departing chief Bob Iger is a hard act to follow. At least Iger is staying on as executive chairman for the rest of this year to ensure a smooth handover.

Hobson’s choice: The shares hit a new high at $197 in March but have been sliding and are now below $182. They could bounce back strongly if results beat expectations. Investors willing to take the chance should buy up to $185.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.