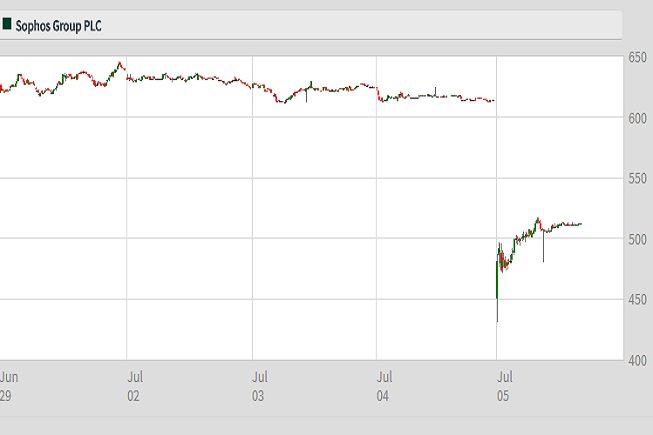

Sophos still fancied despite huge sell-off

5th July 2018 14:11

by Graeme Evans from interactive investor

A plunge of as much as 30% looked overdone, and so it has proved, with bargain hunters fancying this high-flying tech firm, reports Graeme Evans.

For a second time this year, Sophos Group shares have blown up in the faces of investors after the FTSE 250-listed cybersecurity firm’s performance failed to keep up with lofty expectations.

It's hard to see that there’s too much in today’s update from Oxford-based Sophos to justify the subsequent 30% shares reverse. The long-term outlook is unchanged, but there’s clearly disappointment among investors that Q1 billings growth is only 6% despite comparisons with a very strong year in 2017.

The problem is that shares have surged as much as 53% since April, when a strong end-of-year update helped draw a line under a previous shares slump.

Source: interactive investor Past performance is not a guide to future performance

Sophos shares were one of the stand-out performers in the FTSE 250 Index in 2017, with publicity around Wannacry ransomware and other cyber attacks highlighting the attraction of this fast-growing technology sector.

Shares peaked at 669p in late January, but in an echo of today's performance Sophos was then punished for figures that didn’t quite meet expectations.

Analysts at Stifel reduced their target price to 637p following today’s update, down from 712p. However, they remain fans of the stock and said that the latest fall looked to be a great opportunity to pick up shares on the cheap.

They add: "Our long-term enthusiasm for the stock is undiminished."

Source: interactive investor Past performance is not a guide to future performance

While the 6% billings guidance for Q1 was short of the 12% growth forecast by the broker, Stifel is encouraged that Sophos has made no changes to the outlook for the second half of the financial year.

Sophos has consistently said that its goal is to deliver annual billings of $1 billion in 2020, a target that remains in place. In May, it reported a 21.6% rise in 2018 billings to $769 million. The other targets for 2020 include free cash flow (FCF) of between $220-240 million and adjusted operating profit greater than $100 million.

Citi said that the longer-term FCF target was key to its valuation and target price of 700p. However, they added that a significant re-acceleration in second half billings growth was needed for the company to achieve its guidance this year.

Citi said today:

"We see a strong probability for growth trends to

normalize over the course of the year as the group cycles past the difficult

comparator and benefits from forthcoming product releases."

The company's portfolio of cloud-based products protects over 280,000 organisations and over 100 million end users in 150 countries. In the $40 billion cybersecurity market it estimates that there is a $10-12 billion opportunity for the company.

Sophos says it is the only vendor of any scale to explicitly focus on the mid-market, designing enterprise-grade, industrial-strength security solutions.

And as a subscription software business, Sophos benefits from the financial visibility that this offers.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.