Standard Chartered dives again as investors head elsewhere

Standard is the worst of the UK banks since December. Our head of markets gives a view on these results.

27th February 2020 10:09

by Richard Hunter from interactive investor

Standard is the worst of the UK banks since December. Our head of markets gives a view on these results.

Standard Chartered (LSE:STAN) has brought the curtain down on a largely forgettable reporting season for the UK banks, with a similar theme of a reasonably strong first half mitigating a poor end to the year.

For Standard, whose business is largely Asia-focused, this is of little surprise. In recent months the Chinese economy had started to show signs that it was beginning to come off the boil, the protests in Hong Kong helped tipped the region into recession and, latterly, the as yet unquantified impact of the coronavirus has led to a virtual shutdown in China.

More broadly, the interest rate environment tightens the screw further, and margin compression has added to weaker net interest income and net interest margin figures, particularly in the final quarter, leading to a 25% reduction in underlying pre-tax profit.

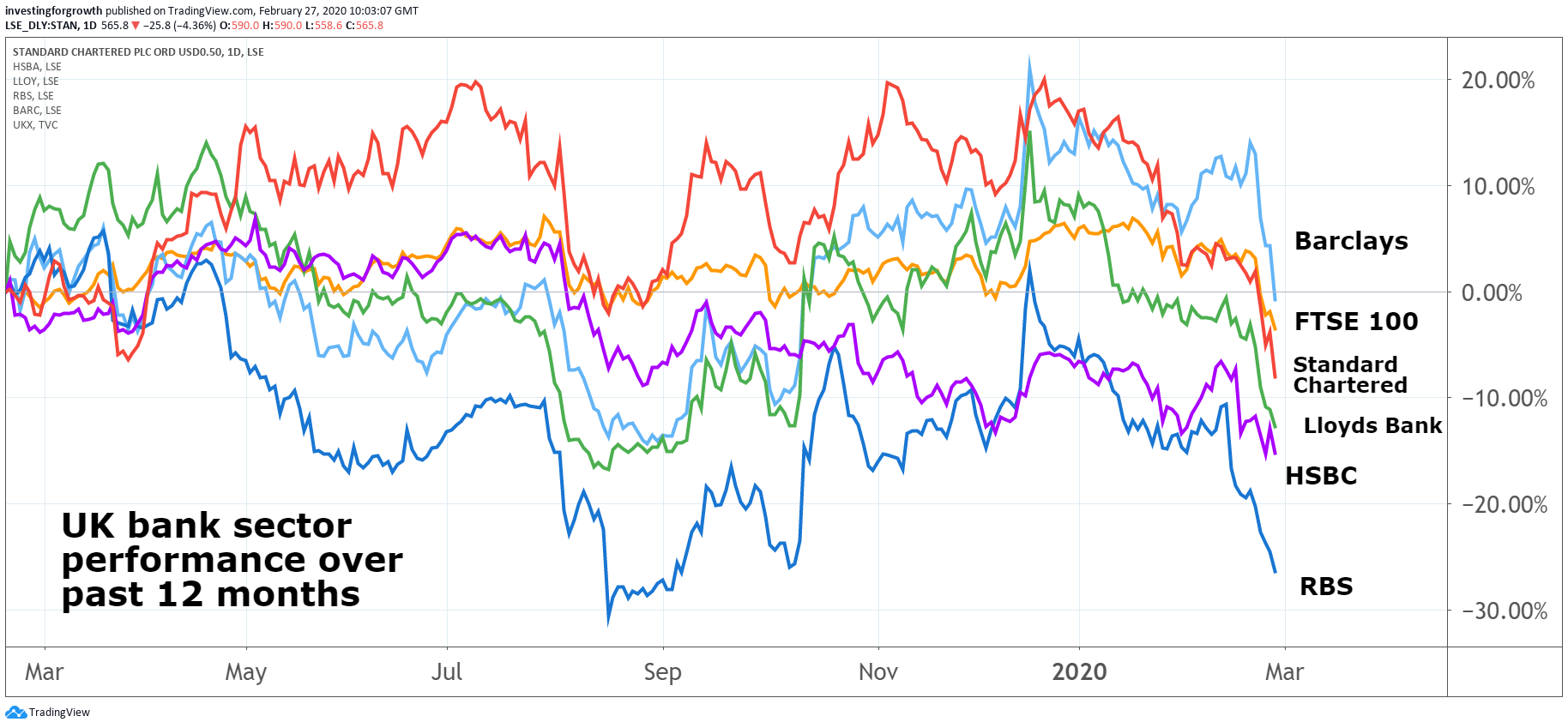

Source: TradingView Past performance is not a guide to future performance

These factors in turn have led to an outlook from the bank which is uninspiring. Income growth for this calendar year is now expected to be slower than expected, while Standard’s previous comments that it would have a “relentless” focus on achieving a return on tangible equity by 2021 is now destined to failure.

Indeed, for 2019 the figure was just 6.4%, albeit an improvement from the previous year. Credit impairments showed a hike of 22% and the proposed share buyback programme of $500 million, while welcome, may be of some disappointment to investors expecting a repeat of the previous year’s $1 billion figure.

- Lloyds Bank shares: A top fund manager’s view

- Coronavirus hammers Lloyds Bank shares and FTSE 100

- Lloyds results: Is there cause for optimism?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Some of these challenges, as Standard is keen to point out, are outside of the bank’s control and it has therefore been concentrating on moving the dial where it can. Cost containment has been a particular focus recently, and has shown further progress with a 6% drop in operating costs and a reduction in the cost/income ratio to 66% from a previous 68%.

Meanwhile, the strength of its performance earlier in the year provided sufficient momentum for full-year pre-tax profit to have jumped by 46%, although this was shy of the 55% the market had been expecting.

Elsewhere, the capital cushion remained at a comfortable level of 13.8%, underlying earnings per share benefited from the bank’s efforts to the tune of 23% and operating income was ahead of expectations at $15.42 billion. The full-year dividend was increased by 29%, which shows some confidence in prospects and leads to a respectable projected yield of 3.9%.

In all, the very focus on Asia which may yet prove to be of long-term benefit is biting the bank in the nearer term. The group is likely to strengthen its focus on costs anew, particularly in light of the expected slowdown in income growth.

Source: TradingView Past performance is not a guide to future performance

The shares have additionally been hit by the woes of the wider market today, adding to a price which had already suffered a decline of 4% over the last year, as compared to a dip of 0.9% for the wider FTSE 100 index.

The general consensus, which has recently marginally declined to a “weak hold” towards the former market darling, is representative both of the challenges ahead and the fact that there is perceived to be safer value elsewhere within the sector.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.