Coronavirus hammers Lloyds Bank shares and FTSE 100

As concerns about the virus grow, both stocks and indices were in freefall today. Where will it end?

26th February 2020 14:00

by Graeme Evans from interactive investor

As concerns about the virus grow, both stocks and indices were in freefall today. Where will it end?

The coronavirus fears infecting market sentiment became even more severe today, with the FTSE 100 index plunging below 7,000 for the first time in more than a year, and companies including Diageo (LSE:DGE) and SSP (LSE:SSPG) the latest to warn about the outbreak's disruptive impact.

The threat posed by the virus is now clearly on the London market's doorstep, given the rising number of cases outside China. Investors hate uncertainty, with still no way of knowing when the outbreak will be contained or quite how far it has impacted spending.

From being fairly relaxed about the coronavirus threat until recently, global markets are now alive to the fact that the economic consequences could be severe and prolonged.

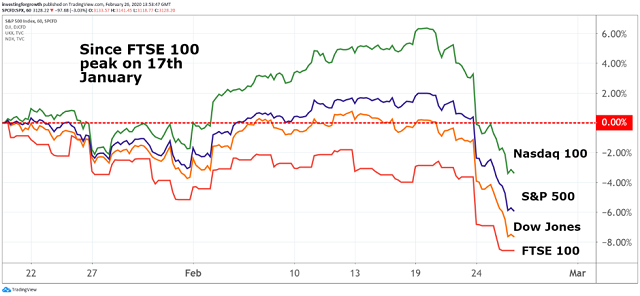

The FTSE 100 index endured its worst day of trading in more than four years on Monday, before falling another 2% yesterday to its lowest close since January 2019. It fell through the 7,000 barrier this morning to as low as 6,871.85, leaving the top-flight almost 12% lower than its peak on 17th January and 9% lighter over the year to date.

Source: TradingView Past performance is not a guide to future performance

That this performance was worse than all other major global indices partly reflects London's exposure to oil and mining, as well as the obviously affected areas of tourism and travel. This was shown by today's 7am regulatory news (RNS) statements, with market heavyweight Rio Tinto's (LSE:RIO) annual results warning of the potential of “significant uncertainty for our business in the near term”.

Global drinks giant Diageo (LSE:DGE) is already seeing a significant impact from the widespread closure of bars and restaurants in mainland China and the postponement of events and conferences in other Asian countries, including South Korea, Japan and Thailand.

Having only previously updated markets on 30 January, the Johnnie Walker, Guinness and Smirnoff maker now thinks the impact on sales from the outbreak will be in a range of £225 million to £325 million with operating profits hit by up to £200 million. But with the situation continuing to evolve, these figures are still little more than best guess estimates.

Diageo shares are now at their lowest level in a year, having fallen 11% since January 17 and by almost 2% today. At airport catering company SSP, shares fell 5% this morning after it said group revenues in February will be hit by up £12 million, with a corresponding impact on operating profit of between £4 million and £5 million.

This reflects an approximate 50% year-on-year drop in sales in the Asia Pacific region, which accounts for 8% of total revenues. It noted a 90% drop in air passenger numbers in China, with other Asian countries seeing a fall of more than a quarter.

- 10 value stocks with solid momentum

- How this AIM stock returned 3,500% so quickly

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The number of London-listed companies updating on coronavirus appears to be rising by the day, with Primark owner Associated British Foods and engineering consultancy Ricardo among them this week. Based on the likely disruption being caused to supply chains and customer demand, this trend is certain to continue into the near future.

The need to update will be particularly pressing as companies approach the end of their financial year or half-year periods in March or June, with time running out to make up lost orders or sales delayed by coronavirus.

The world's biggest company by market value, Apple, has already warned that it won't meet the revenue guidance it set for the March quarter due to the temporary impact of supply chain issues and the fact that most of its stores in China and those of its partners are closed.

Its shares have fallen 12% in the past fortnight, which may also reflect the opportunity for investors to let “air out of the tyres” after the rapid ascent of US technology stocks.

As usual, the message for investors is to stay calm and to maintain a long-term perspective, particularly given that Wall Street markets are only back to levels seen in December.

Source: TradingView Past performance is not a guide to future performance

Lloyds Bank shares still a “buy”

The current weakness also highlights potential opportunities, as highlighted by yesterday's note from UBS on the attractive yield on offer at Lloyds Banking Group (LSE:LLOY). The Swiss bank said Lloyds' capital generation target of between £3 billion and £4 billion was now the equivalent of 9%-11% of Lloyds' market cap.

UBS analyst Jason Napier said: “While we do not expect Lloyds' earnings to grow on the current macro base case, we think the bank's capital generation is now significantly undervalued with a double-digit distributed yield in prospect.” Napier's target price remains 62p for a 17% capital return and “material” running yield.

There's also growing interest in emerging markets, where equities have proved to be more resilient on signs that China is seeing a slowdown in the number of new cases.

Market strategists at UBS said:

“Given the incubation period of the virus, the next two weeks will be critical in determining the extent of the global outbreak, the steps international authorities are willing and able to take to contain it, and the economic effect of these measures.”

They said there were a number of strategies that could help investors during this period of volatility, including a preference for emerging market stocks over eurozone equities and to invest in sustainable dividend stocks, which could be seen as relative safe havens.

There's also the prospect of a strong market bounce if the outbreak is contained, allowing supply chain disruptions to resolve and for consumer confidence to revive.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.