Still chance to buy this recovering drug giant

A difficult 2018 continued through most of 2019, but this $128bn pharmaceutical firm is fighting back.

11th December 2019 10:06

by Rodney Hobson from interactive investor

A difficult 2018 continued through most of 2019, but this $128bn pharmaceutical firm is fighting back.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Pharmaceutical companies are always worth a look because the global population is ageing and the search for new cures and treatments is never ending. However, investors have to be wary because blockbuster drugs eventually lose patent protection and yesterday’s high-flyers can crash to earth unless a new wonder drug takes its place.

This is a big concern for shareholders in AbbVie (NYSE:ABBV), a biopharmaceutical company based in Chicago. It is a comparative newcomer, having been spun out of Abbott Laboratories (NYSE:ABT) almost seven years ago, but those who invested at the float have done well so far. Now there are fears that the best times are coming to a halt.

AbbVie’s one big success has been Humira, a blockbuster drug that treats inflammatory conditions and is used particularly to treat arthritis, psoriasis and Crohn’s disease. It accounts for more than half of the group’s sales. However, Humira is already losing ground to similar biodrugs in Europe and it will lose its patent protection in the US in just over three years’ time.

The approval of rival products in Europe has already affected AbbVie’s revenue, although sales of Humira are still rising strongly in the US. The high spot for total group sales growth came in the first quarter of 2018 with a 21% spurt, but the expansion tailed off throughout the year and by the first quarter of 2019 sales were in decline for the first time since the demerger from Abbott. They have levelled off in the second and third quarters, but some analysts fear that the downward trend will be resumed in 2020.

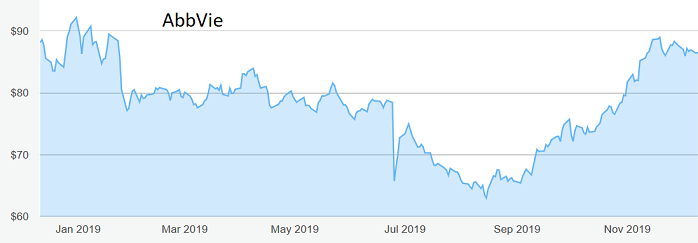

Source: interactive investor Past performance is not a guide to future performance

Abbvie’s answer has been to plough $63 billion into the acquisition of Allergan (NYSE:AGN), a speciality pharmaceutical company engaged in developing, manufacturing and marketing brand name pharmaceutical products. It is best known as the maker of Botox, first introduced as a facial muscle tightener for those conscious of the ageing process but now enjoying an extra lease of life as a treatment for migraine and also for excessive sweating.

The acquisition was unveiled in June and is expected to be completed early in 2020. Botox is a cash cow, which is obviously a welcome factor, and Allergan also sells a dry-eye drug called Restasis. Other drugs are in the pipeline. It is testing treatments for migraine prevention, various eye diseases and gastrointestinal disease.

Investors should remember that many drugs get part way through the rigorous testing programme only to fail at the final hurdle, so drug testing is an expensive and uncertain business, while the rewards last only so long as the patents.

AbbVie itself has this year scrapped a cancer treatment that failed to show any benefits for patients with an advanced form of lung cancer. However, the US Food and Drug Administration did approve its rheumatoid arthritis drug Rinvoq.

Abbvie shares started trading at $33 seven years ago and they ran away too fast to peak at $123 at the start of last year. Then they fell further than results justified, all the way back to $63 in mid-August this year. They then had another good run, rising to a peak of $89 three months later, but have come off the boil this month and at under $87 there is now another credible buying opportunity.

Although the price/earnings ratio is challenging at just a touch under 40, the yield is remarkably good by New York standards at 5.44%, double the average of 2.64% for large pharmaceuticals and three times the average 1.8% for companies in the S&P 500 index. The payout of $1.07 a quarter is up 11.5% on 2018, though one should not count on that rate of progress in the near future as the acquisition of Allergan is digested.

Hobson’s choice: Buy at up to the recent peak of $89.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.