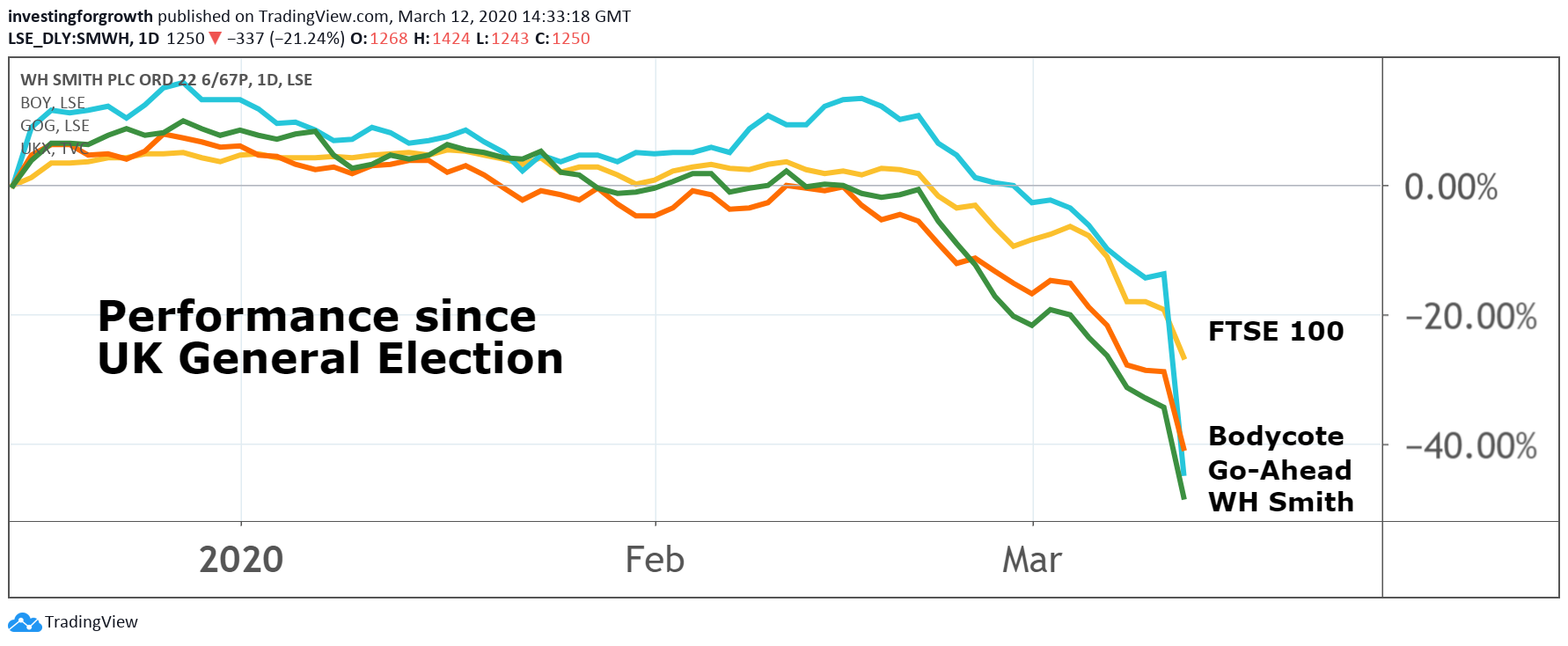

Stock market crashers: WH Smith, Go-Ahead and Bodycote

This trio’s results fell on one of the worst days for stock markets in years. Here’s how they fared.

12th March 2020 14:42

by Graeme Evans from interactive investor

This trio’s results fell on one of the worst days for stock markets in years. Here’s how they fared.

The worst-case scenario approach of investors led to heavy selling of WH Smith (LSE:SMWH), Go-Ahead (LSE:GOG) and Bodycote (LSE:BOY) shares today as the mid-cap trio sought to make sense of the coronavirus impact.

WH Smith fell 21% to the lowest level since 2016 as it revealed what it thinks could be the financial impact on its Travel division, with revenues at UK airports set to be down as much as 35% in March and April. Second-half sales in US travel are expected to be 20% short of hopes.

To make matters worse for the group, President Trump has just announced a 30-day ban on flights from the United States to parts of Europe starting on Friday.

The travel arm has been the driving force behind WH Smith's success in recent years, with profits up 14% in the last financial year. Expansion in the United States has included the 2018 game-changing acquisition of airport digital accessories business In-Motion and the recent addition of Marshall Retail Group.

There's not yet been any impact on the UK high street stores, but the group is braced for the crisis to reduce footfall. Across travel and high street shops, the company expects a potential revenue hit from coronavirus of between £100 million and £130 million for the year to August 31, with up to £40 million lost from underlying profits.

Source: TradingView Past performance is not a guide to future performance

The FTSE 250 stock sought to reassure investors by drawing attention to its balance sheet, particularly its strong cashflows. In its most recent results, the company hiked its dividend by 8% after also completing a £31 million share buy-back.

At Go-Ahead, the operator of regional bus services and Thameslink and Southeastern rail franchises, also highlighted the potential for travel patterns to be disrupted.

The warning is an additional blow after admitting today to pressure on full-year expectations due to cost pressures and adverse weather conditions affecting the regional bus division. Shares fell 36% to 1,078p, which is the lowest level since 2012.

For Bodycote, the 17% fall in share price to 543.5p took the heat treatment engineer back to a level last seen four years ago. The group's full-year results were slightly weaker than expected, while it admitted that coronavirus was one of a number of challenges at the start of 2020.

The company generates an estimated 4% of sales from the worst affected virus areas of China and Italy, but with EU car markets already fragile there are obvious fears about how it will be impacted should the infection continue to spread at the current rate.

Analysts at Jefferies said it expected last night's consensus earnings per share forecast of 54p to suffer mid-to-high single digit downgrades following today's results. However, they added: “This is more than reflected in the current share price, which is already discounting significant downgrades, and the group's longer-term outlook remains positive.”

The broker has a target price of 1,030p. Bodycote is one of five stocks in our 2019/20 Aggressive Winter Portfolio, having posted positive returns for nine of the past ten years and average returns of 25.2% across those winter seasons.

As well as automotive operations, Bodycote is heavily exposed to civil aerospace after previously highlighting the sector's potential for long-term structural growth. Revenues in that division rose 17%, driven by strong after-market business, as the group reported an overall 7% fall in EPS for 2019 to 52.1p. It increased its full-year dividend by 5.3% to 20p a share.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.