Is stock market history repeating itself?

After switching into cash before recent crash, trend investor Saltydog tells us when he’ll buy again.

16th March 2020 14:10

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After switching into cash before the recent crash, trend investor Saltydog tells us when he’ll buy again.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun. (Ecclesiastes)

Last Monday stock markets around the world saw further falls as the price of oil crashed. The previous Friday OPEC had failed to reach an agreement with non-OPEC members regarding a global production slowdown. In response to the lack of demand, Saudi Arabia wanted to cut production. Russia refused, and so Saudi Arabia flooded the market, pushing the price down to $30 per barrel.

Stock markets in the developed economies of Europe and North America fell by between 7% and 8%, some of the emerging markets saw greater losses. Most markets were already more than 10% below their recent highs due to concerns over the spread of the coronavirus.

They then levelled off for a couple of days, but on Thursday saw even more dramatic falls. The FTSE 100 index had its worst day for over 30 years, losing 10.9%, French and German stock indices fell by more than 12% and in the US the Dow Jones Industrial Average also lost 10%. It was the worst day for global stock markets since October 1987.

By the end of the week the FTSE 100 had lost 17% and closed at 5,366. It has fallen further this morning, dropping below 5,000 for the first time since 2011.

It’s hard to believe that on the 19th February, less than a month ago, two of the US Indices, the S&P 500 and the Nasdaq, closed at all-time highs. In the UK the FTSE 100 was up over 2% since the beginning of the month and trading just above 7,450.

For some reason, which I don’t claim to understand, markets tend to move in cycles. They do not go up in a nice straight line, but have frequent corrections along the way. It’s not that unusual for prices to drop by around 10%, but they usually recover relatively quickly.

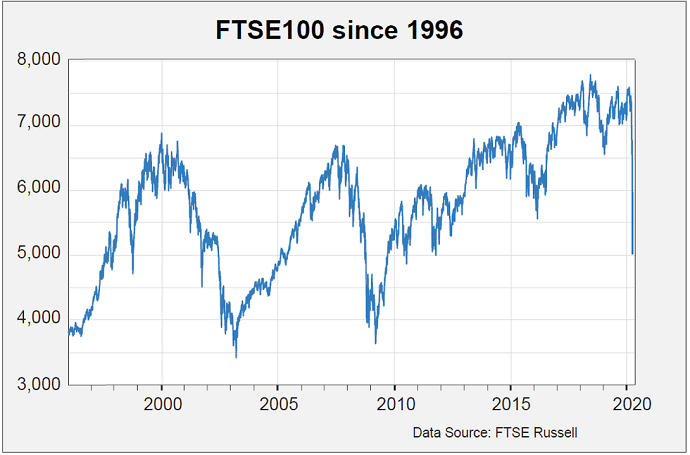

It’s also easy to forget, but much larger market crashes happen with alarming frequency. There was the bursting of the dotcom bubble in 2000-03, and then in 2008/9 it was the financial crisis. Both times stock market investments could have been cut in half.

The FTSE 100 has lost a third of its value in the last few weeks. If history repeats itself, it could have further to fall.

Past performance is not a guide to future performance

At times like this it is difficult for private investors to know what to do. On the whole, the financial industry promotes a buy and hold approach. They maintain that it’s too difficult to time the markets and so you shouldn’t try. It’s time in the market, not timing the market that’s important.

At Saltydog Investor we disagree.

Instead of ignoring the ups and downs of the market, we deliberately respond to them. The principle is simple: any market trend – whether up or down – is likely to keep going in the same direction. Rising prices tend to keep rising, and falling prices tend to keep falling. This is known as the ‘momentum effect’ and is a well-researched phenomenon.

As trend investors we buy into uptrends and get out of downtrends. When there are small corrections it does mean that sometimes we sell things, only to buy them back a few weeks later when the price might be higher, but it does help avoid wealth-destroying crashes.

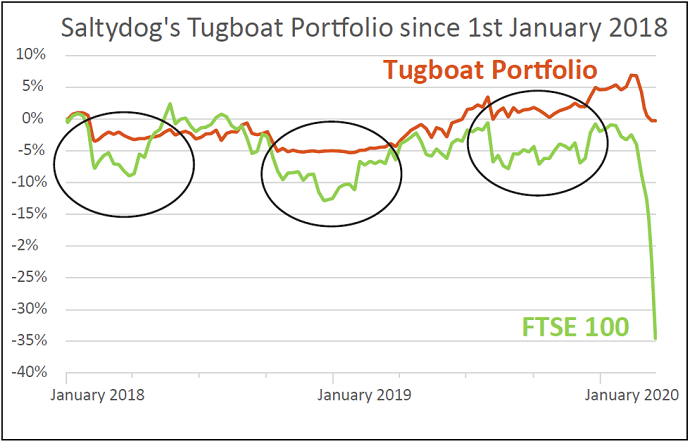

Since the beginning of 2018, there have been four times when we’ve seen markets starting to fall quite significantly. On each occasion the value of our portfolios has dropped and so we’ve headed for safety. The value of our portfolios has then remained relatively steady as markets have continued to fall.

The graph below shows the performance of one of our demonstration portfolios over this period.

Past performance is not a guide to future performance

In the first three cases the markets recovered fairly quickly and so we stepped back into the markets.

This time it looks very different.

On the 12th February our portfolio was at an all-time high, having gone up over 12% in the previous 12 months. Over 90% of its total value was invested.

In the next two weeks it lost 2.5% and we started selling. We are now 100% in cash. The FTSE 100 is still in freefall and there’s no telling how low it will go. It’s a slightly unfair comparison because the FTSE 100 doesn’t include any reinvested income, but even when that is accounted for it’s still down over 28% since the beginning of 2018.

We will now wait until there are signs of a meaningful recovery before starting to invest again.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.