A stock in one chart

31st March 2016 11:18

by Phil Oakley from ii contributor

Former City analyst Phil Oakley believes the fortunes of many companies can be summed up in a single financial chart. This week it's British Land.

Commercial property has been a popular home for investors' money in recent years after taking a hammering during the last recession. London property in particular has boomed as lots of money entered the market in search of higher income than bonds and capital appreciation.

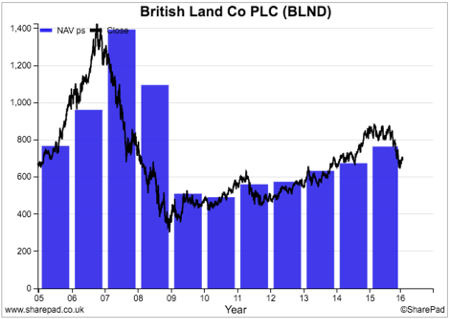

has been a major beneficiary of this trend and has seen its net asset value (NAV) per share move steadily higher. Investors in its shares have also done well, pocketing a steady dividend income and benefitting from a rising share price that has traded at a premium to its NAV.

However, 2016 has seen investors turn more bearish. Look at the chart above and you can see that British Land's share price now trades at a discount to its NAV - and that discount has been getting bigger.

Investors could be saying that they don't believe the value of its properties and that there could be trouble ahead. City analysts point to stamp duty increases in the recent budget and that a vote by the UK to leave the European Union could reduce the attractiveness of London as a financial centre. Weaker global economies could be another concern.

Yet trading at British Land seems to be rather good. In its third-quarter trading update in January it said that its offices were almost full and it was filling them at better-than-expected rents. Its retail properties were also doing well.

Share prices are based on expectations of the future and British Land's is saying that it won't be as good as the recent past. But what if analysts and investors are wrong and are being too pessimistic? If they are, then the shares might be quite cheap at the moment.

The ii view

British Land shares have fallen by a fifth since October, massively underperforming the wider market. Global economic fears and a possible Brexit have kept potential buyers on the sidelines. That large discount to NAV may have to widen further to tempt them back, unless full-year results due mid-May assuage concerns about slower growth. Significantly, non-executive director William Jackson has just spent over £500,000 on shares.

Read more from Phil Oakley here. Financial charts are a feature of SharePad, the web-based service from ShareScope. Voted UK's Best Investment Software 2015.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.