Stockwatch: A contrarian play that's 'simply too cheap'

18th September 2018 10:14

by Edmond Jackson from interactive investor

This heavily-shorted stock has upside if fundamentals prove sound, argues companies analyst Edmond Jackson. We'll find out in a few days' time.

Shares in Kier (KIE) merit attention ahead of final results this Thursday. I'd prefer to consider published evidence only, yet it's possible a minor rally in this infrastructure services group's stock is triggered if this third most-shorted stock on the London market reassures, prompting short closing.

Ocado (OCDO) is a more dramatic case but has this year shown countering short sellers can be highly profitable. A balanced approach might be to consider Kier's situation now, then decide on Thursday whether it's a trading buy or best avoided, although you could find yourself in competition at the market open. Plenty also depends on your risk appetite.

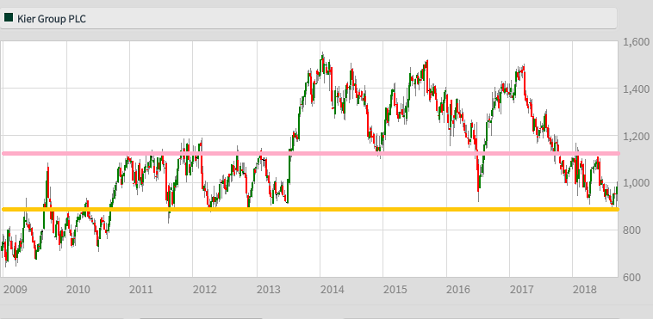

There's a keen bull/bear tussle here: Kier has de-rated from 1,550p in 2014, briefly below 900p last August, then rallied to 975p only to drop back to 900p at the start of September. It has started this week firmly, testing 1,000p which represents about 8.5 times expected earnings for the latest financial year to end-June.

A dividend yield of over 7% is nearly twice covered by earnings and also a strong cash flow profile/record – assuming the published record can be relied on (see table). Note, however, a weak balance sheet with negative net tangible assets linked to acquisition-led intangibles and debt.

Stock slide confounds apparent fundamentals

A heavily-shorted stock need only post a "steady as she goes" report assuaging fears to bounce back. As a contrarian I was attracted to study Kier at 1,090p last January, saying it "currently intrigues if also quite horrifies me".

I was then kicking tyres of stocks hit by Carillion's liquidation, lest anything PFI-related was overly jaundiced. Infrastructure and highways in particular – e.g. the upgrading to smart motorways – is probably quite counter-cyclical in the sense that long-term contractual commitments have been made to advance projects, and even a surprise Labour government would find it hard to call a halt where private companies are involved.

Source: interactive investor (*) Past performance is not a guide to future performance

Yet despite a yield (in January) of 6.7% covered 1.7 times by projected earnings, also the company declaring "no adverse financial impact" on joint ventures with Carillion, and sound trading updates this year, the stock still subsequently fell over 17% to 900p.

Classic acquisitions vehicle presents a dilemma

The bears' picnic relates to the exact concern I had in January, if possibly amplified to distortion, that the chief executive is an accountant - Kier's ex finance director - hence unsurprisingly has been busy with acquisitions, running up exceptional costs and debt/intangibles on the balance sheet.

I learned my own hard lesson with this kind of beast back in the early 1990's: a plant hirer called BM Group where accountants were in charge, acquisitions and debt racked up, then recession meant a painful restructuring where only the rump of an acquired engineering group survived.

• Stockwatch: Does an equities 'melt-up' guarantee a bust?

• Nine stocks to buy after Carillion crash

See from the table how Kier's operating margin has drifted below 1%, allowing scant leeway for trouble. Last January I also noted a mismatch between trade payables and trade receivables as if payments to suppliers might be delayed, but also how the chief executive and his wife had bought stock three times at 1,022p to 1,047p. I concluded:

"Speculative buy if you trust the directors, otherwise is a case study in determining risk from accounts".

Bears have gone further this year, linking Kier with problem cases in the construction support sector, questioning true earnings and an increasing reliance on joint ventures.

Last June, Barclays published a note saying: "Significant acquisitions, working capital outflows, heavy historic use of exceptionals, on - and off-balance sheet leverage, joint ventures and a divisional restructure raise some concerns," although the analysts did credit "a strong position within highways work which should see increased spend, future returns from investments in property development over the past three years". However, they added that "we believe the shares are not as cheap or cash generative as at first glance, with significant adjustments required to appreciate the full leverage position".

Despite all this, Barclays derived a sum-of-parts valuation of 995p a share, i.e. where the price stands now, so if this is a genuine "worse-case view" then it's priced in. Anything considered better will prompt some short closing and it’s fair to expect Kier being on a mission to explain.

| Kier Group - financial summary | Consensus estimates | ||||||

|---|---|---|---|---|---|---|---|

| year ended 30 Jun | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 1,943 | 2,907 | 3,276 | 3,991 | 4,129 | ||

| IFRS3 pre-tax profit (£m) | 25.9 | 15.4 | 39.5 | -34.9 | 25.8 | ||

| Normalised pre-tax profit (£m) | 33.8 | 49.8 | 64.3 | 58.4 | 42.2 | 116 | 130 |

| Operating margin (%) | 1.4 | 1.9 | 2.2 | 1.2 | 0.7 | ||

| IFRS3 earnings/share (p) | 49.5 | 12.9 | 40.0 | -25.7 | 15.2 | ||

| Normalised earnings/share (p) | 62.6 | 46.7 | 74.4 | 72.3 | 29.2 | 117 | 132 |

| Earnings per share growth (%) | -40.2 | -25.4 | 59.3 | -2.8 | -59.6 | 302 | 12.8 |

| Price/earnings multiple (x) | 34.2 | 8.5 | 7.6 | ||||

| Historic annual average P/E (x) | 27.0 | 23.1 | 17.0 | 29.4 | 24.6 | ||

| Cash flow/share (p) | -10.4 | -23.6 | 150 | 154 | 136 | ||

| Capex/share (p) | 50.2 | 51.9 | 57.1 | 43.7 | 60.9 | ||

| Dividend per share (p) | 52.7 | 55.1 | 73.5 | 57.5 | 65.5 | 70.0 | 73.8 |

| Dividend yield (%) | 6.6 | 7.0 | 7.4 | ||||

| Covered by earnings (x) | 1.2 | 1.1 | 1.3 | 1.3 | 0.4 | 1.7 | 1.8 |

| Net tangible assets per share (p) | 252 | -24.7 | -217 | -230 | -302 | ||

Source: Company REFS Past performance is not a guide to future performance

10 July trading statement came across soundly

A post financial year-end update cited underlying profit and earnings in line with expectations. Mind how since January the consensus in Company REFS has downgraded from £140 million to £116 million pre-tax profit, although curiously earnings per share (EPS) has remained the same – 117p – and despite 2019 profit expectations being lowered from £156 million to £130 million, 2019 EPS has upgraded from 130p to 132p.

A latest estimate from analysts at Canaccord is for 2018 EPS of 116p and a 2019 price/earnings (PE) of around 7 times. They expect year-end debt of £170-190 million with average net debt of £375 million, this being the likely area of attention given recent issues and concerns in the sector. Also in focus will be the "Future Proofing Kier" initiatives, how they can affect margins, cash flow and net debt over the medium term.

Analysts at Liberum are also bullish, with a "Ten reasons why the bear case is bull" note, arguing how even a very harsh assessment suggests Kier's leverage is affordable so long as trading holds up. "We expect management to make some compelling points on Thursday. The shares are simply too cheap. Buy."

July's update cited construction volumes returning to normal after bad weather, with "increased" order books over £10 billion providing 90% secured revenue for the 2019 financial year. In highways, three-year extensions to Highways England contracts have secured £250 million annualised revenues.

Obviously, the margin upshot is critical and an issue to look out for on Thursday. In terms of outlook and bearing in mind Kier is some 93% oriented to the UK, July's message was:

"the core businesses operate in three growing markets, each underpinned by macro/demographic fundamentals...a robust platform to deliver our 2020 targets."

17.3% (?) stock on loan and increasing

The short position is reportedly 17.3% according to Markit, putting Kier at number three in the "most shorted" list, although Shorttracker.co.uk puts the position at 10.3% in fourth position, just ahead of the 10.2% final position at Carillion where sellers were proven right – at least in this sector.

Shorting Kier has soared from 0% early this year, and (according to Shorttracker) aside from three disclosed institutions' short positions remaining flat around 0.5% each, all others have increased since July and three have done so in September. Clearly, they believe they are onto something. Only time will tell whether it's just herd behaviour.

The conclusion is inevitably speculative and in rating Kier a 'buy', anyone investing here today should do so with their eyes open to risks. As things stand, probability suggests Kier's numbers will be "in line" accompanied by a keen effort by management to dispel doubt. Speculative buy.

*Lines on chart indicate historic levels of support and resistance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.