Stockwatch: is this FTSE 250 share too cheap?

After a rotten couple of years this company’s valuation now lags a similarly sized rival, but do early signs of recovery mean the gap will start to close? Analyst Edmond Jackson shares his thoughts on both.

15th December 2023 12:12

by Edmond Jackson from interactive investor

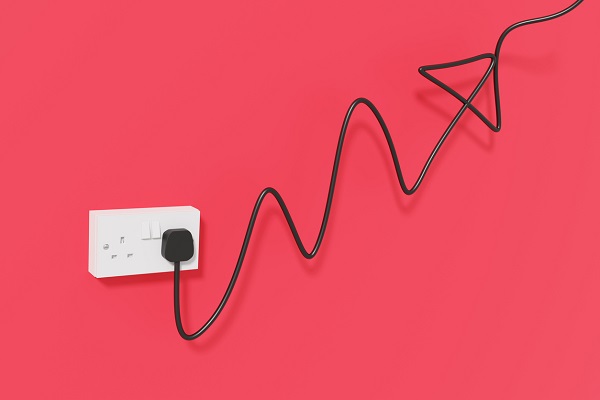

With electrical goods retailer Currys (LSE:CURY) yesterday declaring interim results to 28 October, it is interesting to compare how its stock has trended overall down this year – from 55p to 45p via a peak of 81p in March – while its online peer AO World (LSE:AO.). has steadily risen from around 60p to 95p.

Yes, Currys bears the cost of operating stores as well as online, but we are essentially talking white goods linked to discretionary spending. It has been under the cosh and may not improve as some homeowners face re-mortgaging at higher rates. Admittedly, Currys has faced challenges, especially with its Nordics side, whereas AO is a UK-facing business.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Yet the contrast in price/earnings (PE) multiples is shown by Currys at near 5.7x forward earnings versus AO on more like 21x (assuming consensus forecasts). While Currys is meant to sport a restoration of its dividend to yield 3% and AO has never paid out, some would say Currys’ balance sheet has yet to support this.

Both stocks are capitalised in a £500 million range and on Thursday the market rose, but Currys led AO – up over 10% to 50p versus near 6% to 92p for AO. Currys had the benefit of results out, where the market could have feared worse than the “in line” outcome – but even so, does this hint at a relatively better risk/reward profile?

Sentiment remains in favour of both Friday morning, up to 51p and 95p respectively.

All-considered, a way to go for Currys’ fundamentals

In the six months to 28 October, normalised operating profit actually fell 40% in the UK and Ireland to £15 million, while the Nordics and Greece trebled to £16 million. The Greek business is being sold for £156 million net proceeds, said to result in a net cash position during the first quarter of next year.

On a like-for-like currency neutral view of revenue, it slipped 4% at the group level – so you need to be confident that Currys can improve this as well as deliver operating efficiencies. The group does however tend to be second-half-year weighted.

Full-year guidance includes various issues, including £80 million capital expenditure, £50 million net exceptional cash costs, £36 million pension contributions, circa £325 million depreciation and a big whack – circa £285 million - of leasing costs (but also other debt, reducing) part-offset by £40 million cash interest.

A case for Currys’ equity would be that such issues are being managed down and are priced in. Yet pension contributions remain onerous, rising to £50 million in 2024/25 then £78 million for the following three years and a final payment of £43 million in 2028/29.

That is some albatross around Currys’ neck that compromises any sustainable dividend policy and, as the table shows, operating margins are low single-digit.

| Currys - financial summary | |||||||

| Year-end 29 April | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£m) | 10,242 | 10,525 | 10,433 | 10,170 | 10,330 | 10,122 | 9,511 |

| Operating profit (£m) | 436 | 321 | -225 | -30.0 | 136 | 220 | -348 |

| Net profit (£m) | 295 | 166 | -320 | -163 | 12.0 | 71.0 | -481 |

| Operating margin (%) | 4.3 | 3.1 | -2.2 | -0.3 | 1.3 | 2.2 | -3.7 |

| Reported earnings/share (p) | 26.6 | 20.3 | -26.8 | -13.9 | 0.0 | 6.0 | -43.6 |

| Normalised earnings/share (p) | 31.7 | 26.0 | 21.3 | 10.4 | 17.1 | 15.7 | -1.2 |

| Operational cashflow/share (p) | 31.4 | 26.9 | 24.7 | 50.4 | 70.7 | 36.4 | 24.5 |

| Capital expenditure/share (p) | 21.0 | 16.1 | 14.3 | 16.5 | 10.2 | 11.3 | 10.1 |

| Free cashflow/share (p) | 10.5 | 10.8 | 10.4 | 33.9 | 60.5 | 25.1 | 14.4 |

| Dividend per share (p) | 11.3 | 11.3 | 6.8 | 2.3 | 3.0 | 3.2 | 0.0 |

| Covered by earnings (x) | 2.4 | 1.8 | -4.0 | -6.2 | 0.0 | 1.9 | 0.0 |

| Return on total capital (%) | 9.4 | 7.0 | -5.5 | -0.6 | 3.2 | 5.2 | -10.1 |

| Cash (£m) | 147 | 168 | 622 | 628 | 140 | 96.0 | 67.0 |

| Net debt (£m) | 333 | 309 | 308 | 1,680 | 1,192 | 1,253 | 1,360 |

| Net assets (£m) | 3,055 | 3,196 | 2,640 | 2,280 | 2,381 | 2,501 | 1,892 |

| Net assets per share (p) | 265 | 276 | 228 | 196 | 204 | 221 | 167 |

| Source: historic Company REFS and company accounts | |||||||

The crux for value seems to be whether revenues can rise - helped by inevitable personal tax bribes in a general election, and also a higher National Living Wage from April. But the demand equation is complex given re-mortgaging at higher rates will constrain some households. Then there is the Nordic region to guess at.

Again, it distils to “such uncertainty is priced in”, yet this stock’s history has been a sideways rollercoaster, and nowadays the likes of AO present stiff online competition, compromising margin recovery.

A “buy” here would most definitely be contrarian, where you need good reason to disagree with the market. Positive signs are appearing, though I am yet to be convinced of their substance.

Once bitten, twice shy?

Perhaps I am swayed by my experience earlier this year.

In May’s surprisingly positive trading update, the company raised annual pre-tax profit expectations from £104 million to £110-120 million, chiefly due to better gross margins. That led me to note the stock as worth considering for a starter position. “Perhaps this signals supply chain costs normalising post-Covid, given Currys is essentially an importer/distributor,” I said.

In fairness, plenty of UK cyclical stocks then trended downwards, anticipating the effects of higher interest rates, before rallying from late October amid optimism for rate cuts in 2024, although it’s unclear quite how “market efficient” this will prove for corporate earnings.

Looking back, that update feels quite a bum steer for defining a turnaround, though it came across bullishly.

- Interest rates held again: what might 2024 have in store?

- Investor poll: predictions for FTSE 100, best assets and regions in 2024

Currys’ balance sheet is another issue, if helping to understand why the stock can rise when sentiment shifts to “risk-on”.

While the Greek disposal will clear financial debt, a near £1.9 billion net asset value is constituted 136% by intangible assets. Negative net tangible assets include a £190 million pension deficit, £230 million leases and (for now) £129 million net debt.

Otherwise, working capital numbers are big: £2.5 billion trade creditors – potentially risky, on that scale – if largely balanced by £2.3 billion inventories and receivables.

This does help explain the stock’s low PE.

Consensus is for around £79 million of net profit in the April 2024 year, an upgrading on £77 million the other day. The target of £101 million in 2025 remains stable, for earnings per share (EPS) of around 9p, hence a forward PE of 5.7x with the stock currently 51p.

Currys is therefore “cheap for good reasons” which also means it can twitch on improved sentiment. If management can steadily deliver, then it can continue to rise, but as yet there remain challenges enough to asserting any better than “hold”.

AO World director buys £260k of shares at 85p

Director share buying is a stand-out feature in AO’s story which offers its own challenges to swallow, just like Currys.

After the 21 November interim results, Chris Hopkinson made an “initial notification” purchase despite being a non-executive director since December 2005. With the stock having largely fallen since flotation in 2014 (apart from a speculative rally during 2020 Covid lockdowns) you could regard this as a serious long-term call.

Mind, the PE multiple looks full after the stock has risen steadily from 40p in August 2022, and there is no dividend record.

(A read-back to Currys is this showing how a stock can rise even if the business is seen as a bête-noire, as AO used to be.)

Near-term revenue is expected to continue easing though – with consensus for £1,036 million in this current March 2024 year, but which is shy of the March 2020 year, pre-Covid.

Net profit is anticipated to kick in at £23 million, rising to over £27 million in 2025, when EPS of 4.6p implies a PE near 21x.

Implicitly, the long-time director regards AO as capable of beating such revenue/margin expectations in the longer run.

| AO World - financial summary | ||||||||

| year end 31 Mar | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£m) | 599 | 701 | 797 | 903 | 1,046 | 1,661 | 1,368 | 1,139 |

| Operating margin (%) | -1.8 | -1.7 | -2.0 | -1.7 | -0.4 | 1.8 | -0.5 | 1.1 |

| Operating profit (£m) | -10.6 | -12.0 | -16.2 | -15.2 | -4.3 | 29.7 | -7.5 | 12.5 |

| Net profit (£m) | -6.0 | -6.6 | -13.4 | -17.5 | 0.8 | 17.1 | -30.4 | -2.6 |

| EPS - reported (p) | -1.4 | -1.6 | -2.9 | -3.8 | 0.2 | 3.7 | -0.8 | 1.1 |

| EPS - normalised (p) | -1.4 | -1.5 | -2.7 | -3.1 | 0.6 | 4.1 | -0.6 | 1.9 |

| Return on equity (%) | -14.6 | -22.4 | -23.3 | 1.4 | 21.2 | -4.2 | 6.9 | |

| Return on total capital (%) | -19.0 | -20.3 | -10.5 | -8.7 | -2.6 | 16.2 | -4.4 | 6.9 |

| Operating cashflow/share (p) | -0.8 | 0.8 | -3.4 | -4.5 | 3.0 | 23.8 | -10.9 | 4.4 |

| Capital expenditure/share (p) | 1.6 | 1.4 | 1.2 | 1.0 | 1.7 | 1.9 | 2.0 | 0.4 |

| Free cashflow/share (p) | -2.4 | -0.6 | -4.5 | -5.5 | 1.3 | 21.9 | -12.9 | 4.0 |

| Cash (£m) | 33.4 | 29.4 | 56.0 | 28.9 | 6.9 | 67.1 | 19.5 | 19.1 |

| Net debt (£m) | -25.4 | -12.0 | 34.6 | 83.6 | 99.2 | 28.2 | 134 | 76.2 |

| Net assets (£m) | 48.3 | 42.2 | 77.5 | 72.4 | 69.6 | 97.7 | 73.4 | 106 |

| Net assets per share (p) | 11.5 | 10.0 | 16.9 | 15.3 | 14.6 | 20.4 | 15.3 | 18.3 |

| Source: historic Company REFS and company accounts | ||||||||

At interim results three weeks ago, management proclaimed a “step change in profitability as we continue to deliver on our strategic pivot to profit and cash.”

They see their addressable UK market at near £28 billion “and in order to take advantage of this we will look to deepen our presence in categories such as televisions, laptops, audio visual and small domestic appliances...the long-term structural migration to online retailing continues.”

And they claim AO has “in-built resilience due to a more affluent customer base... also 81% of revenue deriving from major domestic appliance.”

- How to beat the market: Rolls-Royce among seven momentum stock picks

- Global Economic Outlook: after the hikes

- Top share picks for 2024: FTSE 100 stocks among nine to own

I still regard such items as pegged to UK discretionary spending which is tricky to guess amid various conflicting variables.

In a net-positive environment, which stock is preferable? I think you can make a case for both; or, logically, if AO is bought at this level, then why not spread risk with Currys?

I could be missing recoveries here but prefer to see how consumer spending pans out, at least in the first quarter of 2024. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.