Investor poll: predictions for FTSE 100, best assets and regions in 2024

It’s the season when we reflect on the year just gone and anticipate what might happen in the year ahead. In our annual investor poll, you told us where you’ll be investing next year, what you expect markets to do, and your view on interest rates.

13th December 2023 12:19

by Lee Wild from interactive investor

This time last year, investors in most of the world’s major stock markets were nursing significant losses - as much as a third for US technology and a fifth for the UK’s FTSE 250 index. Only Brazil, India and the FTSE 100 generated a small profit. Respondents to our annual poll reckoned markets would be higher this year. They’ve been proved right, but it’s been close.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

In December 2022, over half of you said the FTSE 100 index would be higher in a year’s time. Almost 10% thought the index would finish above 8,000. Well, in February it did manage to break above the magic number for the first time, many of the index’s constituents buoyed by high inflation, oil prices and interest rates. But it was a brief stay, managing to close above 8,000 in just three sessions.

More than three-quarters of you thought the FTSE 100 would finish 2023 somewhere between 7,000 and 8,000 – you were right. Over 40% said it would be between 7,500 and 8,000 – even closer. As I write, the index is trading at 7,525.

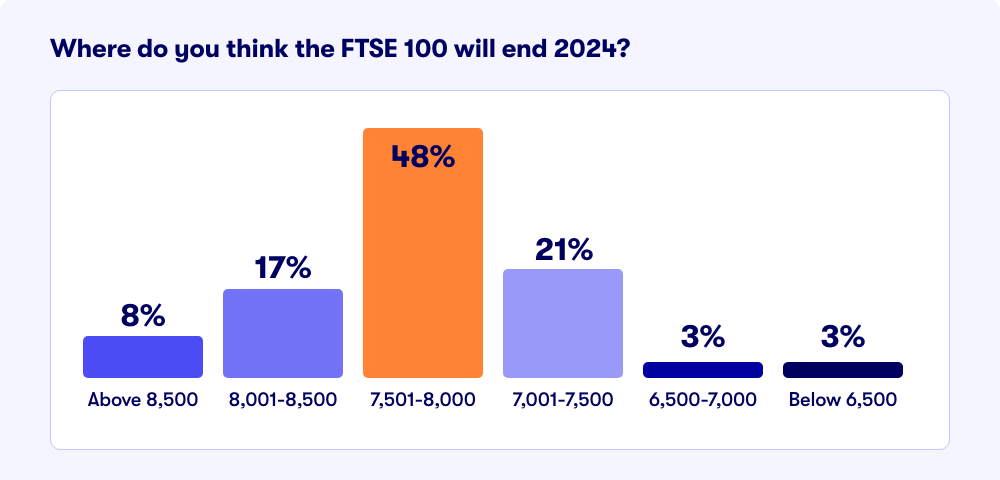

We asked you the same question this year. And this time you’ve been more bullish about prospects for UK large-cap equities. Almost half of respondents (48%) think the FTSE 100 will be somewhere between 7,500 and 8,000 one year from now. But a quarter of you are betting on the index finishing 2024 above the magic 8,000 level, of which 8% think 8,500 or higher is possible. Only 6% think the index will end 2024 below 7,000.

interactive investor website visitors were polled between 5-6 December 2023, with 1,500 responses.

It’s highly likely we’ll have elections in both the UK and America next year, and the domestic economy still faces the prospect of a mild recession at some point. Inflation is on the decline, but managing its path lower remains a juggling act for Bank of England policymakers.

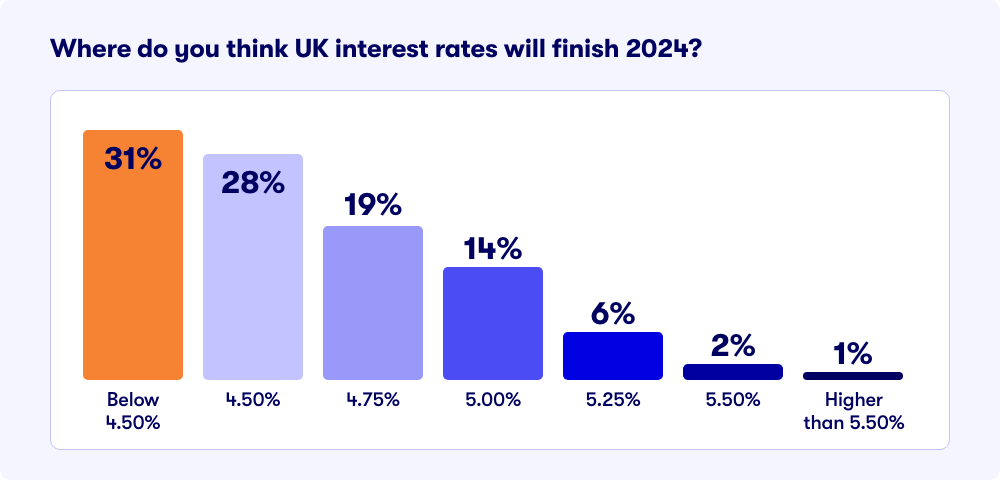

Higher for longer has been the accepted outlook for global interest rates, yet opinion has become more dovish, implying central banks may decide to bring borrowing costs down sooner than expected. Much will depend on the strength of economies and a further decline in annual inflation, but respondents to the ii poll are very much of the view that UK rates will be nowhere near current levels in 12 months’ time.

Over three-quarters (78%) of you say the Bank Rate will have fallen below 5% by the end of 2024, of which 59% believe it will be no higher than 4.50%. Almost a third (31%) think it will be even lower. Anyone with a mortgage or other borrowings will hope they’re right. Only 9% think rates will be 5.25% or more.

If interest rates do fall that far, the returns available on savings accounts will also decline. That weakens the case for holding too much cash, especially if inflation remains above the Bank of England’s 2% target, which it very likely will. If you’re only getting 3.5% on your bank savings, it doesn’t take much inflation to erode the purchasing power of your money and generate negative real returns.

All of a sudden that makes investing in the stock market much more attractive. After a year of losing out to cash, the prospect of positive annual returns both from growth and/or dividend income puts equities centre stage once again. But where will you be investing your money in 2024?

- Why you should think twice about making a big move to cash

- Bonds expected to be best-performing investment in 2024

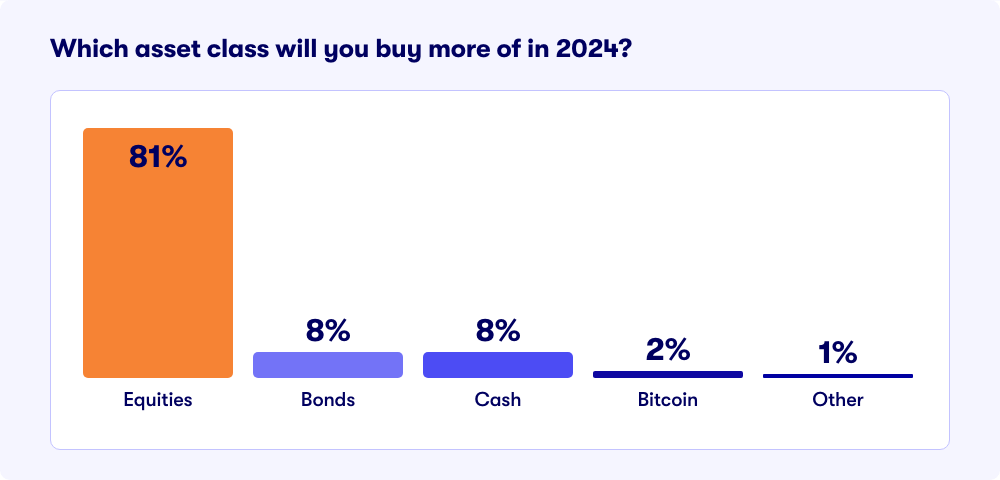

Perhaps, as you’d expect, most respondents to the ii poll (81%) will be buying shares. Bonds and cash each received 8% of the vote, while 2% will bet that bitcoin continues its rapid recovery next year.

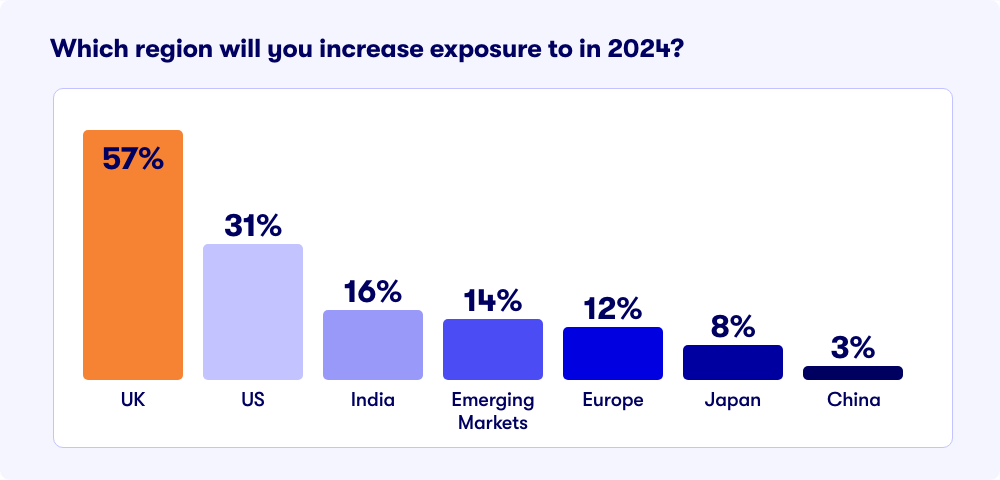

After significantly underperforming other global stock markets in the post-Brexit period, plenty of investors believe UK Plc is undervalued and primed for a rebound. The number of overseas buyers sniffing around British companies confirms that. It’s why over half of respondents (57%) to the ii poll said they would be increasing exposure to UK shares in 2024.

- Top share picks for 2024: FTSE 100 stocks among nine to own

- 2024 look ahead: a recovery reaching MATURITY?

Almost a third (31%) said they’d be putting cash into US stocks, hoping for a repetition of this year’s impressive recovery. The Nasdaq Composite is currently up 35% in 2023 and the S&P 500 up 18.5%. Others are looking further afield for superior returns – in India (16%), emerging markets (14%) and Japan (8%). Incredibly, only 3% of respondents will be investing in China next year, a sure sign of scepticism that politicians there can effectively tackle the country's economic slowdown.

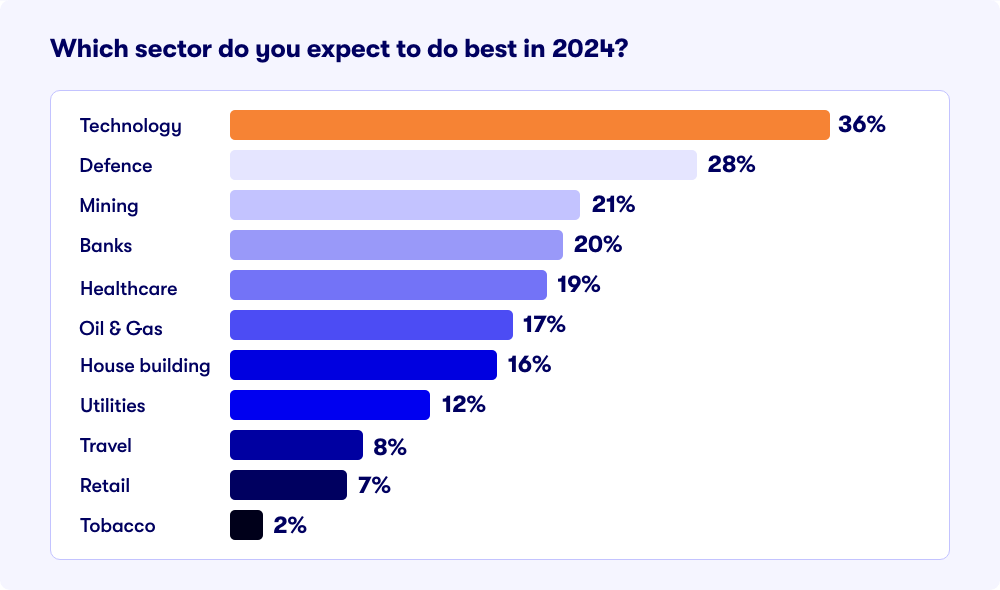

And following a year in which a handful of America’s biggest tech stocks have led Wall Street higher, more than a third of you (36%) think technology is the place to put your money in 2024.

With conflict in both Gaza, Ukraine and elsewhere in the world showing few signs of reaching a swift conclusion, 28% of respondents are backing defence firms to do well again over the next 12 months.

Way over a third of you will keep buying mining (21%) and oil & gas (17%) stocks, perhaps encouraged by attractive dividend yields and the prospect of a stronger global economy boosting demand. A fifth of respondents will buy banks again in 2024, and 16% will be tempted to invest in housebuilders, which is already the best-performing sector over the past seven weeks, up almost 27%. The sooner borrowing costs begin to fall, the better the outlook for them in 2024.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.