Stockwatch: onwards and upwards for this bank share?

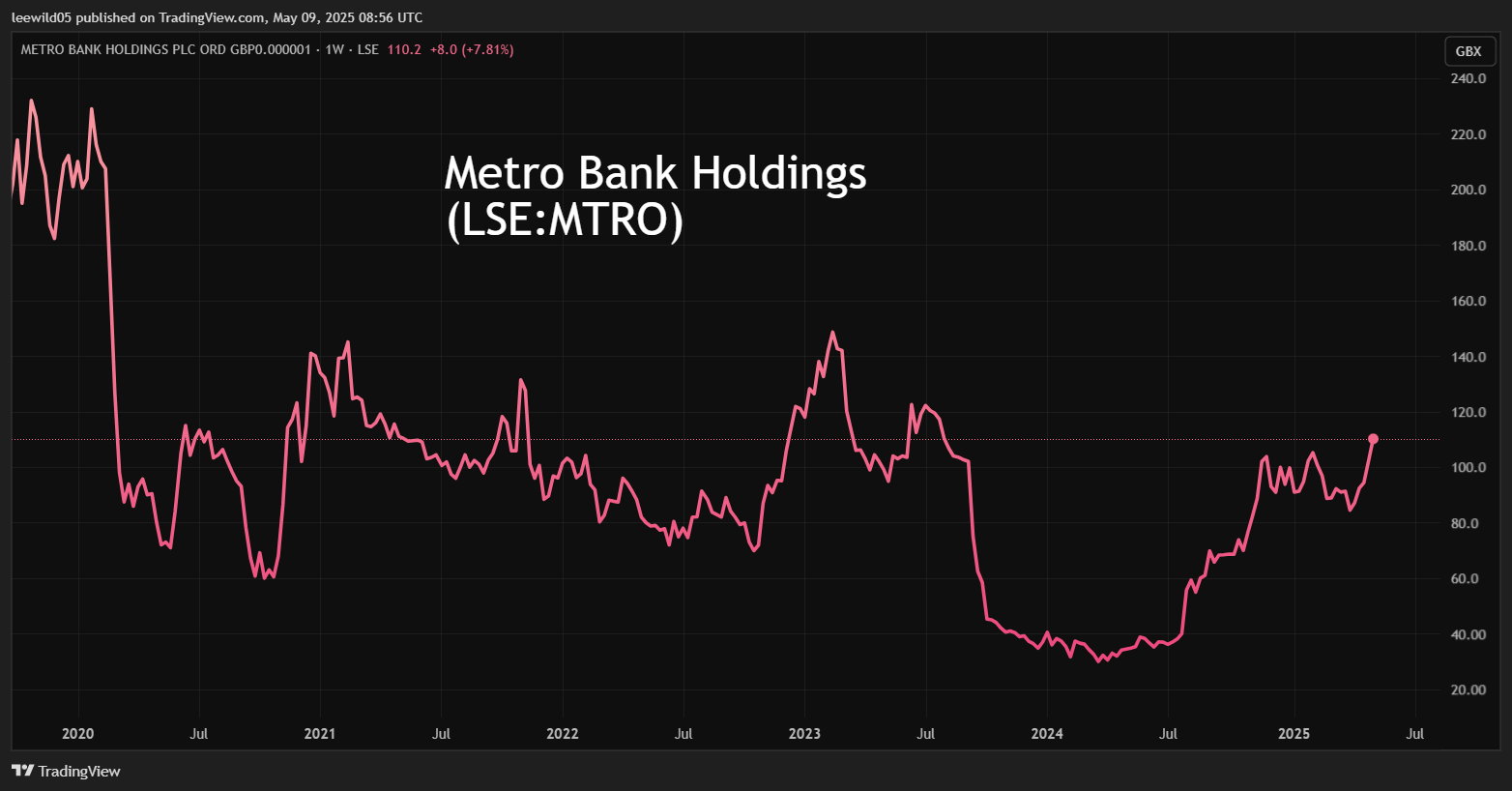

Having staged an impressive rally over the past 12 months, these shares trade at their highest since summer 2023. Analyst Edmond Jackson updates his view on this well-known lender.

9th May 2025 11:29

by Edmond Jackson from interactive investor

While bank shares have rebounded strongly from April’s market drop, it is worth discerning best prospects.

Metro Bank Holdings (LSE:MTRO) is up 7% to a two-year high of 112p in the last 24 hours after a first quarter 2025 trading update cited a “significant” increase in underlying profit on the fourth quarter of 2024. This is derived from higher net interest margin, or NIM (the difference between what banks charge on loans and pay out as deposits), re-working the loan book and managing deposits well. That is significant because usually the reason banks achieve a higher NIM is aided by higher interest rates.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Consensus has already expected improving net profit – to over £50 million this year and towards £110 million next – for normalised earnings per share (EPS) around 7p doubling to 15p in 2026. The price/earnings (PE) ratio eases to just 7x if that scenario is fair.

Moreover, and despite no dividend, the mid-cap shares trade around 0.7x net tangible assets, implying scope to improve. Yes, Barclays (LSE:BARC) at 305p is on 0.65 NTA and sports a 3% yield, but NatWest Group (LSE:NWG) is on nearly 1.3x with a 6% yield.

What intrigues me as to Metro further closing this NTA gap is its overall pipeline for commercial lending cited as over 50% of total 2024 lending.

Source: TradingView. Past performance is not a guide to future performance.

Macro questions remain very significant

Will the UK economy allow a domestic challenger bank like this to further capitalise on positioning towards small and medium-sized enterprise (SME) lending? Or what combination of US tariffs and UK fiscal bind might compromise demand for credit?

In a worse-case scenario of UK stagflation, or even recession (Barclays recently raised its provisioning for bad loans), it is not jaundiced to beware how bank sector numbers and narratives could change. But in terms of a turnaround, it does appear that Metro has become a lot better financed and positioned to overcome its past history of losses.

Ignore any talk about recovery potential to over 500p (the shares traded above 4,000p in 2018) as a November 2023 refinancing included 300% dilution, but as and when the bank can make dividend payments, this would be another watershed in a rerating.

On company-specific criteria I continue to believe Metro offers useful upside, just like when I drew attention as a “buy” at 53p last August. The medium-term uncertainty is UK macro related, during which time there is no yield for holding risk. This financial share could therefore remain relatively volatile.

Metro Bank Holdings - financial summary

Year end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 120 | 195 | 294 | 404 | 422 | 434 | 420 | 531 | 649 | 405 |

| Operating profit (£m) | -56.8 | -17.2 | 18.7 | 40.6 | -131 | -311 | -245 | -70.7 | 30.5 | -212 |

| Operating margin (%) | -47.3 | -8.8 | 6.4 | 10.0 | -31.0 | -71.8 | -58.3 | -13.3 | 4.6 | -52.3 |

| Net profit (£m) | -49.2 | -16.8 | 10.8 | 27.1 | -183 | -302 | -248 | -72.7 | 29.5 | 42.5 |

| Reported earnings/share (p) | -61.3 | -21.8 | 12.6 | 28.3 | -124 | -175 | -144 | -42.2 | 13.4 | 6.3 |

| Normalised earnings/share (p) | -53.0 | -17.2 | 13.9 | 31.6 | -89.6 | -122 | -116 | -34.6 | -8.4 | -2.1 |

| Operating cashflow/share (p) | 680 | 1,522 | 2,670 | 160 | -1,109 | 604 | 1,655 | -687 | 284 | -206 |

| Capital expenditure/share (p) | 99.1 | 186 | 198 | 235 | 135 | 63.8 | 47.0 | 30.7 | 17.2 | 6.1 |

| Free cashflow/share (p) | 581 | 1,336 | 2,471 | -75.1 | -1,244 | 552 | 1,608 | -718 | 267 | -212 |

| Cash (£m) | 282 | 500 | 2,212 | 2,472 | 2,989 | 2,993 | 3,568 | 1,956 | 3,891 | 2,811 |

| Net debt (£m) | 280 | 153 | -2,091 | -1,879 | -1,807 | -1,870 | -2,542 | -899 | 1,772 | -2,136 |

| Net assets (£m) | 407 | 805 | 1,097 | 1,403 | 1,583 | 1,289 | 1,035 | 956 | 1,134 | 1,183 |

| Net assets per share (p) | 507 | 1,001 | 1,240 | 1,440 | 918 | 748 | 600 | 554 | 170 | 176 |

Source: historic company REFS and company accounts.

Director cluster buying after 2024 annual results

The most significant trades – in all respects - were by a new finance director from last September who is a seasoned banker and had time to get to know Metro thoroughly. The 2024 income statement including a £44 million charge for impairments/write-offs, looked to me like a final deck-clearing (unless a recession raises bad debt risk).

On 3 March, he bought over £491,000 of Metro shares at an average price of 83.6p, significant also in the sense that CFO’s are not top-paid among directors and he has a family to support.

Then on 11 March, one non-executive director bought £19,500 worth at 86.9p and on 1 April a second bought £90,000 worth at 90p.

- Insider: directors buy at FTSE 250 firm and high-flying Haleon

- Shares for the future: new scoring splits my Decision Engine

All three would have been well aware of the UK economic risks but judged overall that the bank’s underlying progress more likely tilted the share’s valuation towards “reward”.

Be aware that as a result of the 2023 refinancing, Spaldy Investments (owned by a Colombian billionaire) owns nearly 53% of Metro. This can be interpreted both as a stepping stone to an eventual takeover or block to anyone else trying one. Spaldy went from 9% to this level within the £325 million equity raise element alongside £600 million debt financing.

Latest UK forecast is gloomy but suggests no recession

Yesterday, and for what macro forecasting groups are worth, the National Institute of Economic and Social Research (NIESR) predicted the UK is on course for a long period of stagflation – where lower tax receipts will fairly soon compromise the chancellor despite two tough budgets already.

Where could that leave UK consumer and business confidence if aggregate demand in the economy is tempered? It’s hard to imagine demand for credit would not be affected, although early 2025 business surveys were pretty gloomy and yet Metro has cited a strong first quarter.

When Metro previously described its strategy in terms of pivoting towards higher-margin commercial and residential lending, I felt this must involve higher risks in some respects – even if avoiding “sub-prime”, which was at the root of the 2008 financial crisis.

Yesterday it was also reported that house prices have started rising again, and of course the 0.25% interest rate cut ought to help both the market and mortgage demand – a positive tilt, perhaps.

- Bank of England cuts interest rates in surprise split vote

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

At least, and despite the NIESR downgrading UK 2025 growth from 1.5% to 1.2% during 2025, this avoids recession. Although if inflation remains stubborn because of the Bank of England’s “dovish” stance on rates, then you could say the UK growth scenario is effectively one of mild decline.

These forecasters also see the prospect of further tax rises as compromising UK business investment more than the disruption to international trade from US tariffs.

I think the big question – potentially resonating among financial shares – is whether the US avoids recession later this year, even if short and prompting its central bank to cut rates.

Markets are effectively pricing in at least two further UK rate cuts this year, although the NIESR expects only one due to inflation persisting sufficiently high.

It thinks the Labour government has effectively boxed itself in, pledging to keep government spending in balance while also reducing debt as a percentage of national income. Without higher borrowing and to respect its manifesto, Labour has ended up skewing tax rises on to business, hence compromising economic growth.

A pragmatic stance on Metro shares

Like most other bank shares, Metro is likely to trade according to how UK macro data evolves. But I see more potential leverage currently in Metro relative to the majors, which had their big run when sentiment turned just over a year ago. Meanwhile, downside risk ought to be limited by the discount to assets and corporate overhaul.

This is a £730 million company relative to £43 billion for NatWest, and despite its cost of maintaining a branch network, I imagine customers increasingly appreciate this rarity relative to bigger banks cutting costs to go faceless online.

A “hold” stance I believe is well-justified, even if the UK economy sours. Metro is nowadays better positioned and financed, and likely to recover from challenges.

The question for fresh money is whether to take your cue from rising charts – likewise on other financial shares – and buy, despite confidence having lately turned on a sixpence and possibly still fragile according to data.

Charts would suggest that April’s drop has been shrugged off, and that this is no bear market. Perhaps a 0.5% rise in the FTSE 250 this morning is helping Metro’s 3% rise to 212p as volume is not especially high. You see how macro factors are inclined to prevail.

I am overall going to maintain a “buy” stance on a two-year investment view, as I believe Metro has sorted itself out well enough to prosper – and start paying dividends – even if that is delayed by the economy. Decide investment timing according to your risk preference.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.