A tech stock we all know that loves to surprise

28th July 2021 08:52

by Rodney Hobson from interactive investor

His original tip has generated a 66% profit, but our overseas investing expert thinks this amazing business could be prepping for a shot at a new high.

When a company’s actual results consistently beat management’s own guidance, investors are entitled to assume that the board is being overcautious about future prospects. That is particularly true if the outperformance is significant.

It could indicate that management is afraid to take reasonable risks and is slow to grasp opportunities. More likely though, directors, being only human, simply prefer to surprise on the upside rather than disappoint their shareholders.

- US results season forecasts and latest trades

- A top fund that loves these dull and boring stocks

- Are US stocks fast approaching peak earnings?

- Want to buy and sell international shares? It’s easy to do. Here’s how

That reality means the future still looks bright for semiconductors and integrated circuits maker Texas Instruments (NASDAQ:TXN). Based in Dallas, it is the world’s largest maker of analogue chips, which process signals such as sound and are found in just about every piece of modern electronics. It also manufactures digital processors used in wireless communications and microcontrollers that have a wide use in various types of electronics.

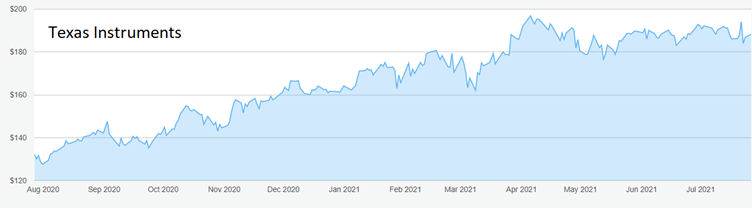

Source: interactive investor. Past performance is not a guide to future performance

Management guidance has been for revenue to be flat, or even slightly lower, over the past three quarters, but that has just not happened, and the cautious attitude has taken the edge off shares after a strong surge.

Results for the quarter to the end of June showed net income rising from $1.38 billion a year earlier to $1.93 billion on revenue up from $3.24 billion to $4.58 billion. The gains were attributed to strong demand in industrial, automotive and personal electronics markets.

The figures were, admittedly, against particularly weak comparatives. In the Covid-gripped second quarter of 2020, Texas suffered an 11% decline in revenue, but subsequent quarterly gains of 1% in the third quarter followed by 22%, 28% and now 41% have more than wiped out that setback.

Company guidance is for no more than a 25% increase for July-September and some investors shied away, feeling that would mark a slowdown. However, the comparatives are going to get tougher and 25% expansion is pretty good from any perspective. If management again proves to have been overcautious when the third-quarter figures are released in October, then the share price could move substantially higher.

There is no denying that the rest of this year is difficult to predict as the tough circumstances surrounding business during the pandemic unwind. Chips are still in short supply, so demand continues to outrun availability.

That applies particularly to the motor industry where Texas is a major supplier of chips and electronic components used in systems to aid drivers, keyless entry, lights and climate control. This sector will be a good source of income until vehicle production gets back to something like normal.

- Stockwatch: can you buy Netflix shares on the cheap?

- Top 20 most-bought US stocks so far this year

- Hot sector: should investors put down roots in plant-based foods?

- Stock market recovery 2021: half-term report

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

Texas pays dividends twice a year rather than quarterly, but they are backed by strong cashflow. The latest payout of $2.04 per share implies $4.08 for the full year and a yield of just over 2%, which is way above average for semiconductor companies. Others in the sector tend to retain earnings to fund expansion, while Texas returns just over half its earnings to shareholders.

The dividend has been increased in each of the past five years, even last year when trading was tough, and it looks safe for the foreseeable future.

The shares dipped just below $100 in March last year in the general stock market fall, then doubled before running into modest profit-taking. Previous pauses, in 2016 and 2018, were a prelude for a steady rise to new heights. The same could happen again.

Hobson’s choice: Just over two years ago, when the stock traded at $111.50, I advised buying up to $115. A gain of two-thirds plus two years of dividends since then is pretty good going. The shares have come off the boil lately, but there is still a decent if unspectacular dividend, so latecomers could consider coming in below $192. If the $200 level is breached the short-term target is $220.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.