These funds and trusts will best serve equity investors in the years ahead

22nd October 2018 12:54

by Andrew Pitts from interactive investor

Investors are witnessing the repercussions of quantitative easing being whipped away from the stockmarket party. Andrew Pitts discusses what's likely to happen next in markets.

An amazing 97% of global stockmarket returns since 1973 have accrued during the months from October to April each year. However, volatility also tends to reach its peak in October, a fact underlined by famous October crashes in 1929, 1987 and, more recently, 2008.

That nugget from history, courtesy of the managers of Royal London Asset Management's multi-asset funds, was penned before this October's extreme bout of volatility. On 10 October the US market sneezed. When that happens, as the old saying goes, the world catches a cold.

Here's a reminder of events. Highly valued US technology stocks led the markets down, with the Nasdaq index suffering its largest one-day fall (-4.1%) since the UK voted to leave the EU in June 2016.

It was the worst 24 hours in the markets since February, with volatility continuing into the following day. But is this a classic case of profit-taking by investors, particularly in frothy tech stocks that have been the cheerleaders for stockmarket growth the world over?

Painful omens

A look back to last February seems to support that hypothesis: back then Wall Street's 'fear gauge', the CBOE VIX index – which measures trading on the US options market - leapt from around 13 to 38 before falling back. This time around, the VIX leapt from a low of 11.5 on 3 October to over 26 on 11 October. Globally, world markets as measured by the MSCI All-Country World index slipped to an eight-month low.

However, the omens suggest continued volatility and further weakness. As one investment strategist put it, the sell-off is "a reaction from investors finally realising we are in a higher interest rate environment".

That is why early October looks different from February: the US Federal Reserve has since raised its target Fed Fund rates from 1.5% to 2-2.25%, with three to four more rises widely expected before the end of 2019. Investors are finally witnessing the repercussions of the Fed whipping away the quantitative easing punchbowl from the stockmarket party.

Investors aren't only running scared of the so-called BATs with FAANGs (Asia's Baidu, Alibaba and Tencent; plus Facebook, Apple, Amazon, Netflix and Google's parent Alphabet) after a very strong run; they are also concerned about what higher interest rates could mean for future corporate cash flows and dividends.

A critical benchmark in this respect is the 10-year US Treasury bond yield, which hit a high of 3.25% on 9 October, its highest level since January 2011. This is important because, generally speaking, stocks are valued on their future earnings and cash flow potential, discounted back to today's current risk-free rate.

In the US, a 'risk-free' rate of more than 3% makes the uncertain returns of growth stocks look less attractive than bonds, where investors can at least lock in a return that is currently higher than inflation. It also makes the unknown future of growth stocks such as the FAANGs less attractive than so called value stocks in sectors such as utilities, consumer staples and even banks, which had fallen by the wayside. Even before the October storms, however, investors had begun to rotate back into these sectors.

Change of direction

Even these 'safer bets' are not immune from a rush to the perceived safety of bonds. That is because many such companies have hitherto been regarded as 'bond proxies', because the dividends they generated were far higher than those available on bonds with a high credit rating. Now, with bond yields and interest rates rising, these dividends look comparatively less appealing, and bond market refugees are repatriating at least some of those funds.

In this momentum-driven investment world that has persisted for the past five years or more, it is worth bearing in mind that travelling on the down escalator can be just as rapid, if not more so, than the journey upwards. Nevertheless, the velocity of travel in a prolonged 'risk-off' environment will vary between stocks and sectors with inherent growth or value characteristics. The latter can reasonably expect to travel less swiftly, in either direction, than the former.

Some might, quite rightly, point out that you can't buy food with outperformance in a market where everything is falling. Nevertheless, the ingredients in the recipe for value to make a bigger and tastier meal than growth look ready for the pot. Growth-driven strategies will be far more difficult to fund in an era of rising interest rates.

By association, corporate executives who have raised debt via corporate bond issues to buy back their company shares and artificially inflate dividends (and their bonuses, of course) will find this far more difficult to achieve.

Also, a further rotation from momentum-driven growth to a higher reliance on fundamental corporate strength should not be viewed as being confined to developed markets. Bruce Stout, manager of Murray International trust, points out that: "Net debt to equity in the US, ex the financial sector, has risen from 48% in 2013 to 62%. In Asia, net corporate debt to equity is just 17%."

For income-seekers in particular, and other investors who want to compound their gains by reinvesting income, Stout's statistic should resonate, as it points to those areas where sustainable dividend increases can be generated.

As further evidence, asset manager Janus Henderson's quarterly Global Dividend Index shows that the Asia Pacific ex Japan region, in particular, has a far superior annual dividend growth record to the UK since the index's inception in 2009.

In the second quarter, for example, dividends from companies that the firm monitors in the Asia Pacific ex Japan region amounted to $42.8 billion, with underlying growth of 13.5% (special dividends boosted the growth to 29.2%). That compares with $32.1 billion in the UK, with 13.1% growth, boosted by a rebound in dividends from UK-listed miners. Even under-pressure global emerging markets, which includes China, grew dividends by an underlying annual growth rate of 16.1%. (The index is measured in US dollars for global comparative consistency.)

A sign of things to come?

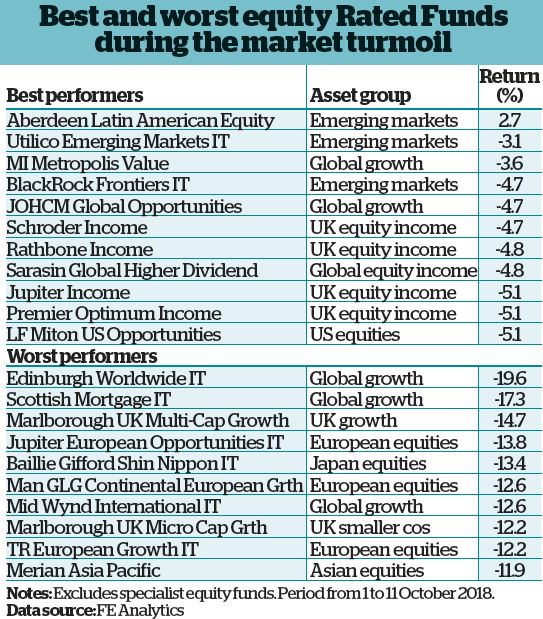

In such a period of intense market volatility, it can be useful to see how funds and trusts that focus on various strategies and asset classes have performed.

The table shows how far the top and bottom 10 among actively managed, equity focused Rated Funds fell in the nine trading days to 11 October. It excludes funds that invest exclusively in specialist areas such as technology, healthcare or biotechnology, which fell by between 11% and 18%.

It is particularly interesting to note which equity-oriented Rated Funds have held up best in this admittedly short period. Top of the pile is Aberdeen Latin American, which eked out a positive return of 2.7%. It is followed by infrastructure and utilities specialist Utilico Emerging Markets, which in a similar vein to Aberdeen Latin American has a decent weighting to Brazil, a country that has recently bounced back strongly.

Funds with a high bias towards investing in fundamentally undervalued companies or which target equity income have also done comparatively well. They include MI Metropolis Value, Schroder Income, Jupiter Income, Rathbone Income and LF Miton US Opportunities. JOHCM Global Opportunities has a bias towards capital preservation and Sarasin Global Higher Dividend is a thematic fund that looks for companies with sustainable sales growth and general financial durability.

To my mind, it is these sorts of funds and trusts, which focus on unearthing value, plus high and sustainable underlying cash flow and return on capital employed, that will best serve mainstream equity investors in the years ahead. That said, the coming weeks or months will also present a buying opportunity for investors who recognise the transformational potential of new technologies – from healthcare to robotics – and their potential for further capital growth.

When the trade war between the US and the rest of the world, principally China, dies down, it will be investors in the Asia Pacific and emerging markets who ultimately benefit. In Europe and the UK, the future is less certain as the Brexit endgame plays out and Italy's populist government sows the seeds of a fresh eurozone crisis.

In short, it means private investors need to be more discerning about where they place their equity stakes.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.