Thomas Cook shares worthless

After months of torment and failure to agree a rescue deal, loyal shareholders have been wiped out.

23rd September 2019 16:10

by Lee Wild from interactive investor

After months of torment and failure to agree a rescue deal, loyal shareholders have been wiped out.

Thomas Cook (LSE:TCG) has gone bust. It's the story splashed all over the front pages. The biggest peacetime repatriation of civilians is now underway, but while disappointed holidaymakers will get their money back, battered shareholders will likely be left with nothing.

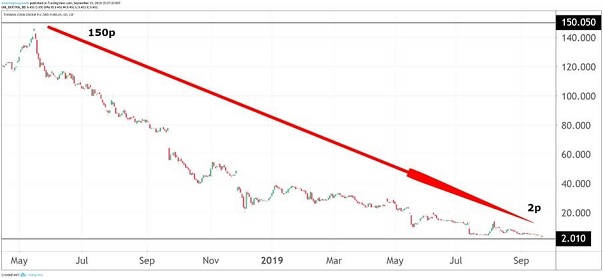

Sixteen months ago, an investor would have had to pay 150p for every Thomas Cook share. Last Friday, they went as low at 2p, closing the session at 3.45p for a decline of 98.7%. The shares are now suspended from trading.

Source: TradingView Past performance is not a guide to future performance

The slump at the end of last week was triggered by a company statement issued in response to media speculation that Cook was struggling to complete a refinancing. The company would only say that talks with banks and its biggest shareholders, including China's Fosun Tourism, were ongoing.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

But after Fosun and the banks had already agreed to pump £900 million into Cook, lenders were unwilling to approve a seasonal standby facility of £200 million to keep the business going through the lean winter months.

It smacks of an unwillingness by lenders to throw good money after bad. Even the government thought so, deciding against bailing out our best-known and oldest travel operator given the very real possibility of it coming back for more cash further down the line.

After the business entered into compulsory liquidation, the Gov.UK website said:

"Unfortunately, as a result of the liquidation appointments, there is no prospect of a return to Thomas Cook's shareholders."

Cook has form when it comes to its finances. Former CEO Harriet Green's major restructuring saved the business before she left in 2014 with the company worth around £2 billion.

Cook shareholders had already been warned that the recapitalisation would significantly dilute their equity stake in the company "with significant risk of no recovery". The writing was on the wall, the outcome almost inevitable.

The rise of online-only operators, terrorism in popular holiday spots and a weak pound have already persuaded Brits to stay at home or find alternative destinations. Uncertainty around Brexit has clearly played its part. But Cook's massive debt pile has made this situation impossible to resolve.

Cook's departure is also an opportunity for rivals in a fiercely competitive industry. Big winners today are TUI (LSE:TUI), whose shares are up 6%, On The Beach Group (LSE:OTB) which is up over 8%, and Jet2holidays-owner Dart Group (LSE:DTG), up 5%

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.