Three boring companies making naughty things we all love

These are mature businesses, but the shares are doing well and they pay respectable dividends.

28th April 2021 10:00

by Rodney Hobson from interactive investor

These are mature businesses, but the shares are doing well and they pay respectable dividends.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Snacks are for life, not just during a pandemic. Producers have been able to push prices higher during lockdowns and the world’s appetite for snacking is unlikely to tail off as restriction ease. Higher consumption and higher prices are probably here to stay.

The sector offers a choice of large, solid companies paying decent yields and with excellent prospects for growth. It is reasonable to argue that prospects are not always fully reflected in share prices.

Mondelez International (NASDAQ:MDLZ) was split out of Kraft Foods, the North American grocery business, in October 2012, taking with it among other brands Cadbury, which Kraft had bought two years earlier in a controversial takeover. Based in Chicago, Mondelez supplies $26 billion worth of snacks, confectionery and beverages a year in 160 companies.

Apart from Cadbury, its brands include Oreo, Chips Ahoy and Halls. Many of its products will not please the healthy eating brigade. For starters, biscuits account for nearly half of all sales, chocolate nearly another third, and gum and sweets a tenth. About 40% of revenue comes from Europe, with the rest split fairly evenly between North America and emerging markets.

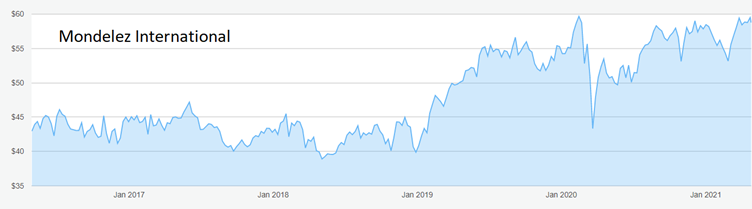

Source: interactive investor. Past performance is not a guide to future performance

Kraft itself went on to merge with canned food giant Heinz in July 2015 to create Kraft Heinz (NASDAQ:KHC), the third-largest food and beverage manufacturer in North America and the fifth-largest in the world, with sales in nearly 200 countries.

Kraft Heinz makes condiments and sauces, ready meals, beverages and Philadelphia cheese among its grocery range.

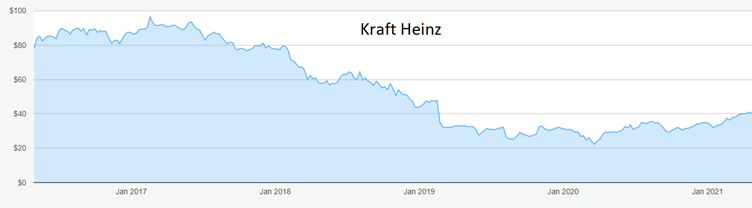

Source: interactive investor. Past performance is not a guide to future performance

The Hershey Co (NYSE:HSY) has less of a global reach, selling in just 85 countries outside the US, but its 90 brands, including KitKat, do account for a remarkable 46% of chocolate display space in US sweet shops.

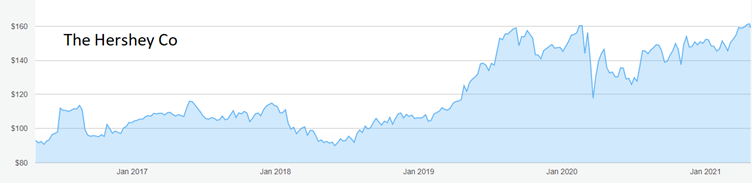

Source: interactive investor. Past performance is not a guide to future performance

Large companies are often looking for bolt-on acquisitions that allow them to expand slowly but surely in addition to organic growth. This policy can help snack producers to expand into healthier eating to improve their images, although such opportunities may be limited.

For example, Mondelez has just paid £200 million for Grenade, a West Midlands producer of protein bars and drinks popular with gym enthusiasts who want high-protein, low sugar snacks. Hershey has gradually added Amplify Snack Brands, Pirate Brands and Original Tings over several years, though admittedly some of these products such as popcorn are for the mass rather than the discerning consumer.

None of these three are likely to see their share prices racing ahead in the near future, but nor are they likely to fall back disastrously. As mature businesses, they represent solid if possibly boring attributes for investors in for the long haul. They have limited opportunities to invest in their existing products so are more inclined to pay a fair proportion of profits back to shareholders in dividends.

Mondelez shares were going nowhere fast until January 2019, when they set off from $40 to $60, where they ran into resistance. They are still bumping up against that barrier despite offering a yield of 2.1% with the prospect of gradually rising dividends for the foreseeable future.

Hershey also took off in 2019 but has moved sideways, with $160 acting as a ceiling. If that barrier is broken the stock could leap forward again. At $159 currently, the yield is 2%.

In contrast, Kraft slumped between 2017 and March 2020, when it bottomed at only $22. The gradual recovery since then is set to continue, with a yield of 4% at $40.

Hobson’s choice: Buy Mondelez below the $60 ceiling. The immediate target is $66, not a massive gain but worth having even so. Hershey is also worth considering before it breaks its $160 ceiling. Those who failed to follow my advice to buy Kraft at around $30 in July 2019 and again in May 2020 still have the chance to come in below $44, the next potential sticking point.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.