Top funds for emerging market exposure

3rd August 2017 14:51

by Dzmitry Lipski from interactive investor

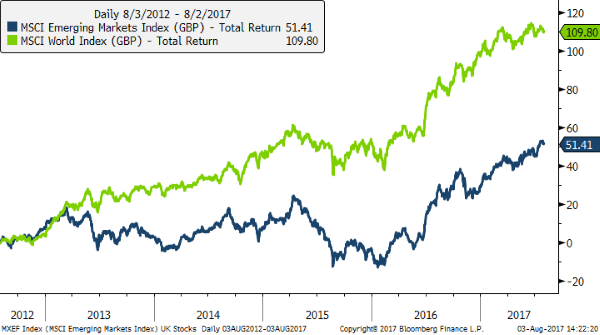

Emerging markets have disappointed investors in recent years, with equities there held back by a mix of weak commodity prices, sluggish export growth, and political disruption. The result has been that developed market returns are almost double those from emerging markets over the last five years.

But this trend is reversing. Emerging market equities have rallied this year, outpacing developed market growth. However, investors are now questioning whether this rally can last.

Despite increased uncertainty, investors agree that the long-term case for investing in Emerging market equities for portfolio diversification and alpha generation remains intact.

Emerging markets provide an opportunity for growth oriented investors. As the developed world faces an ageing population and low levels of economic growth, emerging markets are growing rapidly and have supportive demographics. They are home to 85% of the world's population and account for almost 60% of global GDP.

However, simply buying into the emerging market benchmark index provides little exposure to the largest growth opportunities. For example, the MSCI Emerging Markets index is heavily skewed to China, South Korea and Taiwan, and in sector terms have large weightings in financials and information technology. The index only has modest exposure to the consumer sector and countries such as Brazil and Russia.

Uncovering opportunities

China is increasingly recognised as being a major driver of growth and investment performance, not just in Asia, but the wider world. Its sheer economic size and consistent year-on-year growth means that investors should consider exposure to China when building a balanced portfolio.

But, after experiencing rapid growth for more than a decade, China's economy has experienced a slowdown recently. Moody's downgraded its credit rating last month, saying it expects the country's financial strength will erode in the coming years as growth slows and debt continues to rise.

The second country on the investor radar is India, with clear long-term potential in its domestic economy and growing middle class. Indian incomes are rising fast and the country's urban middle class is expected to grow from around 50 million today to reach 475 million people by 2030.

The big story in emerging markets today is the consumer sector. The rising affluence of more than 3 billion largely emerging market consumers is causing this sector to grow more rapidly than emerging markets as a whole.

Money Observer Rated Funds to consider

Gary Greenberg, manager of fund, is not as worried about Chinese growth as it is still growing more than twice as fast as developed economies. He has some reservations about Chinese government intervention to stimulate the economy, which Greenberg brands “short-term gain for long-term pain” as it will only increase the country's already high levels of indebtedness.

Despite his concerns, Greenberg continues finding attractive investment opportunities. His fund has a large allocation to China, overweight technology and consumer discretionary and underweight to energy, which is largely due to Hermes' focus on environmental, social and governance factors within its funds. Among the fund's top holding are Tencent and Alibaba, China's tech giants which are the equivalent of Facebook and Amazon in Asia.

In contrast, Dean Newman, manager of fund, is more cautious on China given its high debt level. The manager favours technology companies in the region given strong consumer trends and the growing influence of e-commerce in Asia. He also expects banks and consumer discretionary companies to continue to do well, and believes the energy sector could also be a turning point following its relative poor performance this year.

While most funds investing in emerging markets focus on larger, more-established businesses for greater security, the fund represents a unique proposition, as it offers something different. It invests purely in Asian smaller companies and other 'selected' emerging markets, which the managers, Matthew Dobbs and Richard Sennitt, argue can produce better growth than larger rivals and are often overlooked by investors.

They point out that smaller companies can provide higher growth than larger companies over the longer term, due to the fact they are typically in the early stages of their development. Smaller companies are often less well researched than larger ones.

However, managers acknowledge the higher risks involved in investing in smaller companies in any type of market, as they tend to sell off more strongly during weak markets, although they do recover more strongly as confidence returns.

Managers believe that Asia and emerging markets continue to offer significant structural advantages in terms of growth potential over the longer term. Dobbs and Sennitt are bottom-up stock pickers but, given the ongoing speculation from the US regarding trade, they focus more in markets and sectors which are insulated from these risks.

India, in their view, appears the least vulnerable from any trade tax adjustments by the US and domestic defensives such as healthcare stocks are still looking attractive.

Chetan Sehgal, manager of the fund, argue that smaller companies in emerging markets are typically concentrated in higher-growth sectors, such as consumer discretionary and healthcare. Often these companies are more locally focused and many are relatively dominant players in smaller industries. The most successful companies will leverage such local strength to expand internationally.

In such a low-growth world, investing in EM small-caps may provide exposure to many of the fastest-growing companies in the fastest-growing countries globally. India, in Sehgal's view, is one of them, and the manager is convinced that, despite Indian markets at a record high, it is not too late to invest there, and one will still be able to selectively find attractively valued stocks.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.