Top funds offering a secure income stream

This sector could be a healthy addition to the property portfolios of income-hungry investors...

15th March 2019 15:30

With a sector average yield of 4.5% and a highly differentiated risk profile, the primary healthcare sector could be a healthy addition to the property portfolios of income-hungry investors...

The open-ended commercial property fund sector is under pressure, as concerns about the outcome of the Brexit negotiations and the rapid deterioration of the retail property market have spurred many investors to reduce or eliminate their exposure.

In this article, we take a look at primary healthcare properties as a possible alternative to open-ended funds, where the risk of 'gating' - funds closing to outflows - is on the rise in volatile market conditions. With a sector average yield of 4.5% and a highly differentiated risk profile, the primary healthcare sector could be the best place for income hungry investors looking for non-cyclical returns.

Retail valuations moving down, money flowing out of the sector

Open-ended property funds last year saw redemptions of close to £500m, including £315m in December alone. This magnitude of withdrawals was last seen following the 2016 referendum, which led to a suspension of trading and investors' money being trapped in funds (albeit temporarily).

Managers are now having to be wary of a similar scenario occurring and there are signs that they are dramatically increasing their cash reserves in order to meet redemption demand.

This may protect them from having to shutter their funds again, but it also reduces investors' exposure to the property market and effectively means they are paying managers a portion of their cash. Currently the average market exposure of investment trusts is 131%, as opposed to only 78% within open-ended funds - with average cash levels of 22% (according to Canaccord Genuity).

Meanwhile the regulator has been sniffing around, consulting on proposals that would come into force this year, which would require open-ended property fund managers to provide daily updates on the health of their trust.

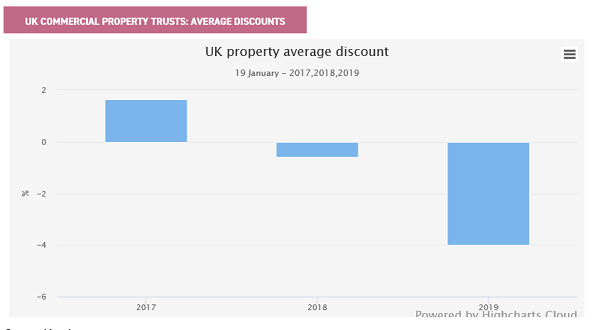

We have made the argument against holding property in an open-ended fund ad nauseam. Nonetheless, Brexit has caused investor sentiment to swing against the listed fund sector too, with small premiums giving way to discounts. Some managers we speak to acknowledge that it is hard to make the case for their sector while the uncertainty of the Brexit negotiations is hanging over them. At the same time, elements within the sector (retail properties in particular) are going through a period of secular change – with the final outcome far from clear.

As we discussed in this article published in November 2018, retail property is under threat from the rise of internet retailing and changing consumer habits. An estimated 1,267 shops in the UK have been closed or earmarked to be closed since January 2018 (source: Telegraph retail store tracker) and hardly a day goes by without warnings of the shifting landscape across the high street.

Retail isn't the only property sector with challenges: the way in which companies use office space is changing. There has been an increase in co-working, remote working, and more flexible ways of using property, all of which has increased the trend towards a reduction in the demand for office space. When the uncertainties surrounding Brexit are thrown in, it is unsurprising that investors are pausing to reflect.

Uncertainty is more prevalent

As shown below, this uncertainty has been reflected across the discounts of commercial property trusts, which have gone from trading on premiums a year or so ago, to trading on an average discount of close to 5% now.

Source: Morningstar

With this in mind, it makes sense for property investors to look for niches which aren't facing some of the broad structural headwinds of the commercial property sector. UK Commercial Property REIT (LSE:UKCM), the £1.5bn REIT run by Aberdeen Standard Investments, has recognised this and announced that it is seeking permission to broaden its investment mandate to be able to invest in the "alternative" property sector. It defines alternatives as including areas such as residential housing, social housing, student housing, self-storage units, data centres and medical facilities. While these sub-sectors are hard to define, they tend to be more recession-resilient and less correlated to the mainstream real estate sectors. According to the manager, these sub-sectors are also offering higher running yields, and will benefit from structural changes in demand, which will serve as a tailwind to the returns these investments will give over the long term.

Range of listed funds offer a fast and low-cost way of switching property exposure

In contrast to direct investors in property, switching allocations between sectors and property types via listed funds is relatively easy and considerably less costly. Anyone who has sold their house knows that transacting in property takes time, with plenty of uncertainty and a surprising level of expense. The industry standard cost for buying a commercial property is 6.8%, including stamp-duty (and 1.8% for selling property). On the other hand, London-listed property funds and REITS offer investors an ability to buy ready-made portfolios at the flick of a switch, at a significantly lower cost compared to direct investing.

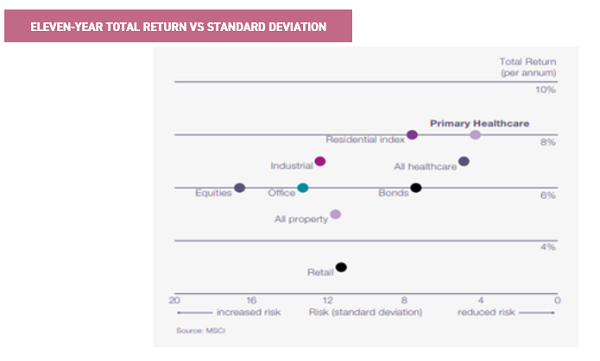

We believe that the current uncertainties surrounding commercial property mean that it might pay to diversify exposure and that listed vehicles offer a clear route to doing this. In particular, one area that looks attractive in our view is the primary healthcare space. This niche in the commercial property sector has displayed some of the highest annual returns with the lowest volatility of all sub-sectors over an eleven-year period, according to data from MedicX Advisers.

Source: MedicX

Aside from having demonstrated attractive returns since the global financial crisis, in contrast to many other sub-sectors, it is also inherently understandable. The primary healthcare sector invests in modern, purpose-built doctors’ surgeries, which are then leased to GP partnerships.

The sector is benefitting from secular tailwinds, which mean it is likely to continue to be in demand, most notably an aging society and demand among taxpayers' for more efficient healthcare spending.

The properties held within these investment companies are also different to others in the broader commercial property sector due to the reliability of the tenants, the length of leases and their excellent covenant strength.

As such, properties in the primary healthcare sector offer a vastly different risk profile and are a possible supplement to commercial property exposure, in particular against open-ended funds where there is increasing risk (driven by regulation as much as market conditions) of having capital trapped.

Importantly, these different risk exposures can be achieved without having to diminish one's income return: the medical property sector average yield of 4.65% compares to the average for the IA UK Direct Property funds weighted average of 3.3%, according to Trustnet.

Certainly, it is possible that the medical property trusts offer less upside in terms of long-term total returns. However, at this point in the cycle, one might argue that the steady, highly secure nature of their income means that short-term total returns could be significantly higher than the open-ended commercial property funds.

As we discuss in detail below, and whilst these trusts employ significant levels of gearing, the listed primary healthcare sector could be an interesting opportunity at the current stage in the cycle for investors to diversify their exposure from broader closed and open-ended commercial property funds.

The case for primary healthcare

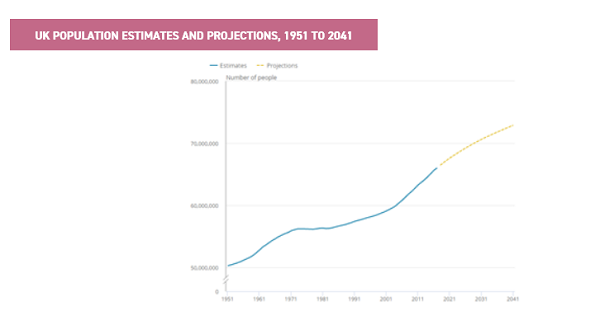

Demographics and financial considerations mean that the primary healthcare market has strong secular tailwinds behind it. 71 years on from the founding of the National Health Service (NHS), the approach to delivering care to patients is coming under increasing pressure. As can be seen below, the UK population is anticipated to grow by around 12% (to 71 million) by 2035, and currently has 11.4 million people aged over 65 (PHP Group).

Source: Office for National Statistics

The NHS is being asked to be more efficient, and part of this effort is in trying to treat patients outside of hospitals, using doctors surgeries (or primary care buildings). As such, primary care buildings – where over 90% of patient contact in the NHS takes place – are now required to accommodate more staff, offer everyday access for general practitioners and provide an increasing range of services.

However, investment in these properties has been stagnant in comparison to the increasing demand. This was reflected last year, when a survey of medical professions found that they considered 50% of the 8,000 GP surgery properties in England and Wales as unfit for purpose (source: Assura).

Furthermore, 50% of primary care premises are more than 30 years old (source: British Medical Association), and an astonishing 62% of GPs stated that their premises are too small to provide vital training or education.

This has not gone unnoticed, and across the UK there is a changing political agenda to restructure healthcare provisions. It has been estimated that GPs get over 300m visits a year and just two visits to A&E cost more than a year's worth of GP care.

Therefore, the government is aiming to have 5,000 more GPs by 2020 and other community services, like mental health and community nursing, are going to be tied more closely to these surgeries. Moreover, in 2016 the NHS and local councils came together in 44 areas across England and formed Sustainability and Transformation Partnerships (STP), which are designed to offer services in a more coordinated way.

Since then, STP areas continue to be the focus of the Department of Health's transformation agenda - December 2018 saw a further £963m of funding to support STP's. The government has now allocated £2bn of £3.5bn announced in the 2017 budget, and the 2018 Autumn budget also included an extra £20.5bn allocated to the NHS over the next five years, showing the increasing emphasis being placed on healthcare across the UK.

Primary healthcare property funds

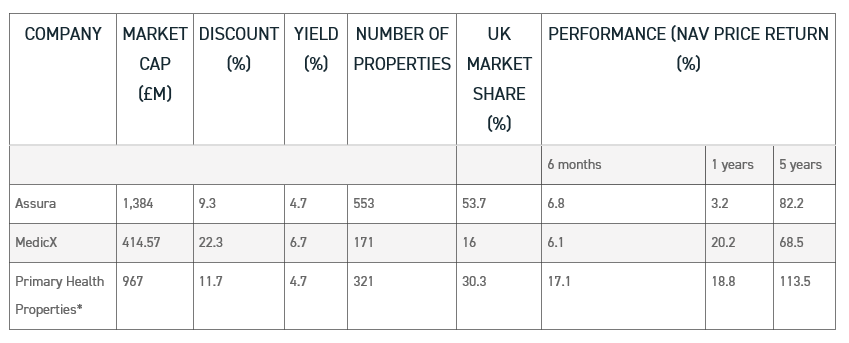

The statistics above demonstrate the government's desire for improved healthcare and the need for bigger and better resourced primary healthcare properties. Reflecting this need, for a number of years, several listed investment vehicles have been investing in the space. As can be seen in the table, hitherto there have been three listed primary healthcare funds. In January, MedicX (LSE:MXF) and PHP (LSE:PHP) announced a merger, which will complete in late March 2019 – of which more below – and as such the listed sector will soon consist of only two funds.

(01.03.19): Cazenove and MedicX

With their specialised mandate, the primary healthcare property funds can be differentiated to commercial property funds principally because of their excellent covenant strength, lease length and very low voids.

Commercial property companies have corporate tenants, which can be considered as having credit risk, whereas doctors' surgeries ultimately have the government as their tenants. This is because although GP partnerships are the ones utilising the vast majority of the facilities, it is ultimately the NHS that underwrites the vast majority of rents.

These characteristics mean that the primary healthcare sector has very different investment characteristics when compared to commercial property and is very much insulated from short-term swings in the state of the economy.

For example, in the retail sector, despite having upward-only rent reviews, landlords are inevitably exposed to bankruptcy of tenants, or CVO's in which business owners attempt to reduce their costs by re-establishing a lower level of rents.

Primary healthcare buildings typically have either RPI-linked rents, a periodic fixed uplift, or open market reviews (based on land and construction inflation).

The two former types therefore give an element of certainty to future rental growth. Each of the listed funds aims to maintain a balance of these different types of rental, although clearly a protracted downturn in the economy would likely have an effect on the ability of rental increases to be pushed through for open-market rental agreements.

On a granular basis, voids in the sector are rare. For example, only one of the 313 properties in PHP's portfolio is unoccupied. In comparison, the two largest commercial property trusts, F&C UK Real Estate Investments (LSE:FCRE) and UK Commercial Property REIT (LSE:UKCM), both have 6.9% of their portfolios currently unlet.

This figure increases even further for open-ended funds, for example M&G Property Portfolio. The fund is the largest in the IA property sectors, but has a vacancy rate of 7.5%, although this does include developments.

Within the medical property sector, assets are purpose-built properties, and given the historic dynamics which have affected the limited stock of doctors' surgeries, as well as today's thrust of healthcare policy, it seems unlikely that demand for such properties will tail off.

Lease lengths are also typically much longer than with standard commercial properties, meaning that the risks of future voids and rents falling are lower. For example, within PHP's portfolio, there is an average lease length of 12.9 years before the first break, as opposed to F&C UK Real Estate Investment, which has an average lease length of six years.

These differences mean that in our view the sector offers diversification benefits to commercial property investors, as well as insulation from Brexit and the potential fallout from a retail apocalypse. It is also worth noting that historically, primary healthcare has delivered its returns with lower volatility. According to data from MedicX, valuations through the GFC hardly moved – particularly relative to other commercial property sectors.

According to their numbers (from IPD), valuation yields rose from 5% in 2007 to a maximum of 6.25% in early 2009, before coming gradually back again to the current valuation yield of 4.99%. Commercial property valuations on the other hand are considerably more volatile - with many commercial property sectors seeing their valuation yields double during the GFC.

As such, we believe the medical property trusts offer highly attractive defensive qualities, and yet offers a significant yield premium at current prices. The current dividend yield on medical property funds is 4.5%, against the IA UK Direct Property Fund sector average of 3.3% (source: Trustnet). This compares with the listed commercial property fund sector weighted average of 5.1%.

Compare and contrast – three are becoming two...

On 24 January 2018, PHP announced that it had agreed an all-share merger with MedicX. This merger will give the group a combined portfolio of around 480 properties worth £2.3bn. PHP investors will own 69% of the united firm, with the rest held by MedicX shareholders. The rationale of the merger was that MedicX Shareholders would benefit from a 14.3% premium to the closing share price on January 23, along with a 13.5% dividend uplift (based on the latest quarterly dividend). Both sets of shareholders will benefit from lower external management fees (as a % of portfolio value) along with greater liquidity and a broadening of the shareholder base.

As one might anticipate, the majority of the benefits of the merger are about scale. However, this has been achieved principally due to the similarities between MedicX and PHP. Both of the boards have acknowledged that their businesses are highly complementary strategically, geographically, operationally and even culturally.

One area in particular that the companies are aligned has been their move into Ireland. The healthcare landscape across the Republic of Ireland (RoI) is similar to the UK, with the country currently going through a healthcare reform with more emphasis being placed on primary care and meeting the increasing demand.

Like the UK, this demand has not been met with increasing investment, despite Ireland facing one of the fastest population growth rates in Europe. By 2051, the population is expected to grow by around 20% (to c.6m) and the proportion of over 65's and over 80's is projected to grow by 150% and 270% respectively.

With this said, there are a few minor differences between the two areas. Firstly, the government in Ireland is looking to use healthcare facilities for a wider range of services. Typically, the Irish equivalent to the NHS, the HSE, will account for 60-75% (as opposed to 90% with the NHS) of the rent roll on a property, and the likes of dentists, pharmacies and physios will rent the facilities alongside the GPs.

Additionally, in Ireland the rents are normally directly linked to CPI, which means they could go up (or down). In comparison, UK leases are typically upwards only, with most set at open market levels reviewed every three years, with the balance based on fixed uplifts or RPI inflation-linkage.

The HSE is looking to have around 200 of these modern purpose-built health facilities throughout Ireland. So far, PHP believe only half of the desired buildings have so far been built, offering plenty of "runway" for investors. With the recent merger, the combined total number of properties in Ireland increases to 13 (representing 3% of the combined portfolio), although this is likely to increase further.

Conclusion

We are currently witnessing a period of great change across the UK property space, in particular UK commercial property. There are multiple headwinds facing the sector, reflected in the widening of discounts in the listed commercial property trusts, and considerable outflows from open-ended funds. With the latter, investors face the possibility of having their money trapped, or at the very least suffering in terms of declining capital values in a volatile market. For listed funds, there are the ever-present risks of widening discounts.

At the same time, the case for primary healthcare properties has become increasingly captivating. We are seeing increasing pressure being placed on the NHS (and the Republic of Ireland's HSE) to reform the way that healthcare is delivered, and this process has already begun.

As we continue to see demographics change, more investment is going to required in the sector and this moment in time, with dividend yields significantly ahead of open-ended funds, offers investors an opportunity to diversify their property exposure and significantly improve their yield. Of course listed funds do have other risks – both PHP and Assura (LSE:AGR) use considerable amounts of gearing. However, with only two constituents in the sector, both of which yield 4.5%, Assura and PHP should offer investors good capital protection and a secure income stream.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons.

The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.