This top performer yields 4% and pays out monthly

Saltydog Investor increases it exposure to the only fund in the ‘Slow Ahead’ group ranked in decile one over four, 12, and 26 weeks.

15th July 2025 09:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Each week, we review the performance of thousands of funds. We look at the relative strength of the Investment Association (IA) sectors and highlight the leading funds from each sector.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

As part of our analysis, we categorise the IA sectors into our own Saltydog groups based on their long-term volatility.

Our least volatile group is “Safe Haven”, which only includes funds from the two money market sectors.

Next is the “Slow Ahead” group, made up of the UK bond sectors (£ Corporate Bond, £ Strategic Bond, and £ High Yield), three mixed-investment sectors (Mixed Investment 0–35% Shares, Mixed Investment 20–60% Shares, and Mixed Investment 40–85% Shares), and the Targeted Absolute Return sector.

Then comes “Steady as She Goes”, which includes the remaining bond sectors, the three UK equity sectors (UK All Companies, UK Smaller Companies, and UK Equity Income), and the Flexible Investment sector.

At the top of the volatility scale are the two “Full Steam Ahead” groups, which cover sectors that predominantly invest in equities, such as Japan, North America, Global Emerging Markets, and Technology & Technology Innovation.

- Terry Smith blames these two factors for underperformance

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

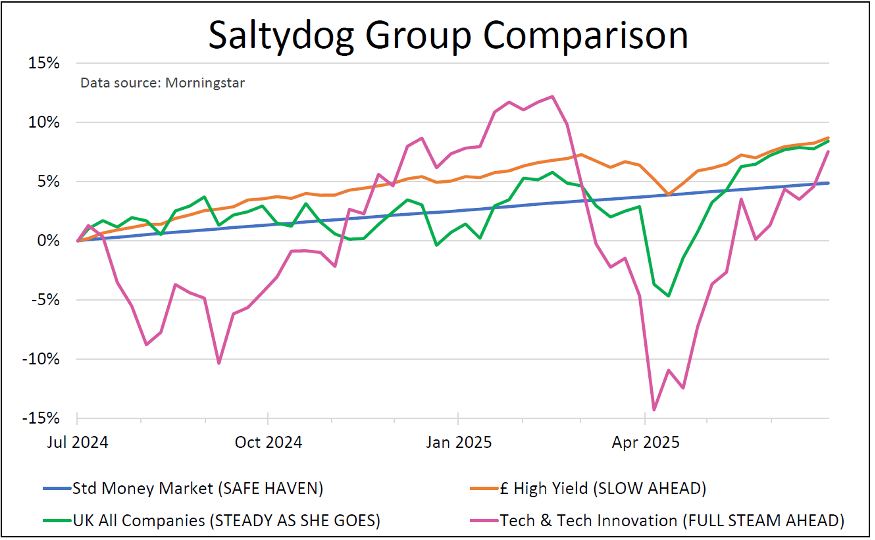

To highlight how the sectors in these different groups perform, here’s a graph showing the performance of four sectors, each from a different group, over the past 12 months.

For this illustration, we have picked the Standard Money Market sector from our “Safe Haven” group, £ High Yield from our “Slow Ahead” group, UK All Companies from our “Steady as She Goes” group, and the Technology & Technology Innovation sector from one of our “Full Steam Ahead” groups.

Past performance is not a guide to future performance.

This clearly shows the difference in volatility between sectors in the different groups.

By varying the amount invested in the different groups, it’s possible to adjust the overall volatility of your portfolio, and make sure it aligns with your personal appetite for risk.

At Saltydog Investor, we run two demonstration portfolios to show how our data can be used to build balanced portfolios. Both are relatively cautious, typically favouring less volatile sectors. We do add limited exposure to higher-risk sectors, but only when they are significantly outperforming the lower-risk alternatives.

- How did one-stop shop funds fare amid tariff turmoil?

- Why I voted against Scottish Mortgage’s dividend payment

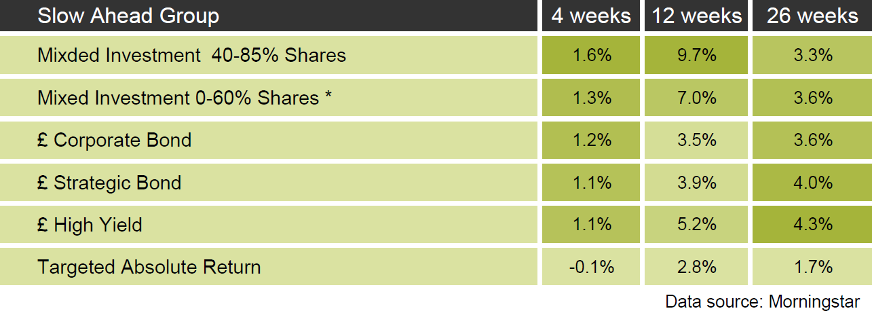

Last week’s analysis showed that the Mixed Investment 40–85% Shares sector was the leading sector in the “Slow Ahead” group over four weeks, with a return of 1.6%. All the other sectors in this group were also up by more than 1%, apart from Targeted Absolute Return, which, somewhat ironically, posted a 0.1% loss.

*We only track a relatively small number of funds from the Mixed Investment 0-35% Shares sector, and so combine them with the funds from the Mixed Investment 20-60% Shares sector in our analysis. Past performance is not a guide to future performance.

Although the mixed-investment sectors are leading over four and 12 weeks, the bond sectors are still ahead over 26 weeks.

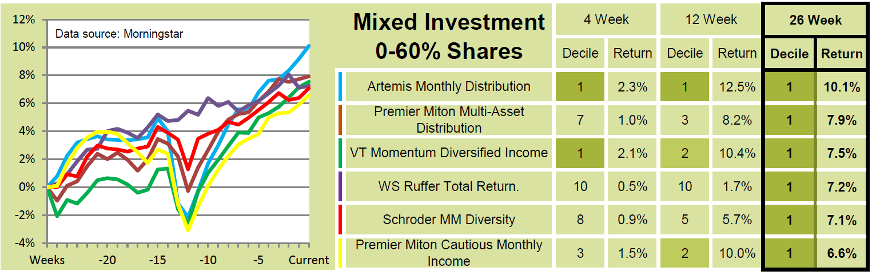

In our portfolios, we have held funds from the £ High Yield sector for over 18 months and added a £ Strategic Bond fund nearly a year ago. Over the past couple of months, we have introduced funds from the mixed-investment sectors, and last week we increased our holding in Artemis Monthly Distribution fund.

As part of our fund analysis, we rank each fund within a group on performance across different time frames, from one (best) to 10 (worst). When there is little to choose between sectors, as is the case now, this helps identify the top-performing individual funds.

When we looked last week, Artemis Monthly Distribution was the only fund in our “Slow Ahead” group with a decile ranking of one over four, 12, and 26 weeks. It yields 4.12% and distributes each month to investors, as its name suggests.

Past performance is not a guide to future performance.

The Artemis Monthly Distribution fund currently holds around 10% in UK equities, 10% in UK bonds, 45% in international equities and 35% in international bonds. Its overseas investments are mainly in North America and developed Europe.

Unlike some funds in the mixed-investment sectors, it has relatively little exposure to the technology sector (less than 2% of the portfolio). The largest equity sector is Financials, around 25%, followed by Industrials, 9%, and Energy, 7%.

With its relatively low volatility, diversified portfolio, and strong recent performance, Artemis Monthly Distribution is a strong candidate for cautious investors looking to add some equity exposure, while maintaining a relatively conservative risk profile.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.