Top stock picks in the mining sector

A rebound in demand for raw materials could trigger a 30% surge in the share price of these miners.

11th June 2020 14:29

by Graeme Evans from interactive investor

A rebound in demand for raw materials could trigger a 30% surge in the share price of these miners.

Anglo American (LSE:AAL) and Glencore (LSE:GLEN) were today backed for their recovery potential as a City bank upgraded a host of mining stocks on a China-led rebound in commodities demand.

Deutsche Bank raised its 2020/21 earnings estimates to materially above consensus forecasts, with a resulting boost to price targets for the likes of Antofagasta (LSE:ANTO), BHP Group (LSE:BHP) and Rio Tinto (LSE:RIO).

The optimism is based on expectations that demand in China will continue to surprise to the upside, with Beijing expected to use its tried and tested methods of stimulating the economy. Credit easing and positive construction trends are likely to be other demand drivers.

The bank thinks the price of iron ore will stay stronger for longer and that the copper market will move from a position of surplus into balance heading into 2021. It's a far cry from February and March, when mining stocks plunged on fears of a supply glut caused by global lockdowns.

A credit-fuelled metals restocking surge in China has been the key positive surprise since then, helping to offset demand weakness elsewhere. Covid-19 disruption to mines has also limited the price downside for a number of commodities, particularly iron ore, copper and zinc.

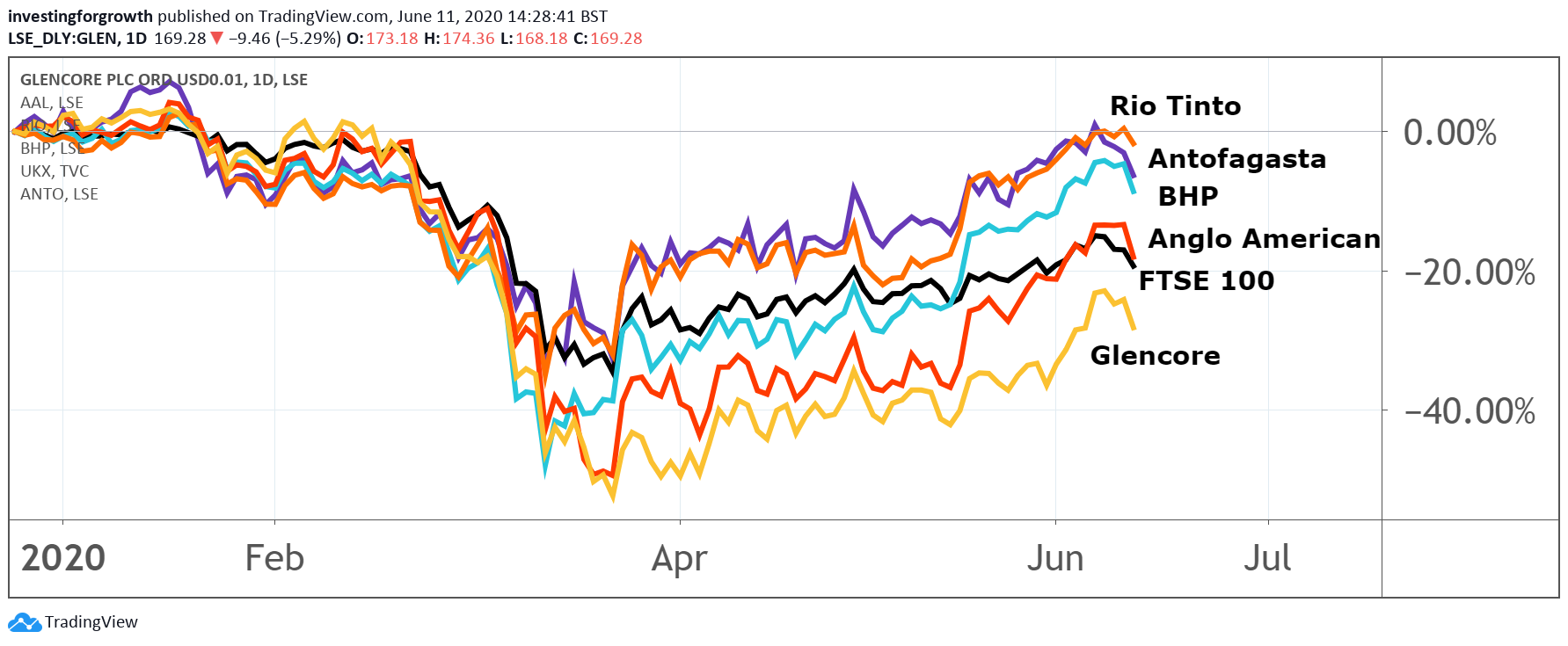

To date, base metal and bulk prices are down 5-15% from January's pre-Covid highs after falling by as much 30% at their March lows.

For cyclical value and recovery potential, Deutsche sees Glencore and Anglo American shares as offering a 30% upside to 240p and 2,300p respectively. For more defensive exposure, its top picks include BHP with a target price of 1,750p.

Source: TradingView. Past performance is not a guide to future performance.

It said: “Rio and BHP are approaching fair value, but elevated prices through 2020-21 offer additional upside which we expect to be mostly returned to shareholders, supported by a track record of consistently high dividend pay-outs.”

Deutsche's mining sector recovery trade is built around favourable comparisons with the 2008 and 2015 downturns, including the fact that major commodities have this time avoided levels of extreme margin compression.

In the previous recovery cycles of 2009/10 and 2016/17, Deutsche pointed out that mining went on to outperform the wider market for about two years due to above-trend demand growth, supply cuts and depressed valuations at the trough.

In 2009 and 2016, the sector rallied 200% and 120% from their lows respectively, whereas the current upturn from the March lows in 2020 has been about 60%.

Deutsche said: “While there will be persistent concerns over medium-term demand (as there were in 2009 and 2016) the rate of sequential improvement is the most important driver of sentiment and prices in the shorter term.”

On its key stock calls, Deutsche said Glencore's recent trading update highlighted the group's strong cash flow generation, even at current low cycle prices.

The note said: “Current valuation is too compelling to ignore, in our view, despite weak coal prices and ESG-related overhangs.”

Deutsche expects Anglo's half-year results to be weak and complicated by mine suspensions in South Africa and elsewhere caused by Covid-19 lockdowns. However, the restrictions are beginning to ease and the company's balance sheet and liquidity position remain strong.

It said: “Looking through near-term earnings, Anglo continues to have the most compelling growth profile among the majors. Significant improvements to the business have already been achieved and successful delivery of key growth projects has scope to further re-rate the shares.”

Deutsche upgraded BHP to a ‘buy’ recommendation in March following an aggressive sell-off for the shares in which it halved in value from January's 1,851p to 939p. They've since recovered to 1,720p and were trading at 1,663p after falling 3% today.

The note said: “We believe valuation remains attractive, particularly for a company offering a very solid balance sheet and a resilient asset base.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.