Two Japanese funds on our radar

Saltydog Investor reveals two high-performing and consistent Japan funds.

21st February 2024 10:38

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

To help gain an overall picture of how financial markets are performing around the world, we keep an eye on 12 key stock market indices.

The star performer so far this year has been the Japanese Nikkei 225. It rose more than 8% in January, and has gained a further 6% in February.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

| Stock Market Indices | 2024 | ||||||

| Index | Country | Full year 2021 | Full year 2022 | Full year 2023 | Jan 2024 | 1 to 17 Feb 2024 | Year-to-date |

| FTSE 100 | UK | 14.3% | 0.9% | 3.8% | -1.3% | 1.1% | -0.3% |

| FTSE 250 | UK | 14.6% | -19.7% | 4.4% | -1.7% | -0.9% | -2.5% |

| Dow Jones Ind Ave | US | 18.7% | -8.8% | 13.7% | 1.2% | 1.3% | 2.5% |

| S&P 500 | US | 26.9% | -19.4% | 24.2% | 1.6% | 3.3% | 4.9% |

| NASDAQ | US | 21.4% | -33.1% | 43.4% | 1.0% | 4.0% | 5.1% |

| DAX | Germany | 15.8% | -12.3% | 20.3% | 0.9% | 1.3% | 2.2% |

| CAC40 | France | 28.9% | -9.5% | 16.5% | 1.5% | 1.5% | 3.0% |

| Nikkei 225 | Japan | 4.9% | -9.4% | 28.2% | 8.4% | 6.1% | 15.0% |

| Hang Seng | Hong Kong | -14.1% | -15.5% | -13.8% | -9.2% | 5.5% | -4.1% |

| Shanghai Composite | China | 4.8% | -15.1% | -3.7% | -6.3% | 2.8% | -3.7% |

| Sensex | India | 22.0% | 4.4% | 18.7% | -0.7% | 0.9% | 0.3% |

| Ibovespa | Brazil | -11.9% | 4.7% | 22.3% | -4.8% | 0.8% | -4.1% |

Data source: Morningstar. Past performance is not a guide to future performance.

We currently track around 30 funds that invest in Japanese companies. Until recently these were either in the Investment Association’s Japan sector or their Japanese Smaller Companies sector. However, last November the Japanese Smaller Companies sector was dissolved, because there were no longer enough funds to make it viable, and the remaining funds were moved into the Japan sector. It looks like the major fund houses are not as interested in running Japanese funds as they once were.

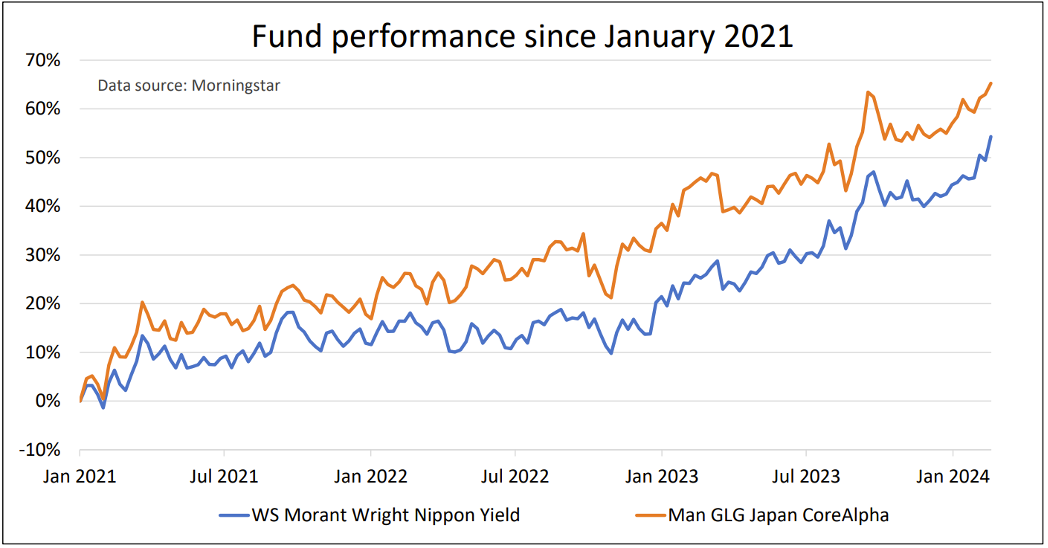

Two of the Japanese funds that we monitor, WS Morant Wright Nippon Yield and Man GLG Japan CoreAlpha, have just come to our attention for another reason.

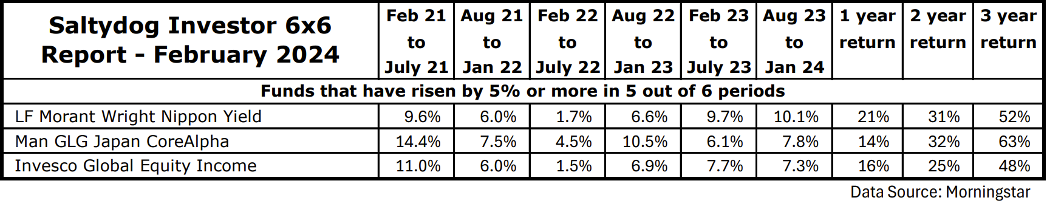

Every three months we generate the Saltydog 6x6 Report. This is where we trawl through our fund data looking for funds that have gone up by 5% or more in the last six six-month periods. They are fairly few and far between, but from time to time we do find them. Unfortunately, we did not uncover any in our latest report but there were three funds that had achieved the target five out of six times. Two were from the Japan sector and one was from the Global Equity Income sector.

Past performance is not a guide to future performance.

Although we have invested in Japan several times over the years, we have never had a lot of success.

Its economy has had an interesting history over the past 75 years, which has been quite different to the US, European and other Asian countries.

After the Second World War, Japan was left in ruins, with its economy devastated, infrastructure destroyed, and a significant portion of its urban areas bombed. The immediate post-war period was marked by severe food shortages, inflation and unemployment. Under the occupation led by the Allied Powers, up until 1952, Japan underwent significant political, social and economic reforms.

The period from the 1950s to the end of the 1970s is often referred to as Japan’s “Economic Miracle”. This era was characterised by high rates of growth, technological innovation and the implementation of industrial policies that promoted sectors such as steel, consumer electronics and cars. The Japanese government played a significant role in this growth through its partnership with the business sector, guiding the economy with policies that favoured exports and supported key industries. Japan had emerged as a major global economic power and, in 1968, became the world’s second-largest economy.

In the 1980s, Japan’s economy saw asset prices rise to unsustainable levels, fuelled by excessive lending and inflated real estate and stock market prices. The Nikkei 225 reached its all-time high on 29 December 1989, at the peak of the Japanese asset price bubble. On that day, the index closed at 38,957. The bubble then burst in the early 1990s, which led to a long period of economic stagnation. The Nikkei finally dropped below 8,000 in 2003.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Core and satellite funds for a £100K ISA portfolio

In 2012, Prime Minister Shinzo Abe introduced a set of economic policies known as “Abenomics”, aimed at combating deflation and stimulating economic growth. These policies were based on “three arrows”: aggressive monetary easing, fiscal stimulus and structural reforms to promote long-term growth. While Abenomics helped improve economic indicators, the overall assessment of its success has been mixed. However, the Nikkei 225 did grow from around 10,000 in 2012 to nearly 24,000 at the beginning of 2020.

In October 2021, Fumio Kishida took over as prime minister. He has built on the foundations laid by Abe, particularly in areas such as monetary easing and support for key industries, but is also focused on economic security, digital transformation and addressing income disparity.

In the past few weeks, we have seen the Nikkei 225 climb back above 38,000, but it has still not set a new all-time high. Is it now about to go on and set some new records?

Although there are plenty of funds that have done better over the full three-year period, the two Japanese funds we highlighted earlier have been among the most consistent. If the Japanese economy continues to recover, then they could continue to perform well. We will be watching them closely.

Data source: Morningstar. Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.