UK equities are the Millwall of markets, but fortunes can change

Thomas Becket assesses the UK’s unloved equities market and its future, as the Brexit debacle rumbles…

27th November 2019 12:37

Thomas Becket assesses the UK’s unloved equities market and its future, as the Brexit debacle rumbles on.

Many football fans of a certain age will remember the ‘knee-trembling’ experience of heading down to the Old Den, Millwall’s former football ground. My first experience there was shortly before they closed it down to move to the slightly less terrifying New Den to watch my team, Watford, suffer a characteristic hammering in February 1993. Walking up the suitably named Cold Blow Lane to the away end, and hearing the famous “No one likes us, we don’t care” from the Millwall faithful, will last long in the memory. The football was less memorable.

- Podcast: Election 2019, gold, and 10 funds for children

UK equities - the big attraction

What has this got to do with investing in UK equities? Well, it is my view that the UK equity market has become the Millwall of global asset markets – “no one likes us” and international investors just don’t care. It is clear from international fund flows and leading investment houses’ positioning that international investors have basically given up on the UK. With the UK equity market now only equating to just 5% of total global equity capitalisation, it has been an easy (and until recently right) decision to make.

Investing in the past is very easy; looking forward is harder – but that’s what matters to investors. So is there a case to be made for investing in the UK and in UK dividend-paying stocks, aside from purely to be contrarian?

Certainly, the valuations of UK equities are cheaper than those of their global peers, even if they are not an obvious steal. But the neverending saga of the UK’s departure from the European Union has created a ‘Brexit discount’ that should reward investors over the long term. It is certainly hard to argue that UK equities are expensive, even if some of the more obvious growth companies and certain dividend-paying stocks have benefited from the collapse in global interest rate expectations.

The key attraction to UK equities is that there are significantly higher dividends on offer from UK-listed companies than there are in other global indices. Based upon analysts’ projections for dividend growth next year (and taking a discount due to potential dividend cuts in a slower global growth environment), one can assume a yield of around 4.5% from the FTSE 100, a significant uplift on the yields that one might achieve from investing in the US or Japan. The yield from UK equities is also comfortably higher than those on offerfrom Europe and most emerging markets, where the risks are in any case comparatively high relative to investing in the UK.

Of course, the big factor working against investing in the UK has been the understandable concerns over the shambolic handling of our departure from the EU. The question that investors have to ask themselves is whether they think the UK will be permanently impaired by any lingering effects of Brexit.

My take is that eventually the clouds will lift, and the UK will grow modestly in the future, but economically it will be in a similar position to where it would have been without a decision to leave the EU. Supply chains will be modified, people will still want to invest in the UK and eventually all this nonsense will be forgotten. Our markets will recover to trade in line with global peers and our currency should appreciate.

Yields well ahead of the wider sector

Playing at home again

If the currency does start to appreciate then investors might be surprised to see some of their success of the past few years dissipate. Indeed, UK investors have had a particularly easy time of it in the past three years as the value of their international assets has risen as the pound has weakened.

Our view is that this trend could well reverse in the future, which is why we have moved UK equities back to neutral in our portfolios and reduced our exposure to international assets.

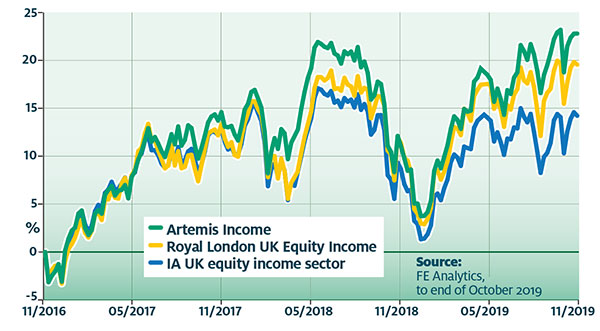

If investors are thinking of ditching their support for Liverpool and backing Millwall, so to speak, then we would suggest that the Royal London UK Equity Income and Artemis Income funds are excellent ways to invest in the UK equity market and achieve a healthy yield. Two decades ago, people would have scoffed at Manchester City winning the league as they floundered in the old second division. So why not Millwall?

Thomas Becket is chief investment officer of Psigma Investment Management.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.