UK funds have wind in their sails

Since US President Donald Trump announced a 90-day suspension on tariffs, stock markets have started to recover, with some UK funds up more than 10% over the past four weeks.

12th May 2025 14:51

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

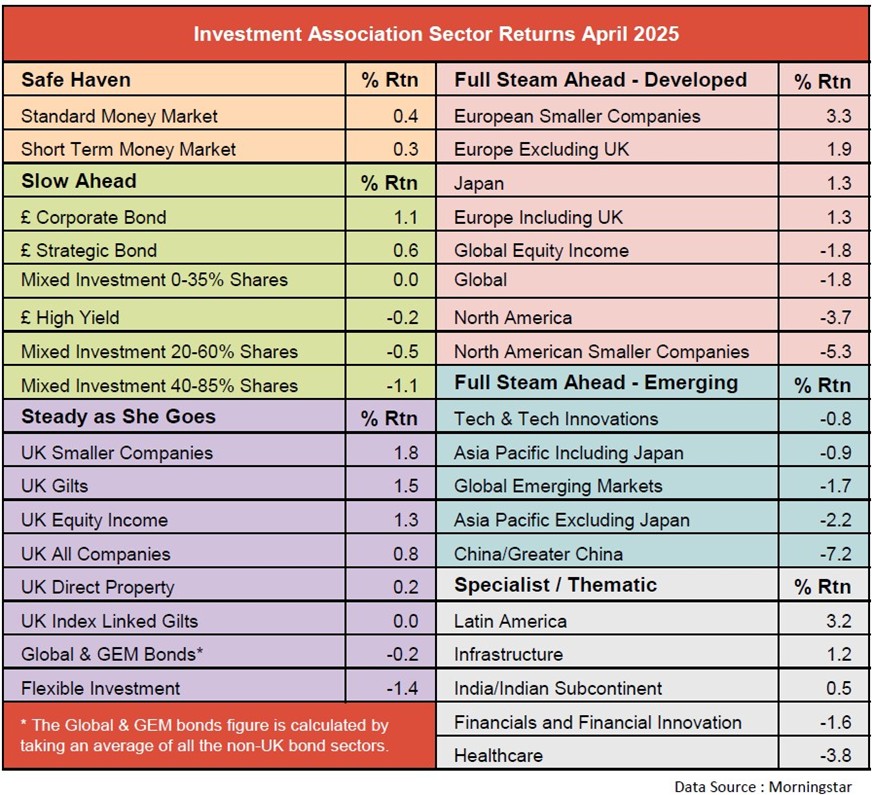

At the beginning of last month, stock markets around the world fell sharply following Donald Trump’s ‘Liberation Day’ tariff announcement. This was clearly reflected in our sector analysis. Between the first and the fourth of April, nearly all of the Investment Association sectors went down. The only exceptions were the money market funds and a few of the bond funds. The best-performing sector was Euro Government Bond, which had risen by 2.3%.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

At the other end of the spectrum, the Financial & Financial Innovation sector had dropped by -9.2%, while the Technology & Technology Innovation and North American Smaller Companies sectors both lost -8.7%. The North America sector fell by -8.0%.

Although the US sectors suffered more than any other region, everywhere felt the impact to some extent. The Japan sector fell by -5.9%, and the three European sectors were down between -5.0% and -5.4%. Emerging market sectors were less affected, but China/Greater China still dropped by -3.0%, India/Indian Subcontinent lost -2.5%, and Latin America fell by -2.0%.

Closer to home, the UK Equity Income, UK All Companies, and UK Smaller Companies sectors lost -4.7%, -4.8%, and -4.9%, respectively.

On 9 April, a 90-day suspension of reciprocal tariffs was announced for countries that had not retaliated. Stock markets immediately started to recover. By the end of the month, half of the 34 sectors that we monitor each week were reporting gains.

The North American sectors were still showing losses, and any sectors heavily weighted towards the US were also struggling. However, it was encouraging to see the European, Japanese, Indian and Latin American sectors making gains.

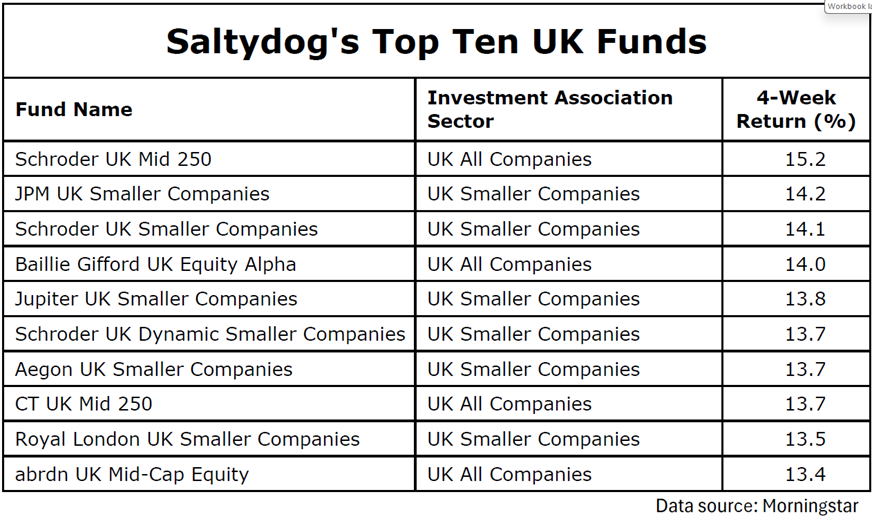

The three UK equity sectors (UK Equity Income, UK All Companies, and UK Smaller Companies) all ended the month in positive territory and have made further gains in May. So far this month, the UK Equity Income sector has edged up 1.9%, while the UK All Companies sector has risen by 3.0%. Ahead of both is the UK Smaller Companies sector, which has notched up a month-to-date gain of 4.0%.

- Investment outlook as US/China force world to pick sides

- Ian Cowie: four ways to tap into a potential trade war winner

Looking over the last four weeks, some of the funds from these sectors certainly seem to have the wind in their sails. Here are our top ten.

Last week, there was some more good news which could help UK funds.

On Thursday, the Bank of England announced that it was cutting the base interest rate from 4.50% to 4.25%, the lowest rate since May 2023. The Monetary Policy Committee (MPC) voted 5–4 in favour, with some members preferring an even larger cut to 4.0%.

The main reasons for the rate cut were slowing UK economic growth, concerns over global trade tensions (including the impact of recent US tariff policies), and easing inflationary pressures.

Inflation, measured by the Consumer Price Index (CPI), has fallen significantly from its peak of over 11% in 2022. The latest official figures show CPI inflation was 2.6% in the 12 months to March 2025, down from 2.8% in February and lower than expected. Despite this recent decrease, inflation is expected to rise in the third quarter of 2025, due to higher energy prices, but then fall back toward the Bank’s 2% target.

- Gold's in a bull market - will it last?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Later the same day, the US and UK unveiled the broad outlines of a trade agreement. It is the first US trade deal agreed since the ‘Liberation Day’ tariffs, and is seen as a significant but limited step forward in post-Brexit trade relations between the two countries. The agreement, termed an "Economic Prosperity Deal," rolls back some of the steep tariffs imposed by the US in March and April. This provides important relief to key UK industries, particularly car manufacturing and steel.

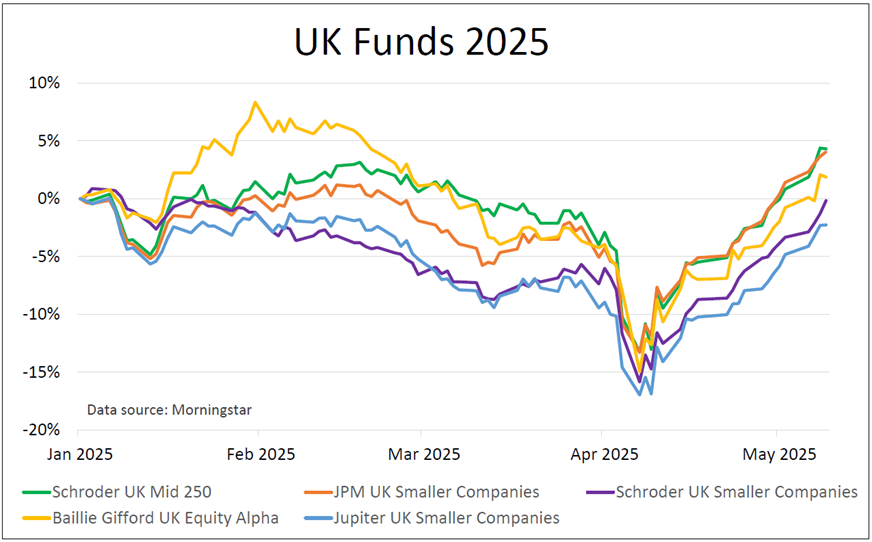

Looking at a graph of the top five funds from the table above, it is clear that they have all followed similar, though not identical, trajectories.

All of these funds went down for the first couple of weeks of January, but then rallied. While the length and magnitude of their recovery varied, by the end of February they were all heading back down again. They suffered significant falls at the start of April. Since then, they have risen steadily, and some are now showing year-to-date gains.

We will be watching them closely to see if this upward momentum continues.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.