UK income stocks to buy, hold and sell

Callum Abbot tells us about the shares he has been buying and selling recently.

25th April 2019 09:59

by Tom Bailey from interactive investor

Callum Abbot, co-manager of JPMorgan Claverhouse Investment Trust, tells us about the shares he has been buying and selling recently.

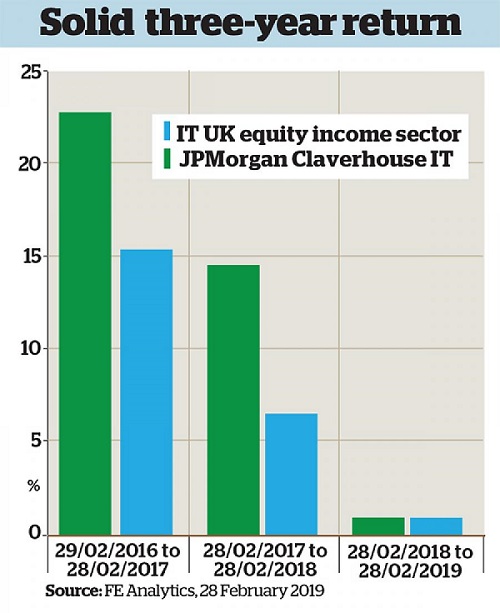

JPMorgan Claverhouse (LSE:JCH), in the UK equity income sector, has managed to increase its dividend for 46 years in a row. That is one of the longest periods on record for a pure UK equity trust, says the trust's co-manager, Callum Abbot. It would be wrong, however, to think of Claverhouse as purely an income-focused trust. "We look for cheapness, quality and price momentum," says Abbot.

Being an investment trust, Claverhouse is able to hold back reserves to pay income. The trust currently has enough reserves to pay a year's worth of dividends. Abbot points out that this means the trust can afford to buy low-yielding stocks without ending its commitment to increase dividends. "We can position the portfolio however we like, confident that we can increase the trust's income stream," he says.

The trust should be viewed as medium risk, Abbot suggests. With its portfolio of 60 stocks (it ranges between 60 and 80), it has enough diversification "to not get completely blown off course". It has produced a three-year return of 41.1% to date (end February).

Buy: Unite Group

(LON: UTG)

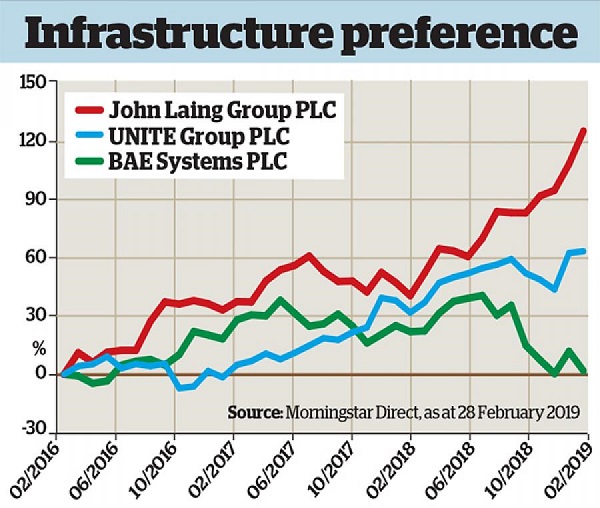

Claverhouse bought into Unite Group (LSE:UTG), a real estate investment trust (REIT) that focuses on student accommodation, in November last year. The Reit oversees around 50,000 beds available to students through a mix of partnerships with universities and its own private student accommodation.

The university partnerships, an area where Unite is currently expanding, provide guaranteed income. "The universities guarantee to fill beds," says Abbot. "Right now Unite is looking to do more partnerships with universities." Universities in turn are attracted to working with Unite, says Abbot, because good accommodation attracts good students.

The main risk to growth in the student accommodation sector in the UK at the moment is Brexit. However, Abbot is not worried. He notes that university enrolment remains high, while just 2% of residents in Unite accommodation are EU nationals. Meanwhile, he says, "the portfolio is biased towards top-end universities". Demand for such universities is likely to remain stable.

Hold: John Laing Group

(LON: JLG)

"This is an infrastructure play," says Abbot. John Laing Group (LSE:JLG) oversees the building of a variety of infrastructure projects, including intercity railway lines, roads, hospital buildings and schools. These projects are then sold off to the secondary market once complete. Abbot notes that the secondary market for such projects is strong. "There is lots of demand for these kinds of assets," he says. Pension funds, for instance, have been big purchasers.

While John Laing's assets are UK-heavy, recently it has been increasing its geographical diversification, with project numbers growing in the US and Australia. Another growth driver, says Abbot, is its involvement in renewable energy infrastructure projects. "There is a long-term growth driver there," he says.

Since John Laing's initial public offering in March 2015, the company has grown its net asset value by 14% a year. Claverhouse first purchased shares in April 2015, one month after the firm's IPO.

Despite the strong returns, the company is a hold because Claverhouse already has a sizeable position and because John Laing now trades at a small premium, up from the discount it used to trade on. "That's the result of consistent and proven execution," says Abbot. "But for us, while we are not looking to sell, it is not as cheap as it has been."

Sell: BAE Systems

(LON: BA)

"There was nothing disastrous, here" comments Abbot. However, Claverhouse's managers decided to sell the trust's holding in BAE Systems (LSE:BA.).

Being a weapons manufacturer, BAE is reliant for profits on the budget sizes of the world's military powers. Around 2011 the US started cutting its military budget. However, then a number of geopolitical factors "created a better environment" for military spending and the US budget started to increase again. "That’s why we were in the stock," Abbot says. Subsequently, however, valuations have become less attractive. Abbot doubts the US will increase its military budget by much now, as it has recently hiked it a number of times.

Other customers also face military spending cuts. He says: "In the UK the budget is tied to GDP. If we see weaker GDP due to Brexit, that will affect the budget." Meanwhile, there is some risk associated with the potential for a Labour government led by Jeremy Corbyn to come to power.

Elsewhere, Saudi Arabia, which accounts for 17% of BAE's sales, has come to be seen in a more negative light recently, leading to increased scrutiny of arms sales to it by western countries, although Abbot notes that "whether this will have any impact remains to be seen".

One final reason why Claverhouse sold its Abbot holding is that BAE may see its cash flows squeezed. A number of its development programmes have not worked out well, so the company will need to increase its investment. This will erode margins. Abbot sold BAE in November 2018.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.