The US economy and its big companies are soaring

4th August 2021 10:48

by Rodney Hobson from interactive investor

Our columnist examines some of America’s biggest corporate names as they seek to put the pandemic behind them.

From the depths to the heights, the US economy soared in the past 12 months.

The second quarter of last year was the worst for most companies around the globe, but the American economy in particular has bounced back and is now larger than it was before the pandemic.

The US government’s $1.9 trillion (£1.4 trillion) stimulus package has boosted consumer spending and output overall grew by 6.5% between April and June after a 6.4% gain in the first quarter.

That momentum, probably at a somewhat slower pace given that the Federal Reserve is shaping up to reduce its economic support, is predicted to continue for the rest of 2021, making US stocks look especially attractive.

- US results season forecasts and latest trades

- A top fund that loves these dull and boring stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

However, investors perusing the latest batch of American company results should remember that they ought to be impressive. Companies that fail to show hefty growth at this stage should be treated with some caution.

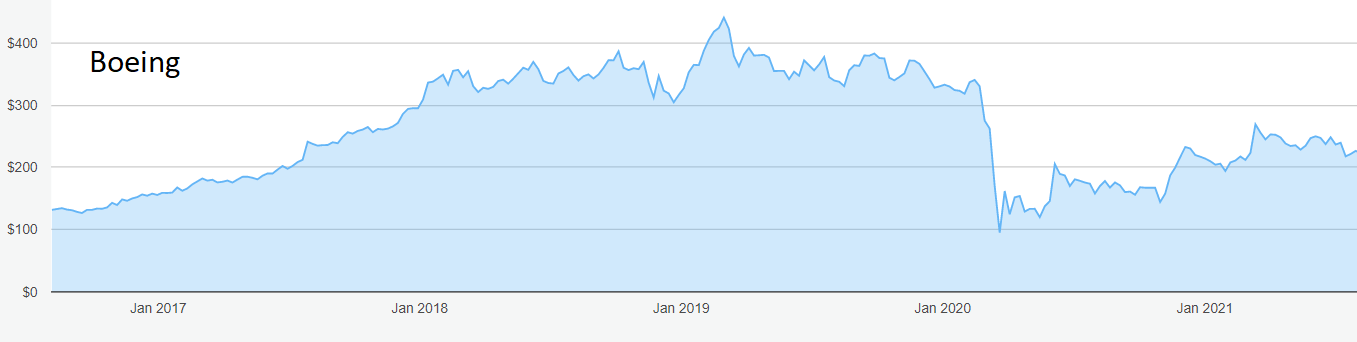

Few companies have been as badly affected by the pandemic than aircraft maker Boeing (NYSE:BA). Orders for its 737 Max jets, the aircraft its future depends on, were suspended or cancelled as models already in service were grounded by technical faults after two fatal crashes.

The Chicago-based company plunged into losses, with an operating loss of $3.3 billion recorded in the second quarter of 2020. The shares crashed too, from $340 to $95 in the space of one month.

Source: interactive investor. Past performance is not a guide to future performance

Now, however, sales of the 737 Max are picking up quickly. The safety ban was withdrawn last November and Boeing is building 16 a month with a target of 31 a month by early next year.

This has still left the commercial aircraft division running at a loss of $472 million in the second quarter of this year, but it means the group as a whole, including the defence and services divisions, is back to making an operating for the first time in two years at $755 million. Revenue rose 44% in the quarter to $17 billion.

The shares have rebounded to around $225, some way short of the $440 peak set in March 2019.

The worst is certainly over but with no prospect of a dividend in the foreseeable future and some hefty losses to make up for, the current share price looks quite high enough for now, especially as the forecast for commercial aircraft sales depends on business and holiday travellers flocking back to the skies.

- Should investors prepare for an autumn market correction?

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

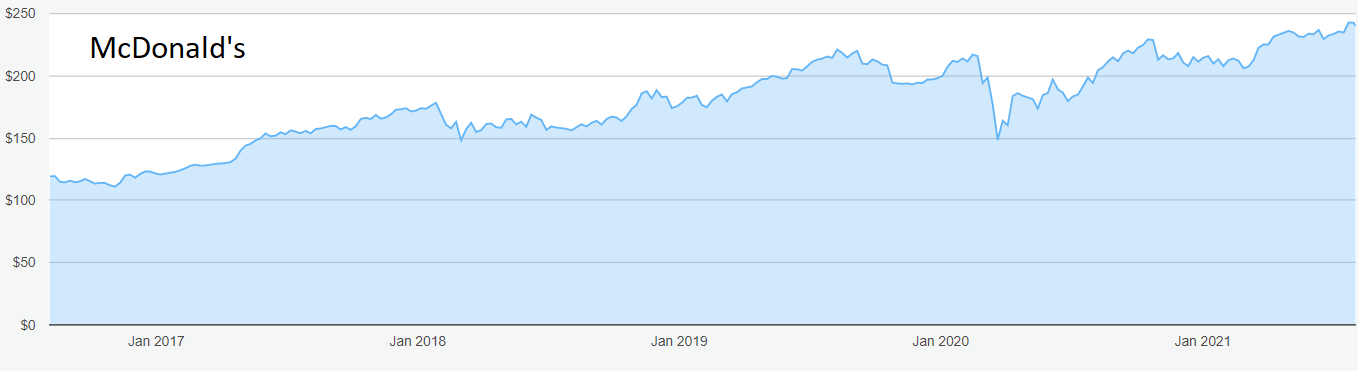

Restaurant chain McDonald's (NYSE:MCD) rode the consumer wave to report a 40.5% leap in like-for-like sales with total revenue, including new store openings as pandemic restrictions eased worldwide, up 57%.

That beat expectations and it enabled McDonald’s to raise its forecast for the full year.

Sales are now 7% ahead of the second quarter if 2019, which presents a fairer though tougher comparison than with the closure-hit second quarter of 2020.

McDonald’s always seems to produce some new bestseller out of the hat to keep the sales momentum rolling and the current favourite is the crisp chicken sandwich. Despite accusations that it serves up junk food, the chain has secured a number of celebrity endorsements.

Despite the appealing figures, the shares immediately ran into profit-taking at $246 and have slipped to around $237, where they offer a yield of 2.1% and look decent value.

Those who took my original advice to buy when the stock was below $200 are still ahead. I repeat my view, expressed in June, that it is still worth getting in below $237 if you have the chance.

Source: interactive investor. Past performance is not a guide to future performance

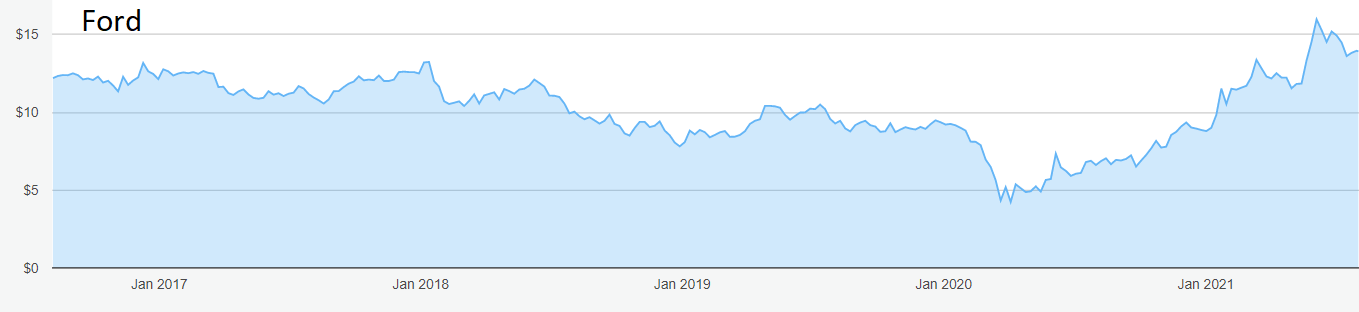

Extra consumer spending is only just starting to filter through to the motor industry but even so Ford Motor (NYSE:F) surprised on the upside in the second quarter.

Instead of producing a small loss as expected it turned in a modest profit equal to 13 cents a share on revenue up 45.1% year on year. Ford raised its earnings guidance for the second half.

How the sector fares for the rest of 2021 depends heavily on two factors: the shortage of computer chips and the roll-out of electric vehicles.

Ford believes the chips shortage will ease from now on. Catching up with the electric vehicle leaders will take longer but the successful launch of the all-electric F-150 truck will go some way to closing the gap.

Orders stand at 120,000, even better than the 80,000 reservations for the Ford Maverick hybrid pick-up.

Ford shares bottomed at $4.29 in March last year but they recovered strongly to just shy of $16 a couple of months ago.

A subsequent retreat to $14 looks a lot more realistic. There is a long road ahead in a highly competitive sector.

Source: interactive investor. Past performance is not a guide to future performance

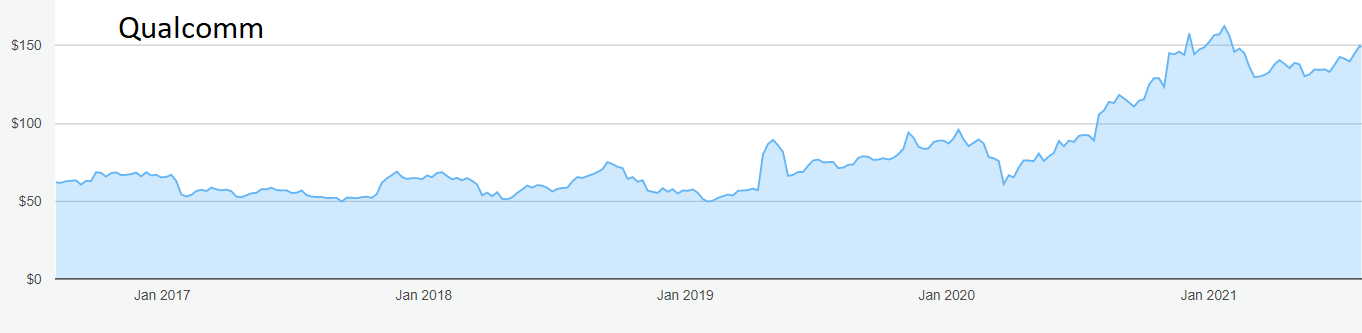

Another company to surprise on the upside was chipmakerQualcomm Inc (NASDAQ:QCOM).

Based in San Diego, its April-June earnings more than doubled to more than $2 billion, equal to $1.92 a share against expectations of no more than $1.70. Sales of just over $8 billion, an improvement of 65%, were also better than analysts had forecast.

Qualcomm has found itself clashing with the mighty Apple (NASDAQ:AAPL), a major customer, but demand will ensure that sales of its chips for use in 5G telecoms will grow. Apple uses Qualcomm’s Snapdragon chips in its iPhones and will continue to do so.

- Income seekers will love this company’s dividend history

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

Qualcomm holds an extensive portfolio of patents for mobile phone devices that will secure its prominence in the industry.

The shares rose steadily from $60 in March last year to just over $160 in January but have come off the boil of late. Although the yield is only 1.8%, Qualcomm is a company for the future and the shares should edge up to new highs later this year. Worth a look below $150.

Source: interactive investor. Past performance is not a guide to future performance

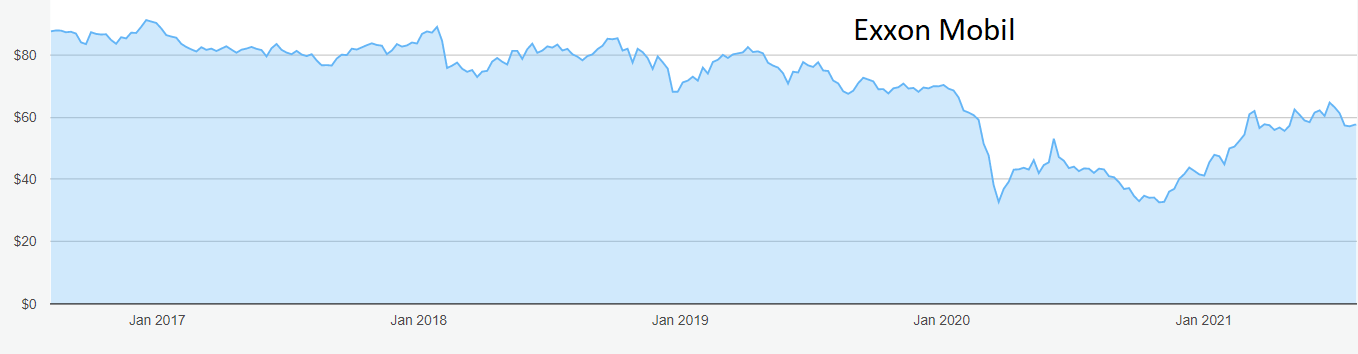

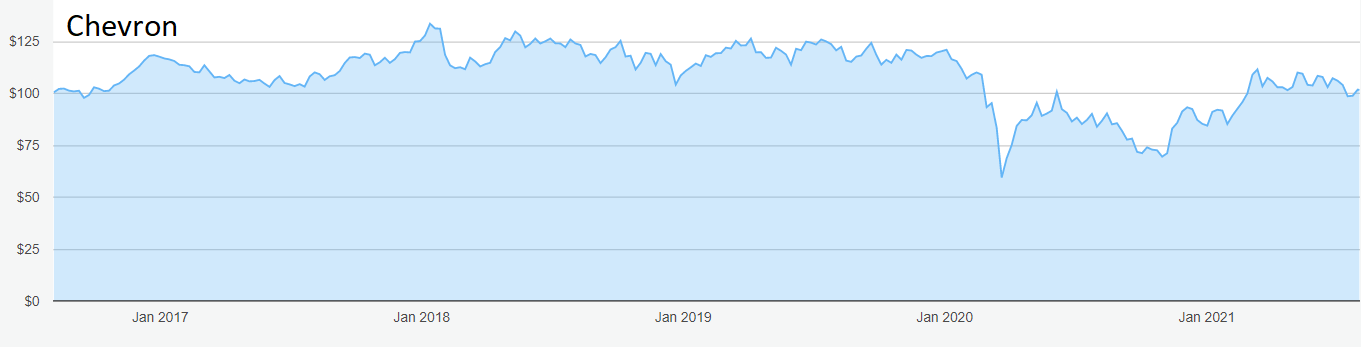

Despite all the warnings about fossil fuels and global warning, oil majors Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) both beat expectations in the second quarter as crude prices rose.

Exxon swung to a profit of $1.10 a share as revenue more than doubled to nearly $68 billion despite a slight fall in crude production.

Source: interactive investor. Past performance is not a guide to future performance

Chevron, like Exxon, made a loss in the previous April-June quarter but its profit this time was $1.71 a share on revenue 179% ahead at $37.6 billion.

Source: interactive investor. Past performance is not a guide to future performance

If you take out the distortions to the share price charts caused by the pandemic, the trend for both companies is one of slow but sure decline.

A programme of share buybacks announced by Chevron, amounting to $2-3 billion a year, may not be enough to reverse this downward momentum.

While the immediate future should see further short-term recovery, this is an industry whose basic product is on the way out and transforming the major players accordingly will be expensive and painful.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.