Value investors, did you check the price tag?

Laura Foll of Lowland Investment Company on why starting points matter for value investors.

22nd January 2020 10:25

by Laura Foll from ii contributor

Laura Foll of Lowland Investment Company on why starting points matter for value investors.

It will come as no surprise that ‘value’ investing has underperformed in recent years. A quick look at the top performers in the FTSE 100 index year to date confirms this: the top three performers are JD Sports (LSE:JD.), AVEVA (LSE:AVV) and London Stock Exchange (LSE:LSE).

All three are good companies that are growing earnings at double-digit rates; but all are on a high valuation (versus both the UK market and their own history) and would pay little in the form of a dividend.

The trend of ‘growth’ stocks outperforming is clearly evident in the market as a whole. The table below demonstrates that during the last year, a company needed to have a historic price/earnings ratio averaging above 18 times in order to beat the FTSE All-Share total return of 2.7%. This has created a difficult environment for income funds and those with a valuation-focused investment approach.

| Total return (%) | |

|---|---|

| FTSE All-Share | 2.7 |

| PE range >27.9 | 11.7 |

| PE range 18.0 - 27.8 | 9.4 |

| PE range 12.6 - 18.0 | -4.1 |

| PE range 8.7 - 12.6 | 0.3 |

| PE range <8.7 | -0.4 |

Source: Factset. 28 September 2018 to 30 September 2019. 12-month historic price/earnings ratio.

The natural question that follows from this is: what if lower-valuation companies are, in reality, value traps that will perpetually underperform? I think the best way to address this is to look back at history, which suggests overwhelmingly that the starting point matters for value investors.

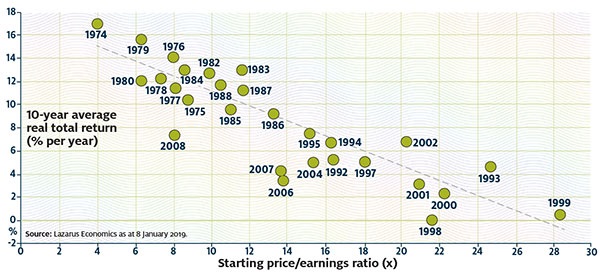

The chart below looks at the period 1974 to 2009, taking the average PE each year and charting it against the real average annual return 10 years on. Each year is a dot on the chart. The worst returns came from investing during the tech bubble – if you had invested in the market on an average PE of 28 times in 1999 you would have generated roughly 0% real return over the next 10 years – hardly compelling. However, if you are starting on a PE of 11 times, the returns have (on average, historically) been attractive and comfortably out-paced inflation.

Investing during tech bubble saw worst returns

The chart captures the ‘rating risk’ of high-valuation companies when they hit (as most do) a bump in the road in terms of their growth. This is a risk that I think is currently under-appreciated in the market.

Is cyclical exposure too risky?

I am sometimes asked by investors whether the Lowland portfolio is too risky, as it has approximately one quarter of the portfolio held in industrial companies, and another 35% in financial companies. These companies, although in reality all quite different and following different cycles, are very broadly ‘cyclical’ in their exposure and are therefore exposed to trade wars, etc.

However, this cyclical risk needs to be weighed up against the valuation risk present in other areas of the market. A consumer goods company may have less cyclical risk than an industrial company, but more valuation risk.

Which is the more risky investment? In my view, the valuation risk of some higher-valuation companies in the market is currently being under-appreciated. This is evident when one of the higher-valued ‘growth’ companies disappoints on earnings: the market response is swift (and brutal).

One note of caution: while we as fund managers are focused on valuation levels when selecting investments for the portfolio, what we are absolutely not advocating is indiscriminately buying any company with a low starting valuation.

There will always be value traps; if anything, the number of value traps is increasing as business models are swiftly disrupted by, for example, online competition.

Our job as value investors is to try and avoid them. We think the best way to do this is to select companies that are genuinely growing both sales and earnings. A company that looks flat in terms of its earnings trajectory is more likely than not in decline. Therefore, while we think history is a good indicator that starting points matter, there is, as ever, a need to be selective.

Laura Foll is co-manager of Lowland Investment Company.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.