Vanguard vs BlackRock: Which of the passive fund titans wins?

We size up Vanguard's LifeStrategy passive funds versus BlackRock's MyMap range.

1st November 2019 15:43

by David Prosser from interactive investor

Sizing up Vanguard's LifeStrategy passive funds versus BlackRock's MyMap range, we assess the offerings from two investment giants.

Vanguard's LifeStrategy passive fund range has built up close to £16 billion of assets under management since its launch in the UK just eight years ago. It seems remarkable that no other fund manager has sought to capture a slice of what is obviously a lucrative market with a rival product.

Until now, that is. BlackRock's (NYSE:BLK) launch of the MyMap range of funds earlier this year represents a direct challenge to Vanguard. Like LifeStrategy, the MyMap range offers investors a choice of multi-asset funds of funds to suit different attitudes to risk.

Built on underlying portfolios of passive products and featuring bargain-basement prices, both ranges are intended to appeal to those seeking a one-stop shop for their investment needs, or possibly a core holding to which more adventurous holdings can be added later.

So does MyMap represent a killer blow to LifeStrategy's dominance, or will it be crushed underfoot by the mighty Vanguard machine?

Cost

Cost competitiveness lies at the heart of MyMap's pitch to investors as a challenger to LifeStrategy. The BlackRock funds are each priced with an ongoing charges figure (OCF) of 0.17% a year, significantly below Vanguard's 0.22%. In fairness, both managers are entitled to describe their ranges as low-cost – though there are cheaper passive funds out there – but MyMap has the edge on pricing.

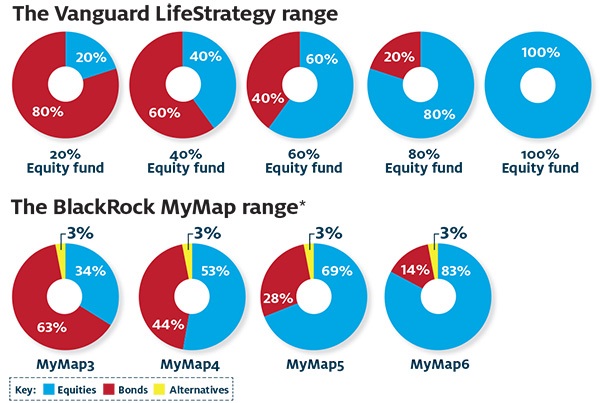

Fund range

With five funds to choose from at Vanguard compared to only four at BlackRock, LifeStrategy is able to offer a broader choice of potential asset allocations, including a pure equity fund and an option comprising 80% bonds. The range of allocations at MyMap, by contrast, is more compressed, which may be less appealing to both the most risk-averse and the most adventurous investors.

Fund allocations compared

Note: *MyMap expected asset allocations on day one and subject to change over time

Investment process

The big difference between LifeStrategy and MyMap is that while the former's asset allocations are more or less set in stone, the latter's will shift over time.

Vanguard's fixed approach to asset allocation makes it a pure passive play, but this does mean both fund performance and volatility will vary and are beyond its control. By contrast, BlackRock is aiming to deliver fixed levels of volatility (rising through the range); its portfolio managers will tweak each fund's asset allocations to hit these targets. They also have access to alternative assets, notably commodities and real estate, to help them stay within their agreed volatility parameters. In this sense, MyMap is a more actively curated investment product.

Neither approach is necessarily better or worse. With Vanguard, you're accepting the volatility and the returns delivered by the asset allocation model you opt for; with BlackRock, you're taking a gamble on the managers' ability to hit their volatility targets.

Another way to think about the contrast is that with LifeStrategy, you're depending on asset allocation to manage volatility and therefore deliver a reasonable total return over the medium to long term. This has worked well to date, but the funds have only operated during a bull market for both bonds and equities. Returns from MyMap, by contrast, will depend on manager skill; and for now, of course, there is no track record to judge such skill by.

Structure

LifeStrategy delivers its asset allocation models by investing across its range of passive funds – and does so largely on the basis of relative market size. The equity portion of each fund therefore includes significant investments in Vanguard index trackers offering exposure to overseas markets, especially the US. The same is true in the bond portion.

However, there is a slight twist here. Vanguard has taken the view that UK investors will want more exposure to UK assets than the relative size of the UK equity and bond markets should in theory dictate. It therefore overweights these markets three times over as it maps asset allocation to fund holdings.

MyMap operates a little differently, though it too uses its own range of passive funds - the iShares ETF range - to deliver its chosen asset allocation. Its managers must decide for themselves which of those ETFs will deliver its volatility targets. Again, the choice here is between the more active approach taken by MyMap and the largely passive stance of LifeStrategy. Can BlackRock's managers add value?

Suitability

The LifeStrategy fund range has proved popular with investors and advisers looking for a basic investment option – very often, it represents an investor's first venture beyond cash holdings. For beginners, simplicity and transparency are particularly valuable attributes, and LifeStrategy delivers well on both: you can see what you're getting and it's pretty straightforward to get your head round.

MyMap is clearly fishing in the same pool for investors. However, its blend of passive and active techniques makes it a more complicated and opaque product.

What the experts think

While MyMap's cost advantage is clear, our panel of investment advisers argue that the real battleground as it takes on LifeStrategy will be the debate about whether its more active approach is the right option.

Martin Bamford, the managing director of Informed Choice, certainly thinks BlackRock can make some inroads. "It would take some doing to steal a march on Vanguard, given how well-established it has become in the UK market, but an active overlay using passive vehicles would appeal to a lot of advisers," he argues.

Jason Hollands, the managing director of Tilney Investment Management, takes a very similar view. "Personally, I think wholly passive solutions have real limitations; no single approach is a panacea and investors are very exposed in the event of a bear market, though I do appreciate many investors are happy to take such an approach," he argues.

"Were I choosing between the two, the BlackRock range would edge it due to its wider diversity, greater flexibility and lower costs."

Elsewhere, Adrian Lowcock, head of personal investing at Willis Owen, says he can see the two fund ranges appealing to slightly different niches. "The LifeStrategy funds are cheap and fairly simple to explain," he says.

"The MyMap funds would appeal to advisers with clients looking to get something extra from their investments, as well as offering a solution which competes with the robo-advisers that actively manage passive portfolios."

Finally, Darius McDermott, the managing director of fund research company Fund Calibre, argues that the untested nature of the MyMap range may be less of a problem than some anticipate, given BlackRock's pedigree. He says:

"The company is very big in passives - like Vanguard - and there is no reason why the MyMap funds shouldn't be as good as any in this low-cost space."

The verdict

BlackRock's MyMap has so far been slow to pick up support, raising only a few tens of millions of pounds since its launch in April. Nevertheless, additional competition in what is a large market for investors seeking easy-to-understand, low-cost and one-size-fits-all investment products is to be welcomed. Vanguard may yet be forced to cut the fees on its LifeStrategy range.

However, the more active approach built into MyMap will unnerve some investors, particularly in the absence of any performance track record for the funds. The theory is good and independent financial advisers, traditionally sceptical about passive management, are attracted to MyMap's greater sophistication; they like the active overlay. For investors seeking simplicity, however, LifeStrategy's purer passive approach will continue to appeal.

Pros and cons

Vanguard Life Strategy

Advantages

- Low-cost, at 0.22% a year

- Simple, transparent product

- Strong performance track record

- Good fund choice

Disadvantages

- More expensive than MyMap

- Fixed asset allocation takes no account of market conditions

- Only offers exposure to equities and bonds

BlackRock MyMap

Advantages

- Even cheaper than LifeStrategy, at 0.17% a year

- BlackRock has strong track record and impressive resources

- More active approach may pay off in challenging market conditions

- Broader exposure to different asset classes

Disadvantages

- More complicated and less transparent than Vanguard

- Slightly narrower asset allocation parameters with fewer fund options

- Active approach may disappoint; no track record for new fund

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.