The week ahead: Vodafone, ITV, BT

20th July 2018 14:54

by Lee Wild from interactive investor

Results season hots up next week, with plenty of big names making their latest numbers public. There are enough potential catalysts here to make the next few days very interesting indeed, writes Lee Wild.

Monday 23 July

Trading Statements

Paragon Banking Group, Marston's, Microgen, Ascential, Tungsten Corporation

AGM/EGM

Global Resources Investment Trust, Active Energy, Ethernity Networks

Tuesday 24 July

Trading Statements

Britvic, Hammerson, Drax Group, Unite Group, Spectris, Science Group, Gresham Technologies, PZ Cussons, Highlands Natural Resources, IG Group, The Fulham Shore

AGM/EGM

Taptica International, 1Spatial, Motorpoint Group, Wizz Air Holdings, Halfords, Gresham House Strategic, EPE Special Opportunities

Wednesday 25 July

Vodafone

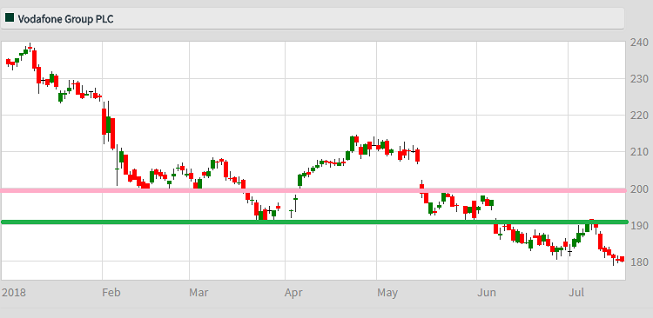

In just a couple of months, Vodafone chief executive Vittorio Colao hands over to current finance boss Nick Read who's been at the company for 17 years. Read is clearly talented and knows Vodafone inside out, but a change at the top for the first time in a decade has created some unease. Vodafone's share price has lost around 14% of its value since the announcement and is down 25% in 2018 so far at levels not seen since 2013.

There's an opportunity at these first quarter results to calm some nerves, but trading, especially in Europe, is super competitive, and there will be interest in progress in India where Vodafone is merging with local giant Idea Cellular.

Source: interactive investor Past performance is not a guide to future performance

Despite its issues, Vodafone expects net operating costs to drop for a third year in a row, underpinning further profit growth over the next 12 months. Expect more on the firm's 'Digital Vodafone' programme, too, where new technologies are being used to boost revenue and cut costs.

Trading on fair valuation multiples and offering a prospective dividend yield of 7.5%, Vodafone shares certainly look as attractive as they have down for some time.

ITV

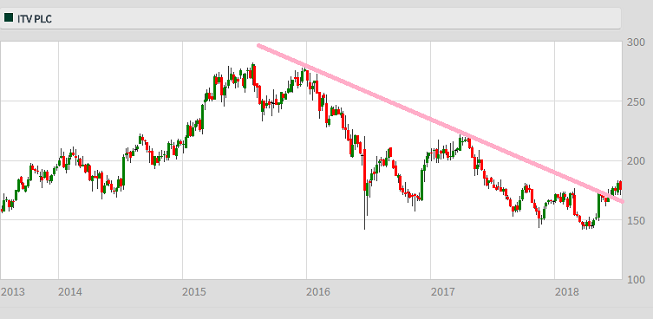

England's surprisingly long run in the World Cup this summer is great news for ITV and will have given a much-needed boost to its advertising coffers. Equally surprising is the popularity of another of ITV's shows, Love Island. ITV shares had halved from 270p a few years ago, but the World Cup effect has lifted them from 141p in April to a one-year high above 180p this month.

Source: interactive investor Past performance is not a guide to future performance

ITV total advertising is expected to be up 2% over the first half, although a chunk of profit from the World Cup will fall in to the second half given the knockout matches took place in July.

We're guaranteed another update on newish chief executive Carolyn McCall's ongoing 'strategic refresh'. ITV trades on a modest 11 times forward earnings and yields just under 5%, but the broader advertising market remains tough. Investors will demand evidence that things are improving.

Trading Statements

Victrex, Vodafone, Brewin Dolphin, 3i Group, Staffline, Indivior, Idox, Pentair, Tullow Oil, Rathbone Brothers, Primary Health Properties, ITV, IP Group, International Personal Finance, Informa, Croda International, Capital & Counties Properties, Wizz Air Holdings, Burford Capital, GlaxoSmithKline, Joules Group, Angle

AGM/EGM

Mediclinic International, Palace Capital, Norcros

Thursday 26 July

Trading statements

Tate & Lyle, Compass, PayPoint, Johnson Matthey, Intermediate Capital, Daily Mail and General Trust, CMC Markets, Morgan Advanced Materials, AstraZeneca, British American Tobacco, Telefonica, National Express, Bodycote, Royal Dutch Shell, Segro, Smith & Nephew, Schroders, Anglo American, RELX, Mandarin Oriental International, Temple Bar Investment Trust, Intu Properties, Dairy Farm International, Franchise Brands, GKN, Inchcape, Countrywide, Vesuvius, Mail.RU Group, Lancashire Holdings, UBM, Jardine Lloyd Thompson, Howden Joinery, Diageo, Renishaw, Sky

AGM/EGM

Weiss Korea Opportunity Fund, Avocet Mining, Intermediate Capital, Johnson Matthey, AVEVA

Friday 27 July

BT Group

There are some potentially exciting times ahead for BT Group under new leadership, but there's likely to be some trepidation until we get clarity over who will take over from Gavin Patterson. BT shares, which have collapsed from over 500p to around 200p in the space of three years, found plenty of buying support at around 200p, but a rally since has proved short-lived. It's asking a lot for first-quarter results to have sufficient content to break the shares out of their current downtrend.

Source: interactive investor Past performance is not a guide to future performance

Patterson has already announced the loss of 13,000 admin and middle management jobs and the hiring 6,000 staff in more relevant roles, including engineers to accelerate rollout of fibre broadband. That's common sense. Finding £1.5 billion of cost cuts and moving out of its expensive London HQ to focus on 30 fit-for-purpose hubs, is also the kind of action BT shareholders have wanted to see for years.

A new CEO may put some life back into the shares, but it will not be easy returning BT to former glories, and certainly will not be quick. However, if a new broom can at least put together a viable recovery plan, the market will give them time to make it work.

Despite its problems, BT shares are cheap and offer a dividend yield close to 7%, which is plenty compensation for execution risk linked to any turnaround.

Trading statements

CYBG, Greencoat UK Wind, Jardine Matheson, Hutchison China Meditech, BT Group, AIB Group, Jardine Strategic Holdings, Jupiter Fund Management, Reckitt Benckiser, Pearson, Rightmove

AGM/EGM

Emmerson, Vodafone, PowerHouse Energy, Nature Group, RedT Energy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.