What the upcoming US presidential election may mean for investors in US equities

The US presidential election is something to which investors should be paying close attention.

6th July 2020 10:10

by Tom Bailey from interactive investor

The US presidential election is something to which investors should be paying close attention.

Despite a global pandemic, an escalation of tensions with China and an outbreak of internal domestic disorder, the US has still managed to be the one of the best places to have your money parked for the first half of this year.

The S&P 500, measured from the start of the year, is currently only a few percentage points down. Within this broader market performance, the country’s big-name tech companies have had a particularly strong first half of the year. The US tech-heavy index, the Nasdaq Composite, for example, has managed to reach new highs.

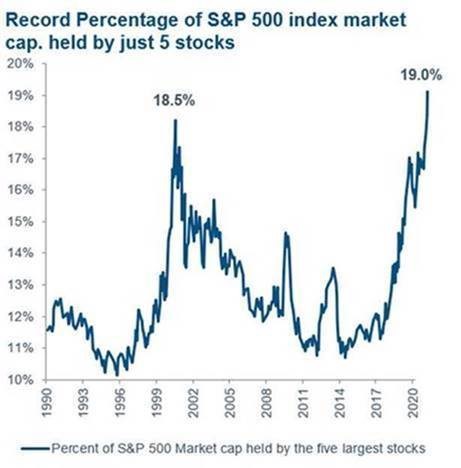

As data from Fidelity shows, the rally in the US market has principally been driven by the handful of mega-cap tech companies that increasingly account for a large percentage of the market index.

But what can we expect from the US market for the rest of the year?

According to Aditya Khowala, a portfolio manager at Fidelity International, the US presidential election is something to which investors should be paying close attention.

At the start of the year, the re-election strategy of President Trump seemed relatively simple: focus on the relative strength of the US economy. However, with the outbreak of Covid-19 and deep subsequent recession, that strategy is no longer viable, leading Trump to pursue other paths to winning November’s election.

According to Khowala, this new strategy has two parts. First, he says, there will be an attempt to re-escalate tensions with China.This will involve the resumption of the trade war and increased rhetoric against China in a bid to blame the country for the recession.

Khowala notes: “Recent opinion polls clearly show that the majority of Americans blame China for the global pandemic, which has given the Trump administration a perfect scapegoat.”

According to Khowala, there is already anecdotal evidence for this view, best shown by Trump’s recent and repeated references to the outbreak as a “China plague” and “Chinese flu”.

Khowala says: “It’s a strategy that appears to have worked so far for the administration, as the negative views of China continue to grow in the US. Relations between the world’s two biggest economies look set to get worse in the medium term.”

On top of that, there are numerous other sticking points between the US and China. There are reports that US trade representative Robert Lighthizer has been putting pressure on US companies to move their supply chains out of China. On top of that the US has been outspoken in its criticism of Beijing’s new national security law in Hong Kong.

We recently took a deeper look into the escalation of US and China tensions here.

The impact this will have on US equities is not clear. Markets in the US have usually reacted badly on news of escalating US and China tensions over the past two years. However, in each instance, markets have recovered fairly quickly. Broadly, the performance of the US economy has been positive since the outbreak of the trade war in 2018.

The second part of Trump’s campaign strategy, however, may prove more positive for US equities. According to Khowala, Trump will attempt to juice the economy as much as possible in the run up to the election. He notes: “Trump knows that simply blaming China will not be sufficient for him to win re-election, and that he also needs the economy to stage a strong rebound by November.”

A key part of getting the economy moving again will involve re-opening those businesses and sectors forced to temporarily close due to the pandemic. This, however, could backfire. As Khowala notes: “This move means the US economy should recover faster in the short term, but the risk of a second or third wave of infections also rises.”

Either way, however, the US economy is getting plenty of support from the US Federal Reserve. As Khowala notes: “the Fed has basically committed itself to unconventional policies like helicopter money and ‘quantitative easing ad infinitum’ in order to monetise debt.

"The Fed has indicated it plans to keep rates at zero until at least 2022 and appears to have prioritised a recovery in the job market over the risks of exacerbating asset price bubbles.”

Meanwhile, the US Congress, after some initial delay, has been generous in its fiscal support. Khowala says: “Fiscal taps have also been opened like never before, as some workers are even receiving unemployment benefits that are more than the wages they would receive if they returned to work. As a result, the household savings rate has shot up above 30%, which is the highest rate in at least 60 years."

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.