This is where fund managers think markets will peak

19th November 2018 16:22

by Tom Bailey from interactive investor

Confident following October's big sell-off, Tom Bailey reveals how long fund managers believe the good times could roll.

One in three fund managers think the US market has peaked, according to Bank of America Merrill Lynch's monthly Global Fund Manager Survey. However, for the most part, fund managers surveyed seemed more concerned about worsening global conditions than the US.

First, a total of 44% of fund managers expect global growth to slow over the next 12 months, the most bearish outlook for the global economy since November 2008.

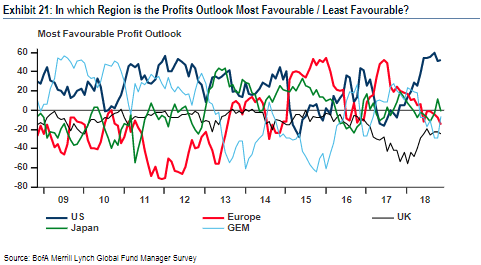

Meanwhile, the outlook for US profits was the most positive compared to other regions, with 65% citing the region's outlook as 'most favourable.'

The comparatively positive outlook for the US can also been seen by regional equity allocation. Fund manager's allocation to the US climbed by 10% over the month, leading to asset managers having been net 14% overweight. As a result, the US regained its position as the most favoured region for equities.

At the same time, the biggest risks cited by fund managers are those likely to weigh most heavily on emerging market and other non-US equities.

For instance, for the sixth time in a row, fund managers cited the trade war as their biggest concern. The trade war has, in part, caused the poor performance of equities in emerging market and Asia-Pacific economies.

Next on the list was monetary policy tightening. As the sell-off in October showed, tightening from the Federal Reserve is a key risk to US equity markets. However, Federal Reserve policy has wreaked much greater havoc on emerging markets, with rate rises strengthening the dollar.

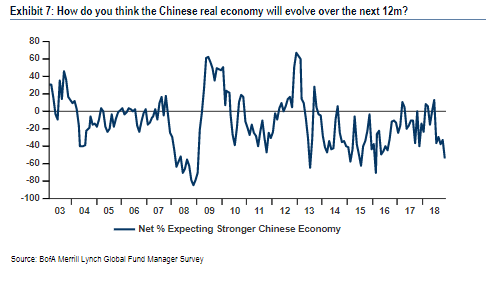

Also, high on investor's radar was the slowdown of economic growth in China. Over half surveyed expected China's economy to decelerate over the next year, the most bearish outlook on the country's economy since 2016. Such a slowdown will have global implications, but much more weighted to emerging markets and the Asia-Pacific region.

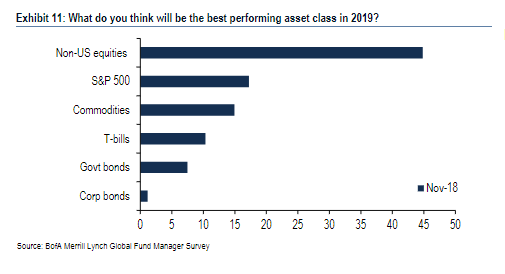

However, fund managers are not totally bearish on the global environment. Despite expected slower global growth, the comparatively higher profit outlook for US corporates and such global risks, over 40% of fund managers expected "non-US equities" to be the best performing asset class in 2019.

Either way, the consensus appears to be that the US market still has some life left in it. When fund managers were asked at what level they expect the S&P 500 to peak at, the weighted average was 3,056. That would mean the index growing by over 10% from today's level.

At the same time, the average cash balance of fund manager's dropped to 4.7%, down from last month's 5.1%. This would suggest managers are spotting buying markets in today's flatter markets.

Of course, that bullishness may be cause for cation. As Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch, notes:

"We remain bearish, as investor positioning does not yet signal 'The Big Low' in asset markets."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.