Where to invest in Q4 2020? Four experts have their say

Four experts tip gold to continue to shine in the winter months, as they shun UK equities and property.

19th October 2020 12:25

by Jim Levi from interactive investor

Four experts tip gold to continue to shine in the winter months, as they shun UK equities and property.

The quarterly asset allocation series highlights macroeconomic viewpoints from a selection of professional investors. The series was a long-standing feature in Money Observer magazine, and has been retained by interactive investor. Some changes have been made to the panellists since the last update in July. The next piece will be published in mid-January.

The arrival of a second wave of the pandemic means investors now face a period of uncertainty as extreme as any in living memory.

At least a spread of investments across different sectors and markets has provided some wealth protection from the virus. A glance at the performance tables for the first nine months of this year shows sectors such as US equities and Asian equities (particularly China) showing great resilience. Even government bonds and corporate bonds have provided positive returns. And gold, of course, has been a star performer – at least until it peaked in August.

In contrast, UK and European equities and such emerging markets as India, Brazil and Russia have been an unhappier story. Property has also been in the doldrums. The question now is: can the protective resilience we have seen so far continue through the winter months?

With varying degrees of optimism or pessimism, our panel of four fund managers tries to find an answer.

Both Keith Wade of Schroders and Richard Dunbar of Aberdeen Standard Investments broadly believe the strategy of being overweight (by giving a score of over 5 on the scorecard, please see below) in most equity sectors except the UK should be maintained. Both are also staying overweight in corporate bonds.

Wade points out that the global recovery has lost momentum. “China seems to be leading the way in the world growth stakes, but that growth is mainly from industrial activity.

“To get full recovery, we need the service sector (travel, hotels, restaurants and sports venues) to come back, and for that to return to pre-pandemic levels we need a vaccine.”

Dunbar agrees: “Across the board we are seeing a slowing in the rebound of the global economy. Evidence of a second wave reminds us – if any reminder were needed – that a vaccine is important.”

He believes investors are pinning their hopes on vaccine progress later this year. “Any disappointment in that direction will not be taken well,” he admits.

- Trust tips: adventurous and conservative picks outperform

- Smithson Investment Trust: two favourite stocks

- Nine in 10 income investors suffer portfolio impact from Covid-19

When it comes to US equities, the debate rages over bloated valuations of some of the leading technology-related stocks. However, all the panellists, apart from BMO’s Rob Burdett, are sticking with Wall Street with overweight scores.

Burdett, however, believes a widely predicted victory for Joe Biden in the presidential race will create a headwind for the US economy.

Rathbones’ David Coombs stresses great caution about the US from here onwards. He describes his score of 6 “as low as I have had for the US for 10 years”. He fears a market fall if the election result is “messed up” and there are delays.

Wade reckons there are only really half a dozen stocks in the US market that are making the running. “If your portfolio in the US was equally weighted across all stocks, it would be slightly negative,” he says. “In the end, fund managers are saying they have got to be with those front-running stocks because their earnings outlook appears very good. They fear that otherwise they will be missing out.”

In UK equities, Burdett is the odd one out. While the other three panel members are underweight (with scores of below 5) Burdett scores a 7, claiming there is now “room for the UK to end its pariah status in markets. The UK is about as cheap as it has ever been in a global comparison.”

He believes the crunch point will come when the Brexit negotiations come to an end. “We think there will be market relief whatever the outcome. There may be a sell-off if there is no deal, but we would see that as a buying opportunity.”

Coombs agrees: “I am scoring a 3, but the UK looks very cheap and it could swing quite fast. My score might be an eight by Christmas.”

The uncertainty surrounding immediate global prospects has meant an increasing emphasis on holding cash by both Burdett and Coombs. Elsewhere, Wade is neutral but Richard Dunbar scores only 1. His justification: “I am comfortable with low exposure to cash, while I have sizeable positions in bonds to liquidate if I need to.”

When it comes to a view on emerging markets, it is Coombs who is the odd man out. “I would rather have emerging-markets debt than emerging equities at the moment,” he says. “China is the only area I would invest in at the moment. It is the only major economy in the world this year with positive growth. It should no longer be lumped in with other emerging markets. If it were separate, I would probably [give it a] score of 8.”

Wade has now gone overweight in emerging equities, while Burdett has pushed his score up to 9. Wade is raising exposure to increase the portfolio’s weighting in equities generally, while taking some profits in the recent rise in corporate bonds.

“Asian economies, which make up 80% of emerging markets by value, are in much better shape in terms of their balance sheets and their exposure to Covid-19 than Western economies,” Burdett claims. “My bullish view does need a weaker dollar since the strength of the dollar in recent years has been holding back performance in emerging equities.”

- Japan: safe dividends and five stock ideas

- Baillie Gifford Shin Nippon trust backs Covid ‘problem solvers’

- China stock market surpasses $10 trillion – why is it rallying?

In terms of Japan, Burdett remains a long-term fan of the sector. He believes the new prime minister Yoshihide Suga will reinforce the reforms pioneered by his predecessor Shinzo Abe. “Japan’s handling of the virus has been better than any other major economy,” says Burdett. Overall, there is plenty of support for Japanese equities, with Wade seeing the potential benefits to Japan of the upswing going on in China.

Coombs regards Japan as “quite a useful asset class” because the strength of the yen provides good defensive qualities. “But I would want to be investing in technology and growth stocks rather than in traditional industries such as car makers,” he says.

Enthusiasm for European equities is muted. Like the UK, the sector has not performed well this year. Dunbar’s neutral score of 5 indicates his view that “there are better opportunities elsewhere”. Meanwhile, Coombs recognises that there are some “very good global companies in Europe you might want to own”. Scoring only a 2, however, he indicates he does not want to own domestic European companies on the whole. “I find it quite difficult to comment on this sector when we bundle Spanish, Swiss and Scandinavian companies all into one asset class.”

In the government bonds arena, both Wade and Dunbar seem to be of one mind – offering identical scores of 3 in both UK and global categories. Wade admits considering even lower scores. “But there is still a feeling among investors that we need a hedge against a double dip in the economy prompted by the second wave of the virus,” he says.

Coombs puts his own spin on the attractions of the sector. While avoiding UK government bonds, he holds a spread of international government bonds in places such as Singapore, Japan and even Australia, as well as the US “because the currencies of those countries tend to do well when we enter a period of lower global economic growth”.

Corporate bonds have performed well this year and only Coombs does not remain an enthusiast for the sector as a halfway house between government debt and equities.

The property sector is now completely out of favour because of the impact Covid-19 is having on office work and the impact of online shopping on the high street. “But warehousing and logistics is one pocket of the property market that is probably doing better than ever,” says Wade, although even he remains underweight the sector.

- Top-performing fund, investment trust and ETF data: October 2020

- Funds and trusts four professionals are buying and selling: Q4 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There are some fears that the gold price has lost some momentum. Dunbar is the leading sceptic here and he scores only a 5.

Dunbar adds: “I describe gold as a storyteller’s dream. Supporters of gold will tell you any story you want to support their view on gold. In fact, it is very difficult to value. When the price reached a peak in August, there was nobody around arguing that the price could fall. That was a bad sign.”

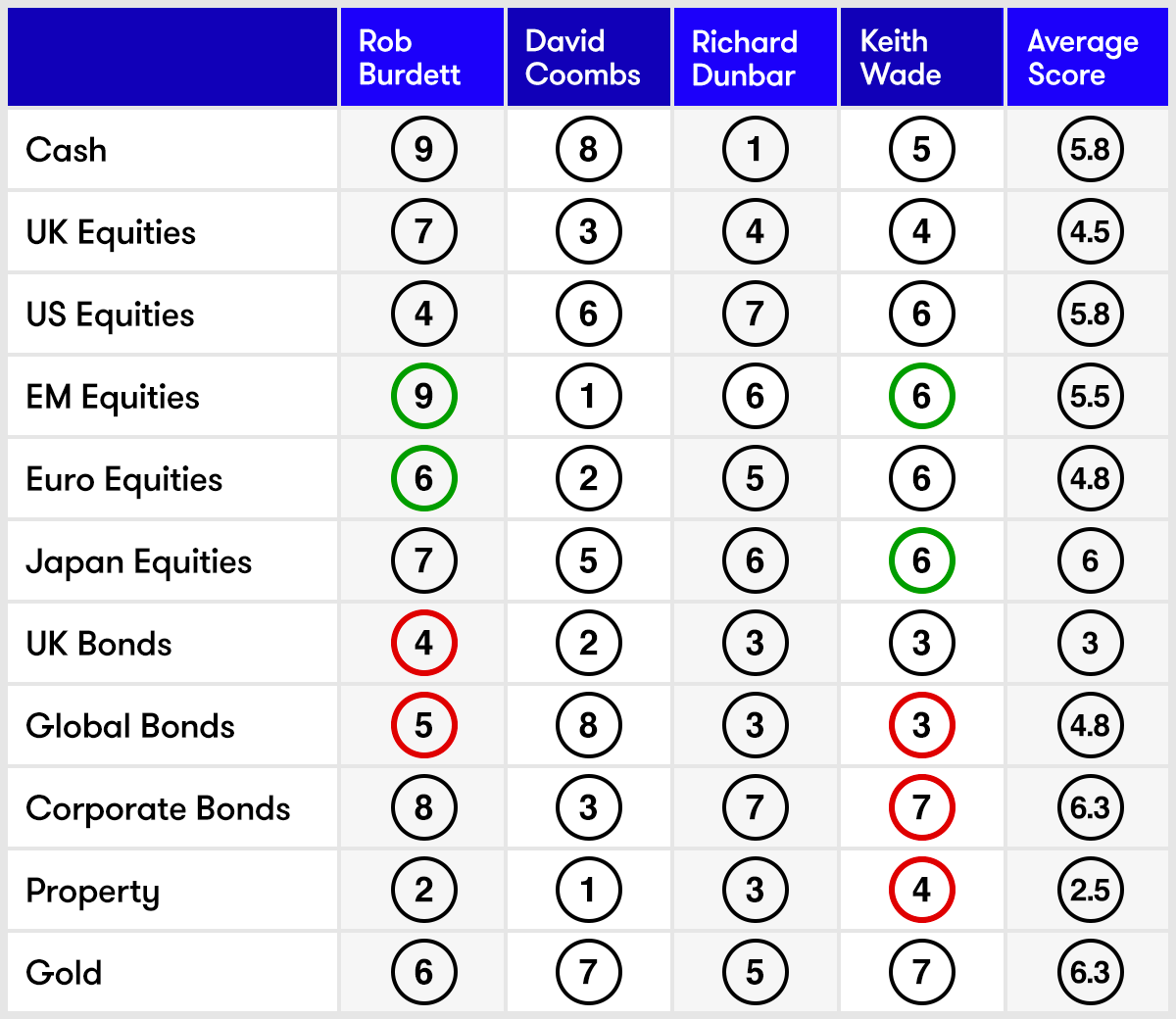

Scorecard: safe-haven gold takes top spot

Note: the scorecard is a snapshot of views for the fourth quarter of 2020. How the panellists’ views have changed since the third quarter of 2020: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent. David Coombs is a new panellist, which is why his scores are neutral. Gold scores are also neutral for this update, as gold has replaced commodities in the scorecard going forward.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at Aberdeen Standard.

Keith Wade is chief economist and strategist at Schroders.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.