Where next for oil, gold and other metals in 2020?

Against an uncertain backdrop, we assess the outlook for commodities, and highlight some ETFs to consi…

14th January 2020 10:22

by Jeff Salway from interactive investor

Against an uncertain backdrop, we assess the outlook for commodities, and highlight some ETFs to consider.

This piece was written in December 2019.

If geopolitical developments had the effect on equity markets that’s so often feared, recent years might have been much more volatile. But while the investment implications of political and macroeconomic turbulence are frequently overestimated, their impact on commodity prices can be a different matter.

Long driven by the fundamentals of supply and demand, commodity markets are increasingly shaped by factors such as policy change, trade disputes, political tensions and the response to climate change concerns.

Geopolitical tensions contributed to commodity price volatility in 2019. At the same time, the diversified nature of the market means that when the outlook for some areas is negative, for others it will be much brighter. So while 2020 seems certain to deliver further uncertainty, it won’t be short of investment opportunities.

- 2020 predictions for gold, bitcoin and other precious metals

- Is water the new oil promising a flood of returns?

- How to profit from battery technology

- How should investors deal with risk of war?

- Favourite funds for 2020

This is the state of play in the major sectors:

Oil

The direction of crude oil prices in 2019 closely mirrored developments in the escalating trade war between the US and China. The crude oil price was particularly volatile in the summer, as the downward pressure from the US-China dispute was offset by upward pressure when attacks on oil tankers in the Strait of Hormuz triggered fears of fresh conflict in the Middle East.

Prices were calmer by October, as tensions on both fronts began to ease; and David Thomson, chief investment officer at VWM Wealth in Glasgow, expects oil prices to remain resilient in 2020. “Middle East tensions are never far below the surface, and while oil prices are less dependent on Middle East production, any issues in the region will invariably send the price higher,” he says.

Thomson also believes Saudi Arabia’s market flotation of Aramco, the world’s most profitable oil company, will offer an incentive to keep oil prices high and therefore support higher valuations for oil companies.

While central bank interest rate cuts could lead to positive global economic growth and push oil prices up, that trend may be dampened by developments such as increased production of US shale oil, says Simon Lloyd, chief investment officer at Murray Asset Management.

“With the US now producing more oil than it uses, it is less likely to police Middle East and Eastern Europe production, and the spikes caused by civil unrest, terrorism and war may go unchecked. But demand growth remains solid at present, albeit at a slower rate than in the past.”

Economists expect oil prices to remain under pressure next year, with one Reuters poll producing an average forecast of $64.16 a barrel in 2019 and $62.38 in 2020.

Oil by no means good as gold over the past 10 years

| Total returns over: | |||||

|---|---|---|---|---|---|

| Commodity/index | Base currency | 1 year (%) | 3 years (%) | 5 years (%) | 10 years (%) |

| LBMA Gold Price PM USD | US $ | 20.61 | 10.78 | 52.57 | 84.22 |

| WTexas Crude Int Oil BL | US $ | -17.96 | 7.84 | -14.12 | -8.50 |

| FTSE 100 TR GBP | UK £ | 10.59 | 18.89 | 40.24 | 111.31 |

| S&P 500 TR USD | US $ | 16.34 | 43.42 | 113.26 | 357.11 |

Note: Table shows performance of gold and oil against FTSE 100 and S&P 500 over various timeframes. Source: Morningstar, to end Oct 2019.

Gold

Gold was the star performer in the sum- mer months, with the spot price soaring on fears of a global economic slowdown. There was then a sharp fall in October, as expectations grew of a positive resolution in the US-China trade negotiations.

But the prospect of further uncertainty will ensure gold retains its investment appeal. Gold and other precious metals are seen as a safe haven in times of geo- political crisis, while it offers an inflation hedge due to its pricing in US dollars. Any further deterioration in US-China relations would likely result in a slow- down in economic growth and lower interest rates, making gold look even more attractive.

“I expect gold to perform well in 2020, as it is particularly attractive in an environment where interest rates are falling and the returns on cash are negligible, or in some countries effectively negative,” says Thomson.

Other metals

Concerns over demand and trade tensions have weighed on base metal and ore prices in recent months, and China in particular will remain a decisive factor in certain metals markets, according to Lloyd. “Iron ore might start to improve if China gets a grip on its current slowdown, and more generally with global economic growth turnaround. Meanwhile, there’s been growth in the supply of zinc, so unless there’s a build-up of economic demand the price could weaken.”

Indeed, the outlook for specific metals still depends largely on supply and demand dynamics. Lithium, nickel and copper, for example, are in demand due to their use in the production of electric vehicles and the infrastructure to support them.

Even for those markets, however, Lloyd expects Chinese spending on resources to remain the biggest swing factor.

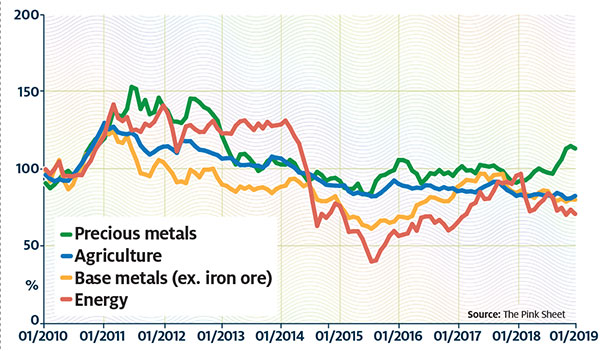

Commodities performance a mixed bag

Agriculture

All eyes are on China when it comes to food and agriculture too, with the world’s biggest pork markets hit by the spread of African swine fever. The disruption caused by the disease, wiping out livestock and so pushing prices up, was described in the Food and

Agriculture Organisation’s (FAO’s) and Organisation for Economic Co-operation and Development (OECD’s) annual agricultural outlook for 2019-2028 as one of the greatest risks to a well-supplied global agricultural sector.

From an investment perspective, the performance of agricultural commodities tends to be erratic because they are often weather-dependent. “However, if investors become aware of production problems at an early stage they can make money by getting in early before the prices start to rise rapidly,” says Lloyd.

A clear theme is evident throughout the various commodities sectors. While specific demand drivers point to a bright outlook for some precious and industrial metals, much hinges on economic and geopolitical developments. “A thawing in the China-US trade dispute would be beneficial to global growth and commodity prices. Generally, one might expect industrial metals to see price rises in the coming months, as sentiment around macroeconomics improves,” says Lloyd.

The investment case for commodities is not just about growth, though. Most commodities offer valuable diversification due to their typically low correlation with the main asset classes, while gold is just one example of an effective hedge against inflation.

It is difficult for ordinary investors to buy commodities directly – with the exception of gold and other precious metals, which can be secured through bullion dealers – but there are plenty of other routes. Those comfortable with the risk of buying direct equities can hold stocks such as oil and gas majors and mining firms.

However, private investors typically access commodities through collective funds (including ETFs – see box below).

“For those who prefer active management, among the best performers in the past year has been the VT Gravis Clean Energyfund, while Pictet Clean Energy and the Pictet Water fund have also performed well,” adds Thomson.

Passive plays: how to buy the asset class

The commodities market is one in which passive vehicles such as exchange traded funds (ETFs) can add value for investors. David Thomson of VWM Wealth highlights some ETFs to consider:

1) Wisdom Tree Physical Gold – backed by physical gold held in HSBC’s vault in London and designed to offer holders a simple and cost-efficient way to access the gold spot price.

2)iShares Oil & Gas Exploration & Production UCITS ETF – this large BlackRock-managed ETF enjoys a strong record of tracking the benchmark with a diverse range of underlying stocks. Falling oil prices have affected performance, but it should benefit if prices tick up in the event of either improved economic conditions or raised tensions in the Middle East.

3)iShares Agribusiness ETF– gives investors market capitalisation-weighted exposure to seven of the world’s largest agricultural firms. Although soft commodities such as cocoa, sugar and wheat can be affected by climate, a diversified ETF of this nature is less prone to the effects experienced by one single commodity.

4) Wisdom Tree Enhanced Commodity UCITS ETF – an option for broad commodities exposure and acts as a good diversifier, though probably worth waiting for signs of global economic pick-up before investing in a broadly based commodities ETF like this one.

5) Global X Copper Miners ETF – with industrial metals such as copper and lithium tipped to perform well in coming years, this ETF provides access to a broad range of global copper-mining companies.

6) Global X Lithium and Battery Technology ETF – this taps into the full lithium cycle from mining and refining the metal through to battery production, and is therefore a thematic play on lithium battery technology.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.