Why Computacenter shares could be a good buy

23rd November 2018 15:18

by Richard Beddard from interactive investor

Reselling computers and software is a tough business, but Computacenter's been getting better and better at it. It has more strings to its bow too, argues companies analyst Richard Beddard.

Last month, Computacenter reported lower revenue in its third quarter (July to September) compared to the same quarter in 2017, but it’s not, the company believes, the beginning of a contraction. Computacenter just had a very strong third quarter in 2017.

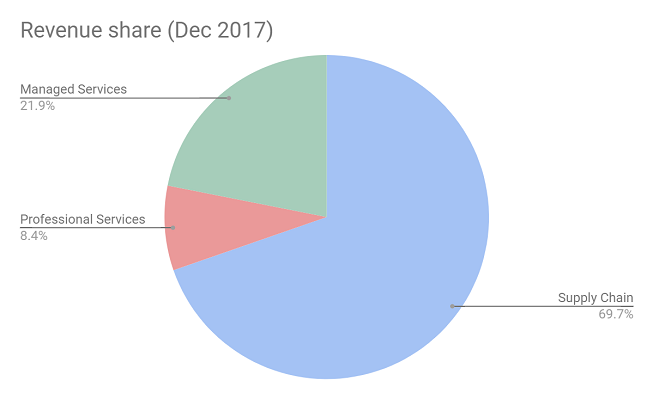

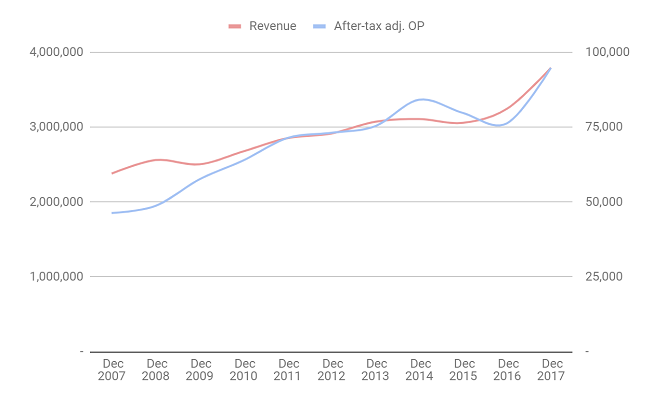

Overall, the company grew revenue 11% in the first nine months of 2018. Its biggest division, "Supply Chain", which sells hardware and software, is doing very well as customers adopt new, often cloud based technologies, to make their businesses more efficient, data driven, secure, and networked.

Change is also good for Computacenter's smallest division, Professional Services. Its consultants help businesses as they adopt new IT. Managed services, the division that runs IT functions for companies, is growing much more slowly though, as customers seek to reduce the cost of long-term contracts.

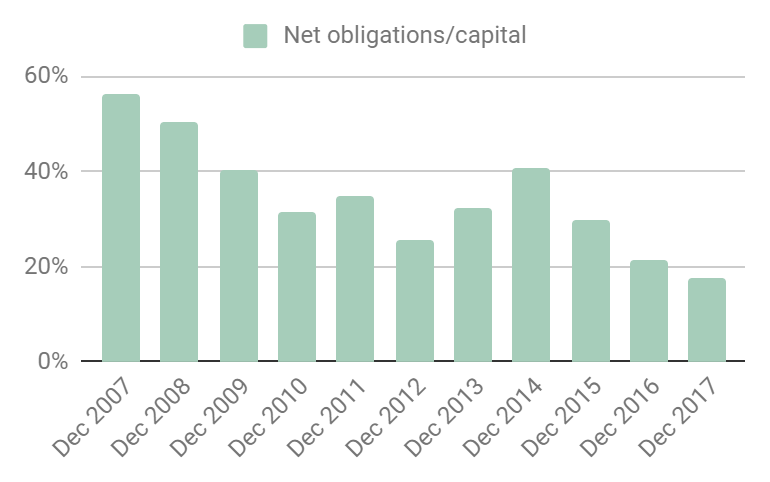

The growth in revenue does not include contributions from two businesses acquired in quick succession in September. Given Computacenter expects underlying growth in the fourth quarter, it should finish the year in December 2018 with revenue and profit higher than it was in 2017 even before the impact of the acquisitions. Borrowings will have increased too, but the company was cash rich in December 2017, and debt is unlikely to have reached levels we need to worry about.

In other words, I think events reported so far in 2018 are unlikely to have undermined the case for investing in Computacenter because it remains profitable, adaptable, resilient, equitable, and cheap. As usual I have scored these criteria. Each one can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

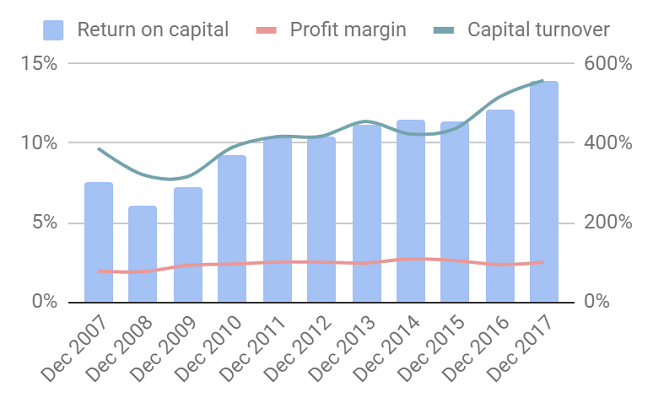

Computacenter mostly sells computers and software in large quantities to big businesses and government departments. Resellers do not add much value and their blue chip suppliers and customers drive hard bargains, which explains the company’s low after tax profit margins of between two and three per-cent over the last decade (pink line):

Thin gruel, but since the financial crisis, Computacenter has steadily grown profitability in terms of return on capital to quite impressive levels, while reducing its dependence on outside finance.

Although the company has stuttered at times, notably in 2005 when fierce competition from computer manufacturers selling direct meant it failed to earn rebates for meeting sales targets agreed with its suppliers, during the financial crisis in 2008, in 2012, when it locked itself into three loss-making service contracts in Germany, and in 2014, when it began restructuring its loss-making business in France, on the whole, Computacenter has done more good than harm, and the business has grown revenue and profit:

So how has it done it?

Adaptable: How will it make more money?

Score: 2

There are a lot of moving parts, but I think Computacenter has become a better reseller as its become less of a reseller.

In the notes to the accounts, Computacenter reveals it increasingly sources IT from distributors rather than manufacturers, which may have reduced its dependence on the supplier rebates that got it into trouble in 2005. It has also vastly reduced the amount of stock it holds, and, other things being equal less capital tied up in stock, means higher returns on capital.

It is also earning more money from services. Unfortunately, the company does not disclose the profitability of its three business divisions but it likely earns higher profit margins from consultancy and managing IT for customers than it does reselling kit.

This ties in with the company’s strategy, which, it says, has evolved from being Supply Chain led between 1980, when it was founded, and 1995, Managed Services led from 1995 to 2014, and Professional Services led since 2014.

The service-driven strategy is driven by a thirst for IT because managing huge amounts of data has become integral to businesses and the public sector. There are simply not enough IT experts to meet demand, which means customers need help.

The company has expanded geographically too, by acquiring a Dutch company to complement its businesses in Germany, France and Belgium, which already earn 60% of total revenue. A bigger US acquisition joins Computacenter's US operation, originally set up to supply its European customers in the US.

Resilient: What could go wrong?

Score: 1

My biggest fear is redundancy. As companies migrate their computing to software services in the cloud, there is a risk they will cut out the middleman. Computacenter thinks it has this risk under control and it is more worried about prosaic risks like regulatory compliance, cyber-security and, with some justification since it lost millions in Germany this way, commiting to onerous contracts.

The strategy may well address the risks, but I'm reluctant to declare it as a certainty because I have little experience of the industry. It is easier to deliver software as a service, but customer's requirements are becoming more sophisticated and if they lack the personnel to implement and operate IT, they will need help. The company says Indian resellers are offering increasingly sophisticated services, but here too Computacenter has advantages.

It has long established relationships with suppliers and customers, and has probably built up a lot of goodwill, for example by honouring the onerous contracts it took on in 2012.

Brexit may complicate life for Computacenter but since it already imports products from many countries directly into the EU, it is unlikely to affect the business fundamentally.

Equitable: Will we all benefit?

Score: 2

Computacenter has a very experienced board. The company’s two founders are non-executive directors and own 27% of the shares. Mike Norris has been chief executive since 1994 and Tony Conophy has been finance director since 1998, but he joined the company in 1987.

Boards stacked with old boys can stultify businesses if they don’t have new ideas, but Computacenter has evolved and I think the board’s experience is a strength. It comes at a price though. Norris and Conophy are very well paid. Norris’ total remuneration was £2.2m in 2017.

I like the tone of the annual report. The chairman's statement is headed "Managed for the long-term", and the chief executive's is subtitled "Appetite to invest". The company aims to be the friend of the Chief Information Officer, the senior manager responsible for implementing IT in an organisation, which is laudable, and it thinks it can do it by attracting IT professionals with a positive workplace and exciting work. In addition to buying US customers, one of the reasons for acquiring a business in the US was to give employees opportunities they might not get servicing European companies there. Another was to improve the range of services to its European customers operating in the US.

Cheap: Is the firm's valuation modest?

Score: 1

The shares cost 14 times earnings adjusted for debt. That is a modest price for shares in a company that is not only growing, but growing more profitable.

During October and November, chairman Hugh Lock has bought over a million pounds worth of shares. Although this is the first time I have put Computacenter through the wringer, if his actions are a verdict on the company's prospects, I'm inclined to agree with him.

A score of 7/10 means it is probably suitable for long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.