Why did this successful investor just double their cash holding?

22nd October 2018 10:09

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After dramatically increasing the amount of cash in his portfolio recently, Saltydog analyst Douglas Chadwicktells us why he did it, what he plans to do with it and when.

Another lousy October for equities - we're going for gold

October has got a bit of a reputation among investors. The Wall Street crash of 1929 started on 24 October, Black Thursday, and continued until 29 October, Black Tuesday. It was followed by the 12-year Great Depression. Other historic crashes took place in October 1987, when the Dow Jones lost over 20% on Black Monday, and more recently in October 2008, as part of the financial crisis.

This month has also had a shaky start. After the first two weeks the Dow was down 4.2%, the Nikkei was down 5.9% and the Shanghai Composite was down 7.6%. The FTSE 100 had dropped 6.8% and was more than 10% below the peak that we saw in May.

At the moment, it feels like there's a temporary lull in the storm. We've seen a significant correction, where there was no hiding place, but in the last week the markets have stabilised or even started to recover. So where will they go next?

Unfortunately, we've got no way of knowing, but in our sector analysis nearly all sectors are down over the last four weeks, and most are down over 12 weeks - so we're not going to assume that they are going back up again until we see some stronger signs.

One of the advantages that we have as private investors is that we can move in and out of the markets as we see fit. This is a luxury not afforded to fund managers, who usually have to keep a minimum amount invested to satisfy the Investment Association sector criteria, or for wealth managers, who would usually find the process too onerous for it to be cost effective (for them).

During September we doubled the amount of cash that we are holding in our portfolios and we're increasing it further. This has benefited us in the last couple of weeks and will do so again if markets continue to fall. It also puts us in a strong position, when we feel it's time to reinvest.

If markets continue to strengthen in the next few days, then we'll lose out on some of the recovery, but that's a risk that we're willing to take. With American bond yields starting to rise, uncertainty over Brexit, Chinese stock markets collapsing, Trump's trade wars and America First policies, Italy's budget crisis, rising oil prices, and the enormous debts that most economies are carrying continuing to rise at uncontrollable rates, it's not difficult to imagine that the potential downside could outweigh any short-term gain.

Backing this gold fund to shine again

While most investments have been going down, the gold funds have picked up in the last few weeks and so we have made a modest investment into one of them. We know that they can also be volatile, and so will only add to our holdings if they continue to do well.

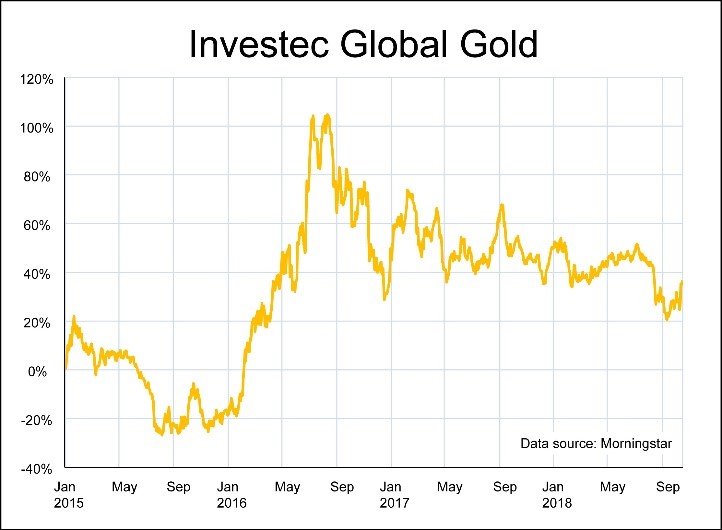

On the other hand, when they do well they can do really well. The Investec Global Gold fund is one of the few funds that we've invested in, in the past, which went up by 100% while we were holding it.

This fund peaked in December 2010, and then fell dramatically over the following five years. It reached a low in August 2015, but didn't really start going up until 2016. We invested in February 2016 and sold in August 2016.

Since then it's been trending down, but it has started to pick up in the last few weeks. There have been other false starts, so it's too early to tell if this one is any different, but if stockmarkets continue to struggle, then gold might benefit.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.