Why the US remains a great place to invest in shares

Highly rated US stocks have rallied, so our overseas investing expert analyses possibilities in 2020.

24th December 2019 10:30

by Rodney Hobson from interactive investor

Highly rated US stocks have rallied, so our overseas investing expert analyses possibilities in 2020.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

For investors looking at overseas stock markets, the United States should be the first consideration whatever level of expertise and experience the individual can claim.

The US was the first developed country to bounce back after the financial collapse in 2008 and it has enjoyed the most robust economic growth since. It has a stable political and legal system, financial regulation and the two largest stock exchanges in the world. On the New York Stock Exchange and the Nasdaq you can find a full range of possible investments, including some sectors that are under-represented in London.

Source: interactive investor Past performance is not a guide to future performance

The coming year will inevitably introduce an element of uncertainty in the form of a presidential election accompanied by voting for the entire House of Representatives and one-third of the senators.

American presidential campaigns are long, protracted affairs and a lot can happen before the vote next November, but investors should set aside their personal views on Donald Trump and consider the likely outcome.

Despite the vote by the House of Representatives to impeach Trump, he is not going away.

The Republican-controlled Senate will exonerate him. With the advantage of backing the incumbent working in the Republicans’ favour, while the Democrats fight among a crowded field of presidential hopefuls, the odds initially stand on the side of continuity, which is generally good for investors.

Trump had the advantage of inheriting a strong, stable economy from his predecessor Barrack Obama and his quixotic leadership style has not caused that to unravel – at least not yet.

Unemployment is at its lowest level in half a century, with 266,000 jobs created in November extending the trend.

Wages are rising, especially for low earners, which not only helps the worst off but will tend to push up salaries further up the food chain as those in better jobs seek to maintain pay differentials.

Meanwhile, inflation remains close to zero and so do interest rates, which are unlikely to rise in 2020 and are more likely to be reduced further under pressure from the president.

The Federal Reserve Board is traditionally reluctant to change rates in a residential election year.

GDP figures for the United States need to be treated with a little caution as they are presented as quarterly figures annualized rather than as a direct comparison with the same quarter a year earlier.

This can exaggerate swings in the rate of growth.

US GDP grew 2.1% in the third quarter, the latest figure available. That was better than the 2% recorded in the second quarter and it indicated that the world’s largest economy is still holding up well, although these figures are admittedly well down in the 3.1% recorded in the first quarter of 2019.

There will be a day of reckoning for all the spending and tax cutting that is boosting the US government deficit as well as the economy. That day will not fall in the next 12 months.

There is no reason why the economy will not continue to outstrip those of other developed nations and Trump will that state of affairs to continue until the presidential election in November.

The big question mark remains the trade wars that Trump has initiated with China and, to a lesser but still significant amount, with the European Union.

This is having the desired effect of reducing America’s trade deficit, as evidenced in figures for October showing the gap at its lowest level in 16 months.

The downside is that while imports into the US have declined sharply, exports of goods and services have also shrunk, just at a less dramatic rate. A fall in imports means less cheap goods for American consumers; a decline in exports threatens jobs.

Economists generally agree that the United States will suffer from a protracted trade stand-off, so any move towards a settlement is vital, especially if it involves China backing down.

An interim trade deal between the world’s two largest economies was reached as the year drew to a close, although investors should remain cautious after so many on-off episodes in the sparring between US President Donald Trump and his Chinese counterpart Xi Jinping.

The latest scheduled round of new tariffs due to be imposed on $156 billion of Chinese goods by the US had been postponed twice and has now been cancelled.

Some existing tariffs on $120 billion worth of goods have been halved from 15% to 7.5% but 25% levies on another $250 billion of goods remained in place.

In return, China promised structural reforms and other changes in the area of intellectual property, technological transfer, agriculture, foreign exchange and financial services and to make substantial additional purchases of US goods and services in coming years. A system to resolve trade disputes quickly and effectively is to be set up.

- Looking to diversify your portfolio? ii’s Super 60 recommended funds is full of great ideas

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

Although the tentative agreement was not signed by either side immediately, it was seen cautiously as a positive step in unfreezing relations between the world’s two largest economies. We have seen false dawns before in these trade wars so nothing can be taken for granted.

In particular, Americans will want to see clear evidence that Beijing will keep its side of the bargain.

The propensity of China to steal ideas and processes from foreign companies, or force them to disclose company secrets in return for access to Chinese markets, has rankled with the rest of the world.

Many Americans will feel that it was about time their president took up the cudgels. Any progress is good for shares.

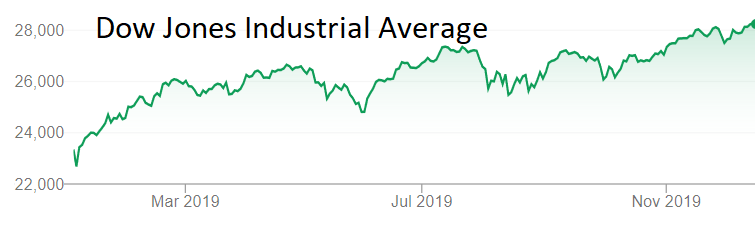

The Dow Jones Industrial Average has been on a generally upward trend throughout 2019, setting new highs on several occasions.

From 23,327 at the end of 2018 the index has topped 28,000. The more broadly based S&P 500 Index has followed a similar trajectory but even more strongly, moving from 2,500 points to around 3,200.

Source: interactive investor Past performance is not a guide to future performance

Many large companies listed in New York are trading on tough price-earnings ratios and low or non-existent yields, so it would be overoptimistic to count on another such strong run next year, however, there is no cause to believe that the indices are about to come crashing down. The US remains a great place to invest in shares.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.