Why we are holding more cash in our portfolios

There are good reasons to be more cautious and take some chips off the table, writes Douglas Chadwick.

2nd November 2020 14:41

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There are good reasons to be more cautious and take some chips off the table, says our Saltydog analyst Douglas Chadwick.

In October, the FTSE 100 fell by 4.9%, which was its worst month since March, when the index lost nearly 14%. Overall, year to date it has dropped by more than 26%.

As the table below shows, it was not just the UK market that struggled.

| Data source: Morningstar | Stock Market Indices 2020 | |||||

| Index | Country | 1st Jan to 31st March | 1st April to 30th June | 1st July to 30th Sept | Oct | 1st Jan to 31st Oct |

| FTSE 100 | UK | -24.8% | 8.8% | -4.9% | -4.9% | -26.1% |

| FTSE 250 | UK | -31.0% | 13.4% | 1.1% | -0.6% | -21.3% |

| Dow Jones Ind Ave | US | -23.2% | 17.8% | 7.6% | -4.6% | -7.1% |

| S&P 500 | US | -20.0% | 20.0% | 8.5% | -2.8% | 1.2% |

| NASDAQ | US | -14.2% | 30.6% | 11.0% | -2.3% | 21.6% |

| DAX | Germany | -25.0% | 23.9% | 3.7% | -9.4% | -12.8% |

| CAC40 | France | -26.5% | 12.3% | -2.7% | -4.4% | -23.1% |

| Nikkei 225 | Japan | -20.0% | 17.8% | 4.0% | -0.9% | -2.9% |

| Hang Seng | Hong Kong | -16.3% | 3.5% | -4.0% | 2.8% | -14.5% |

| Shanghai Composite | China | -9.8% | 8.5% | 7.8% | 0.2% | 5.7% |

| Sensex | India | -28.6% | 18.5% | 9.0% | 4.1% | -4.0% |

| Ibovespa | Brazil | -36.9% | 30.2% | -0.5% | -0.7% | -18.8% |

| RTSI | Russia | -34.5% | 19.5% | -2.8% | -9.5% | -31.1% |

Both of our demonstration portfolios (Ocean Liner and Tugboat) have also fallen from the all-time highs that we saw in mid-October.

It is always uncomfortable when you see the value of your portfolios go down, especially when it happens quite quickly, but overall we are pleased with their progress so far this year. We avoided the worst of the stock-market crash in February and March and have benefited from the subsequent recovery. Our more cautious portfolio, the Tugboat, is up 2.3%, while the slightly more adventurous Ocean Liner is up 4.2%.

Even when funds are in a generally upward trend, it is not unusual to see them fall back for a couple of weeks before recovering. We do not feel that now is the time to panic, however the upward momentum seems to have weakened and last week we reduced our exposure to the markets.

In our weekly analysis, we review the performance of the Investment Association sectors. We put them into our own Saltydog groups based on their historic volatility. The groups, in order of increasing volatility, are: Safe Haven, Slow Ahead, Steady As She Goes, and Full Steam Ahead.

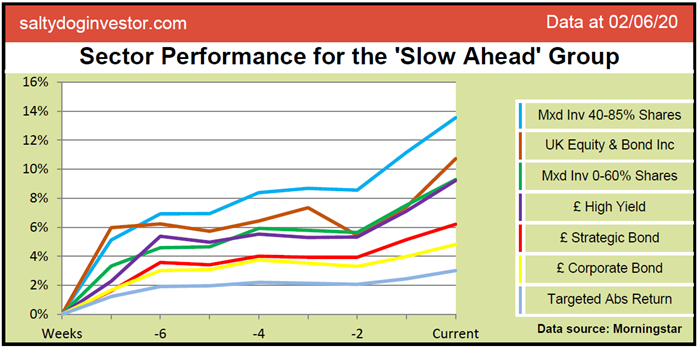

Go back to the beginning of June, and this is what the sector graph for the Slow Ahead group looked like.

Past performance is not a guide to future performance.

Most sectors were going up relatively steadily and the Mixed Investment 40-85% Shares sector was up 5.2% in four weeks and clearly ahead over eight weeks.

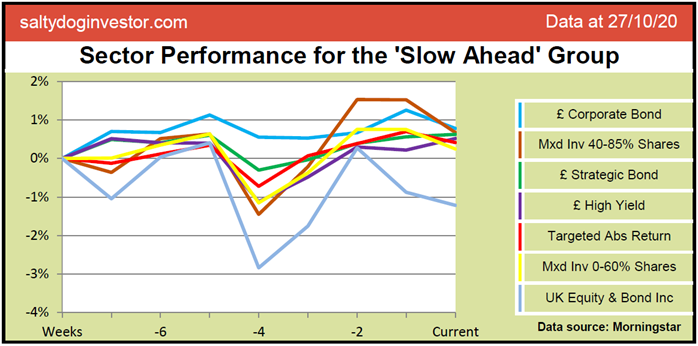

Here is a similar extract from last week’s numbers.

Past performance is not a guide to future performance.

Although the Mixed Investment 40-85% Shares sector was still at the top of our four-week table, it had only gone up by 2.1% and that followed a week when it had gone down. It was now in second place on the eight-week graph.

I have shown the sectors in the Slow Ahead group, but if you do a similar comparison across the other groups you reach the same conclusion. The recent trend is much less clearly defined, and the magnitude of the growth is significantly lower. There seems to be a higher level of uncertainty in the markets and, with increased concerns over a second wave of coronavirus, imminent elections in the US, and the stalemate over a Brexit deal, that’s hardly a surprise.

Although we have no way of telling whether markets are definitely heading further south or about to rebound again, there are good reasons to be more cautious and so that is why we decided to take some chips off the table.

There are several ways in which we could have reduced our exposure to the markets. We could have just taken out the higher volatility funds, or funds that had gone down the most over the last few weeks. In the end, we took a very pragmatic view and just reduced our largest holdings. It was a quick and easy way to achieve the result that we were after, and straightforward enough to reverse if markets suddenly recover.

In the Tugboat portfolio, the amount of cash that we are holding is currently just over 30% of the overall value, and in the Ocean Liner portfolio it is around 22%. A week ago, cash in Tugboat was 16% and 14% in Ocean Liner.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.