Why WPP's just taken a battering

4th September 2018 10:56

by Richard Hunter from interactive investor

It's all change at WPP and the high-yielding ad agency is out of favour following these half-year results, writes Richard Hunter, head of markets at interactive investor.

Against the backdrop of the cultural shift of a change at the top and a rapidly evolving industry, there are certainly serious challenges to be negotiated at WPP.

Despite these shifting sands, WPP has delivered a robust first-half performance. Net sales have returned to positive territory, revenues are ahead and pre-tax profit has improved by 8.6%.

Meanwhile, the earnings per share figure is also markedly better whilst the company's focus on digital business remains promising. In the background, a dividend yield of 4.7% is attractive and the underlying share buyback programme has been supportive.

Nonetheless, there are concerns for the group, some of which have been inherited. The company is a sprawling mass of different businesses, although there has been a disposal or divestment of 15 of these so far, which should both focus the company and take some pressure away from a net debt figure which remains stubbornly high.

Source: interactive investor Past performance is not a guide to future performance

In addition, there is something of struggle within parts of the brand consulting unit, and the United States in particular, which is slightly alarming given the strong current growth being seen in the world’s largest economy.

The currency effect has been a mixed bag, whilst it remains to be seen whether the structural change within the industry is here to stay and, equally, whether WPP is up for the fight.

• 10 contrarian blue-chip stocks for daring investors

• Chart of the week: WPP shares in the 'buy zone'

• Why equities are struggling and new era at WPP

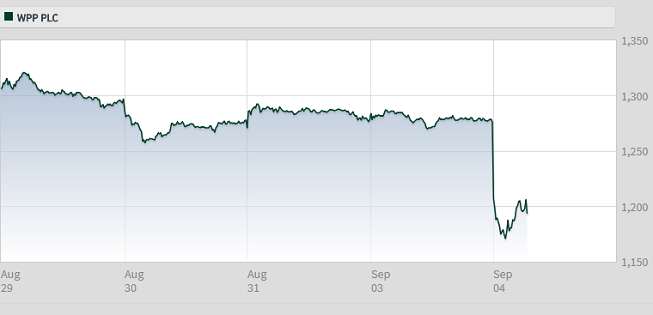

The company's previous image of a market darling has taken something of a battering of late, with the shares having dropped 10% over the last year, as compared to a marginal 0.9% gain for the wider FTSE100.

More recently, there has been a recovery in the form of a 5% hike over the last three months, although the net annual performance remains down and the initial share price reaction to the interim results has been typically harsh.

The company has promised to announce the results of its strategic update before the end of the year, which should hopefully give investors a roadmap to consider. Ahead of this update the market consensus has not surprisingly dipped to a 'hold', albeit a strong one, until the company's aims and ambitions are fully understood.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.